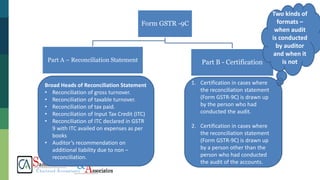

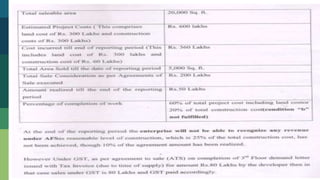

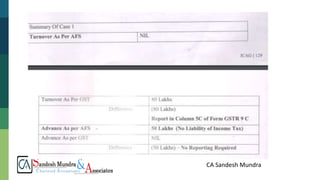

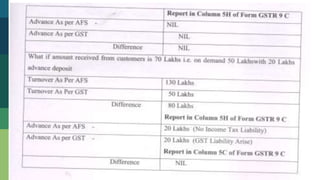

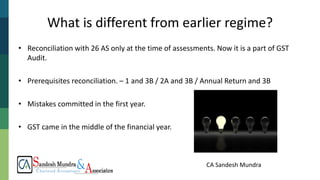

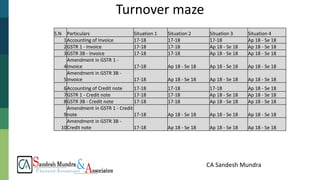

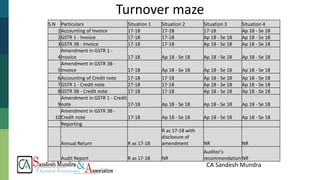

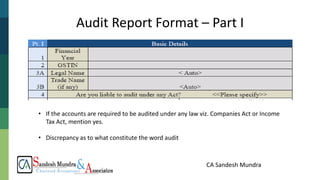

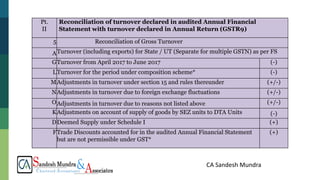

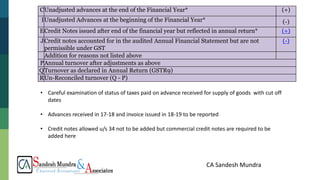

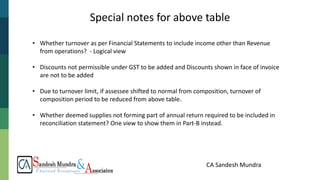

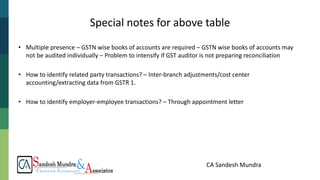

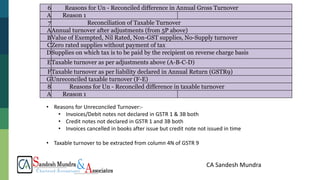

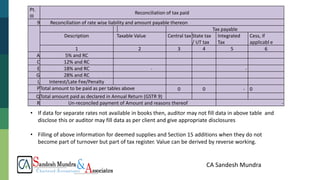

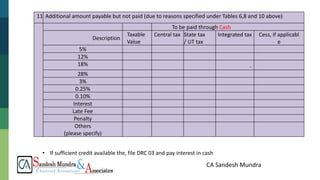

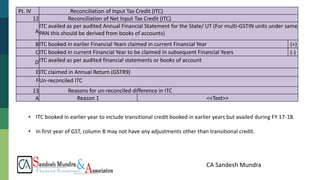

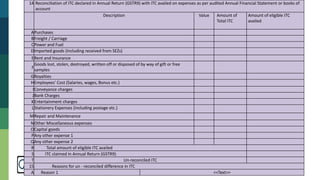

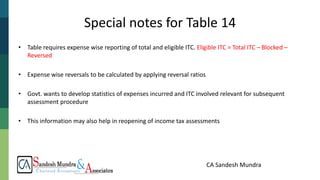

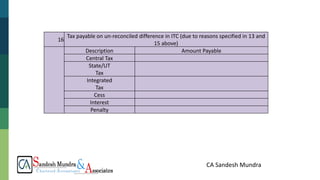

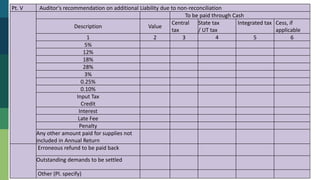

The document outlines the procedure for preparing Form GSTR-9C, which includes a reconciliation statement of gross turnover, taxable turnover, tax paid, and input tax credit (ITC). It emphasizes the importance of accurate reconciliation between financial statements and GST returns for compliance and identifies potential areas for discrepancies. Auditor's certification is also addressed, highlighting the need for thorough documentation and management representation in the reconciliation process.