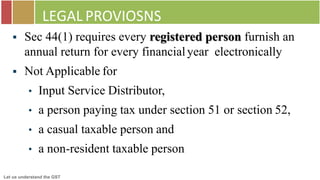

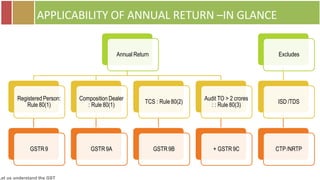

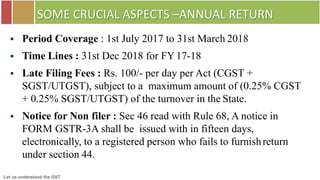

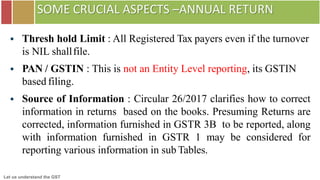

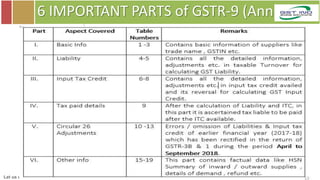

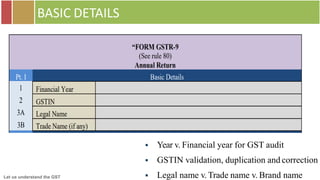

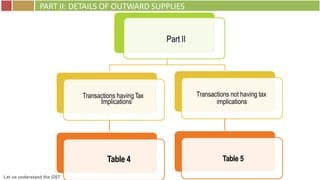

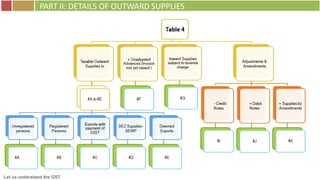

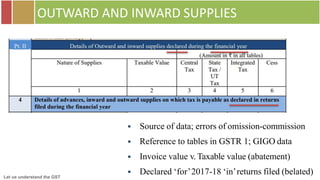

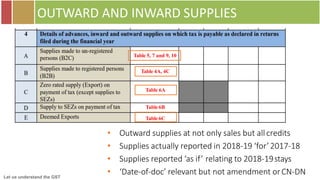

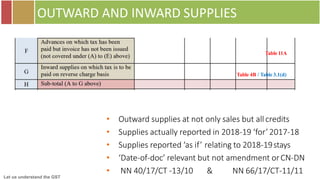

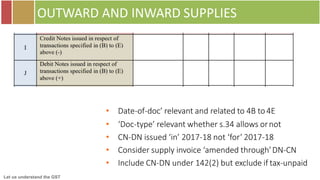

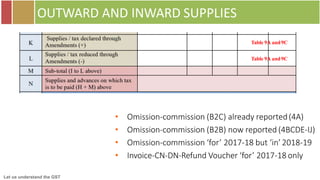

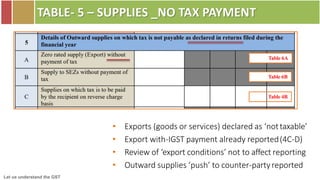

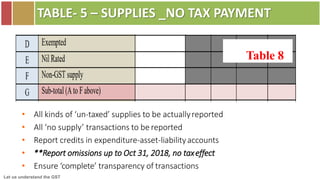

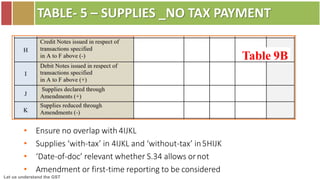

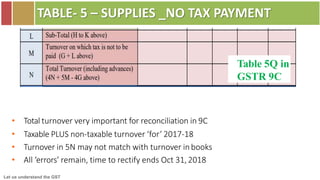

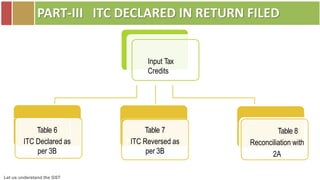

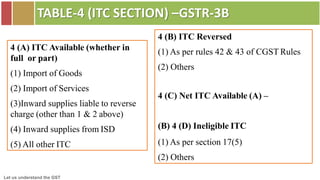

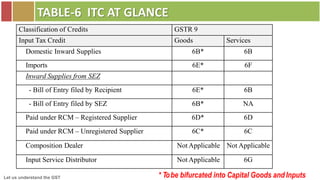

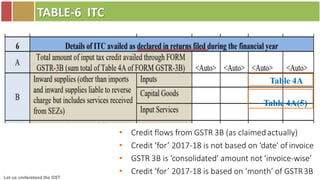

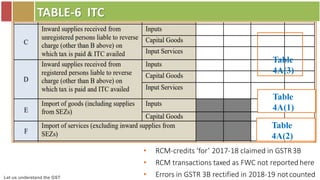

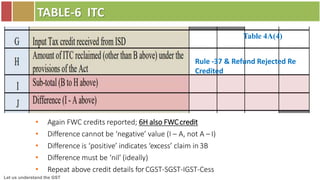

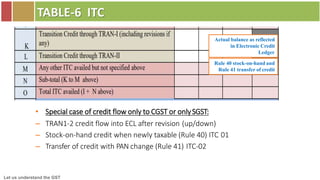

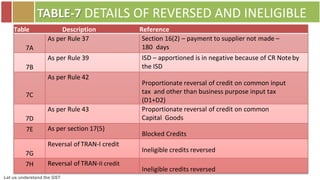

