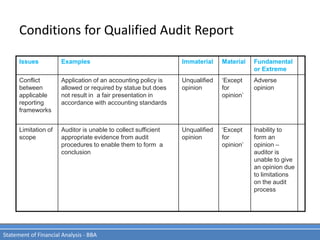

The audit report communicates the auditor's opinion on the financial statements and sets out requirements for its content and format. The standard audit report includes basic elements like the title, addressee, management and auditor responsibilities, scope of the audit, and opinion. There are two main types of reports - unqualified and qualified. An unqualified report means the financials fairly represent the entity. A qualified report is issued if problems cannot be resolved with management.