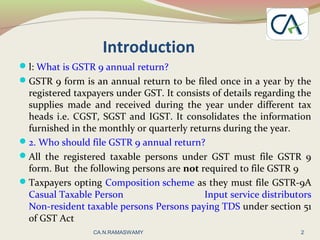

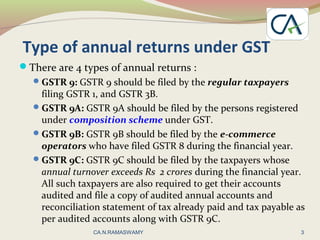

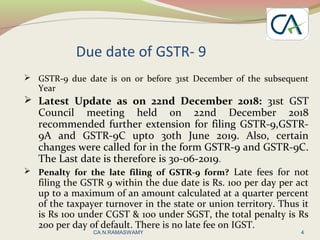

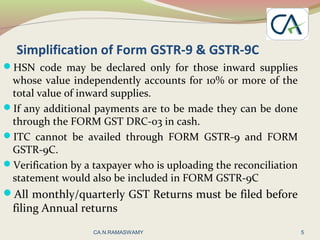

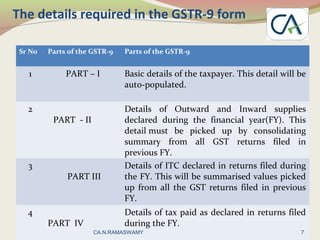

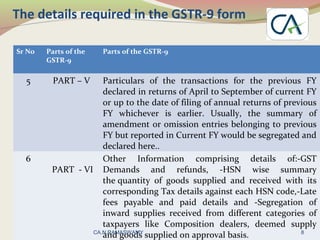

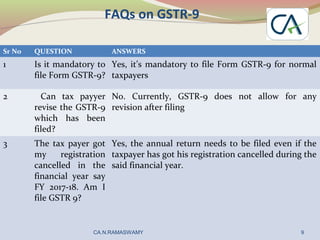

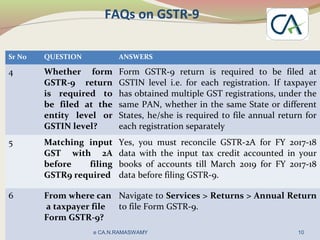

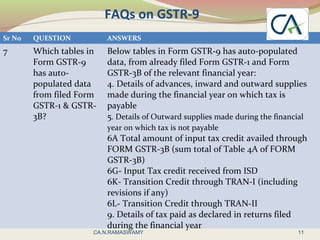

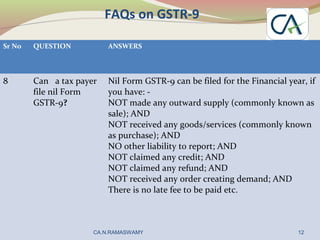

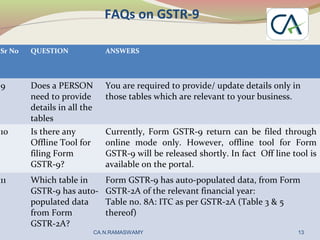

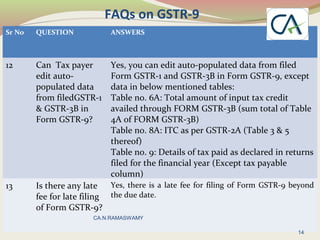

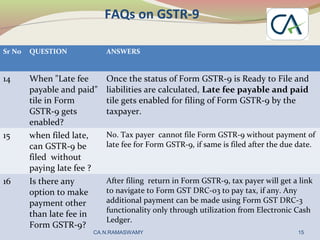

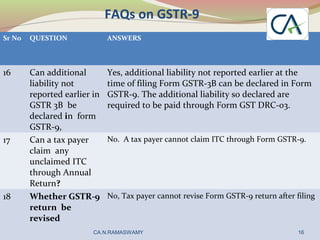

The document provides information about the GSTR-9 annual return filing requirements under the Goods and Services Tax (GST) in India. It states that GSTR-9 must be filed by regular taxpayers to consolidate supplies and input tax credit details for the entire financial year. It outlines the different types of annual returns that must be filed depending on the taxpayer's registration type. It also discusses the due date for filing GSTR-9, which has been extended to 30 June 2019, and penalties for late filing. The key parts of the GSTR-9 form and details required to be reported in each part are also explained.