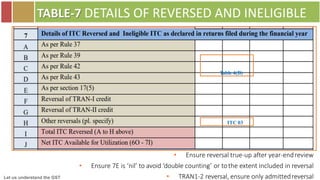

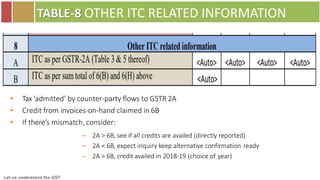

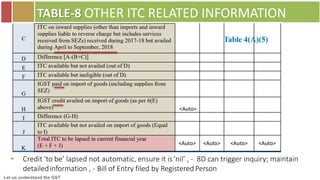

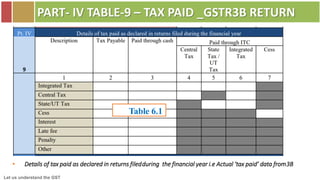

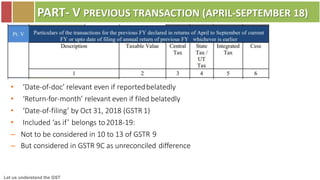

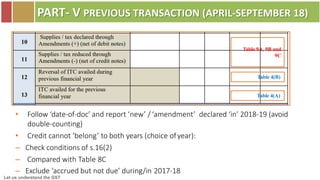

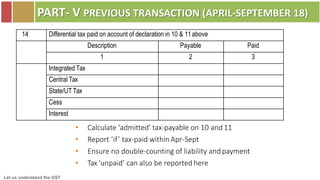

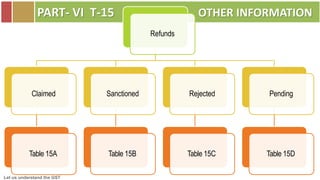

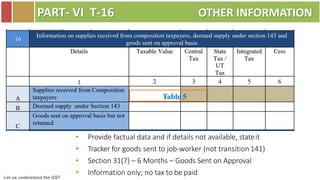

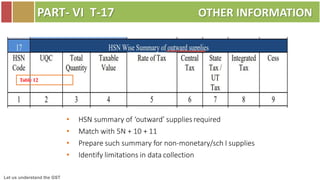

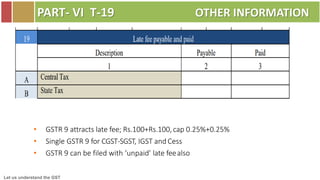

The document provides a comprehensive overview of the Goods and Services Tax (GST) annual return filing process in India, focusing on GSTR 9 and its various components, regulatory requirements, deadlines, and penalties for late filing. It details the types of registered persons required to file and outlines essential parts of the return, including outward and inward supplies, input tax credits, and reconciliation aspects. Additionally, it highlights key dates and emphasizes the necessity for accuracy in reporting to avoid potential penalties or discrepancies.