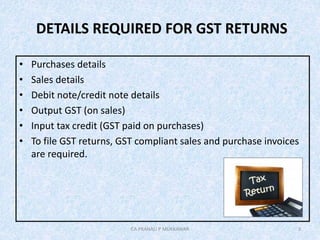

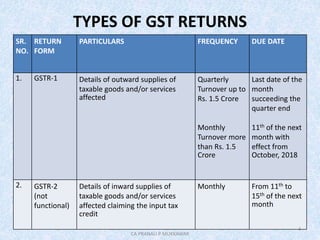

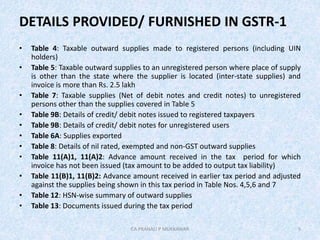

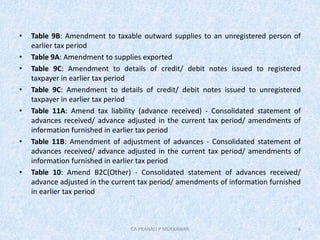

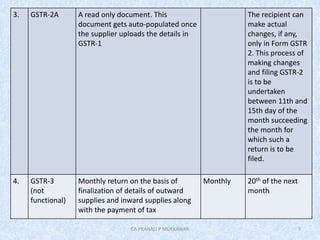

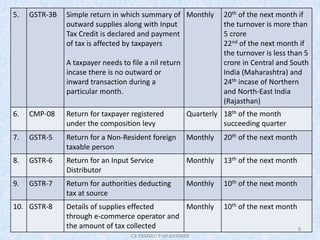

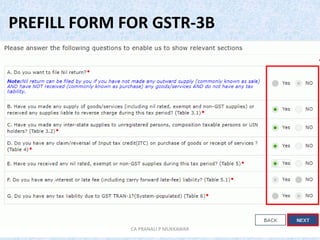

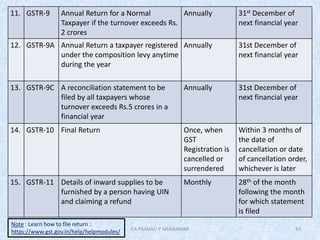

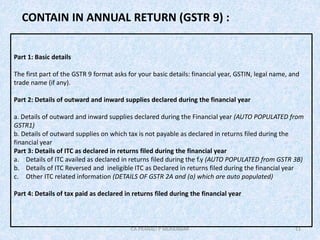

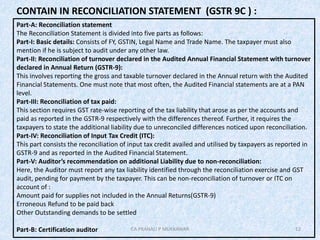

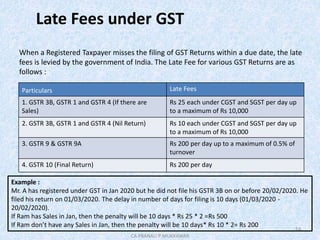

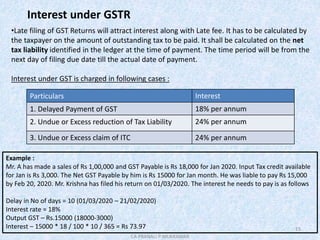

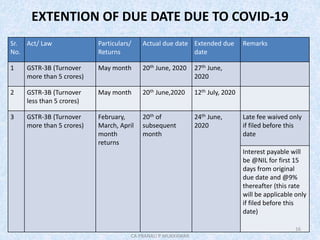

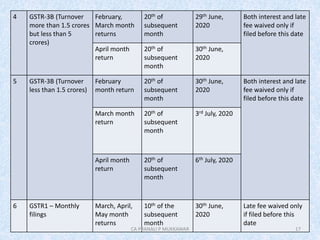

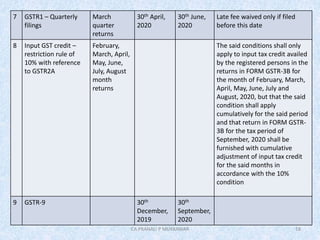

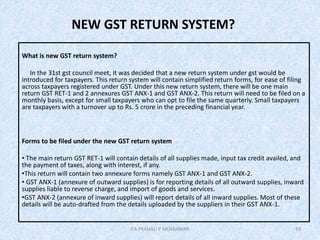

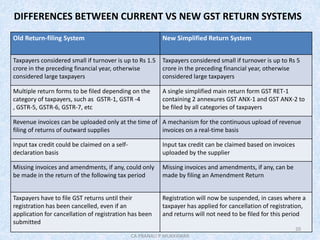

This document provides information about GST returns in India. It defines what a GST return is and details that are required to file returns such as purchases, sales, debit/credit notes, output and input tax credits. It outlines the different types of GST returns like GSTR-1, GSTR-3B, GSTR-9, etc. and provides details on what information is included in each return. It also discusses late filing fees and interest charges for late/delayed GST returns and extensions provided for return filing due dates during COVID-19. In the end, it briefly introduces the new proposed GST return system with simplified return forms.