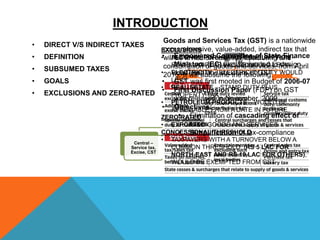

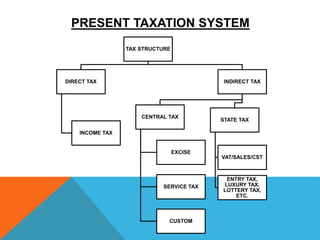

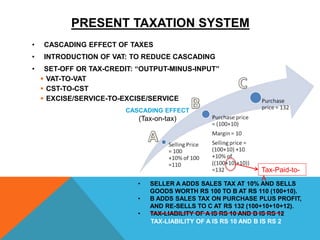

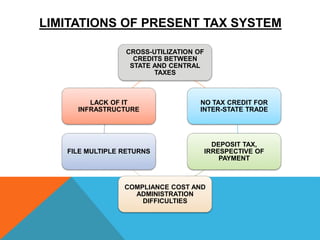

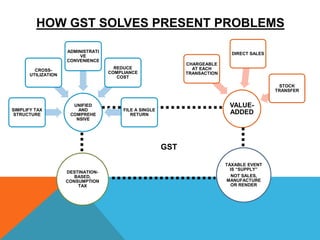

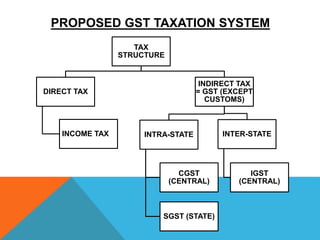

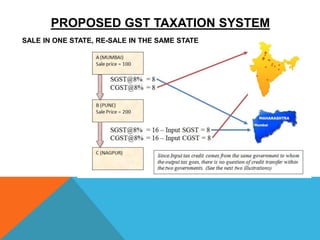

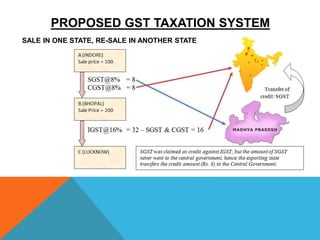

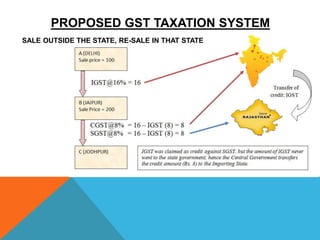

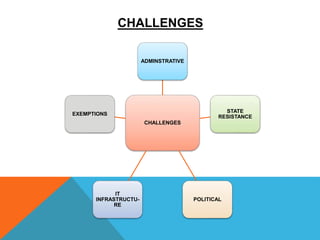

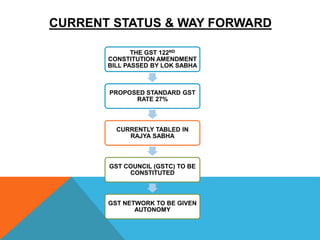

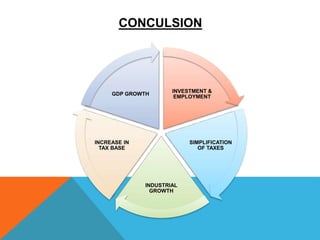

This document provides an overview of the proposed Goods and Services Tax (GST) system in India. It discusses the limitations of the current indirect tax system, including cascading taxes and lack of centralized administration. The proposed GST system would create a unified tax structure with three components - CGST, SGST, and IGST. This would simplify compliance, reduce costs, and promote a unified national market. The bill has passed the Lok Sabha and is currently tabled in the Rajya Sabha. Implementation of GST is expected to boost investment, employment, and economic growth in India by simplifying taxes and widening the tax base.