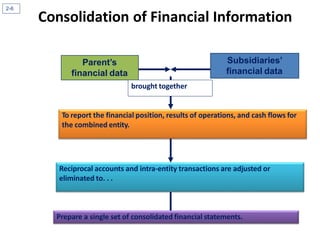

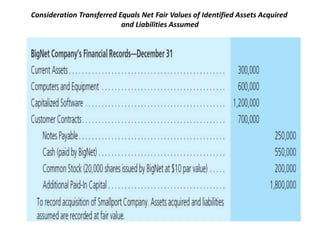

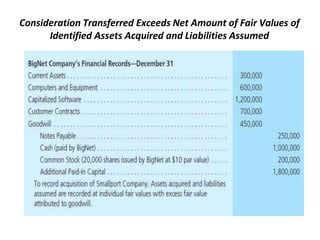

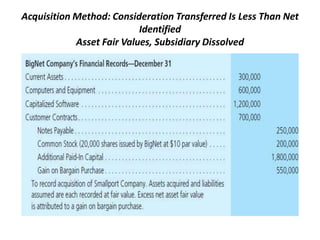

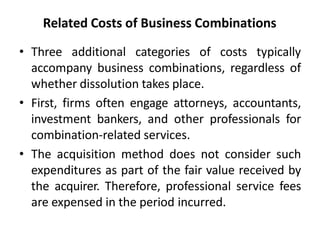

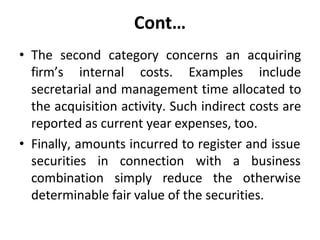

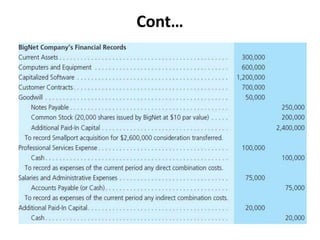

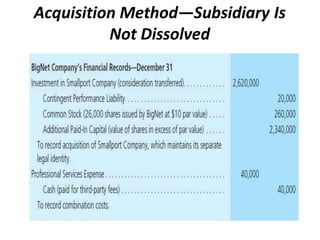

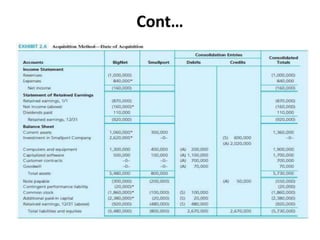

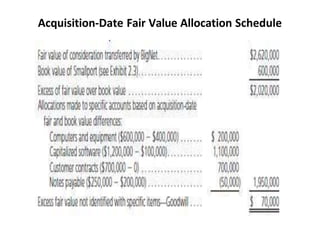

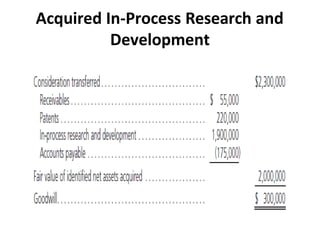

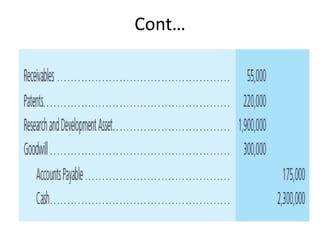

This chapter discusses the consolidation of financial information for business combinations. It explains that consolidated financial statements combine the financial data of a parent company and its subsidiaries. The chapter outlines the acquisition method for accounting for business combinations, where one company obtains control of another. Under this method, the consideration transferred is allocated to identifiable assets acquired and liabilities assumed based on their fair values. Goodwill arises when the consideration exceeds the fair values. The chapter also discusses how pre-existing goodwill and in-process R&D are treated under the acquisition method.