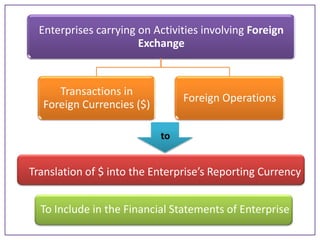

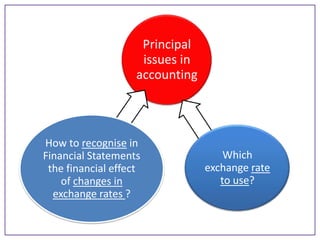

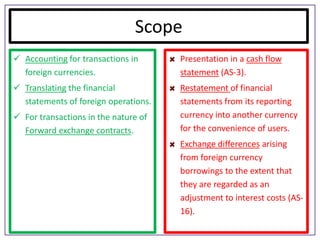

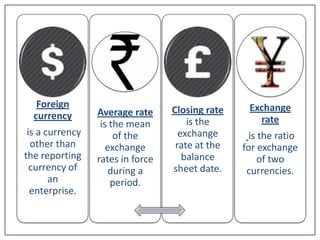

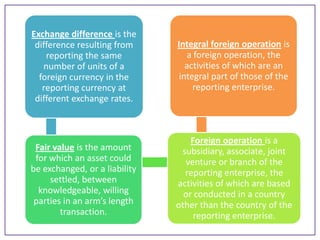

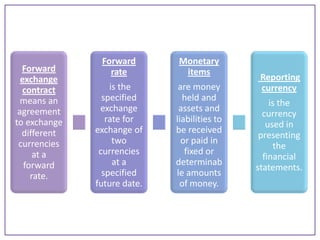

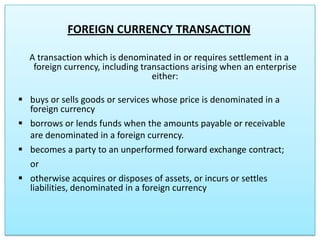

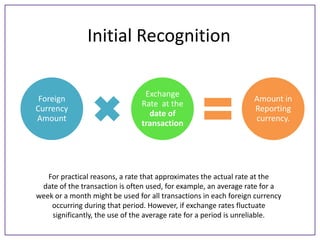

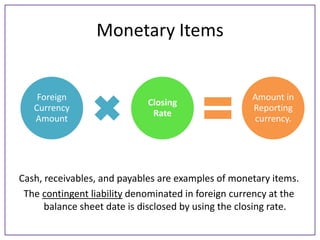

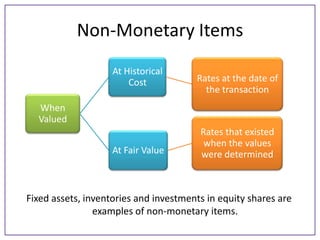

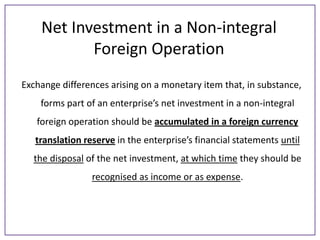

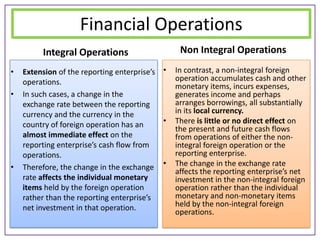

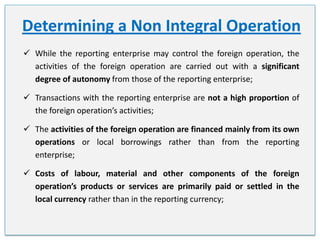

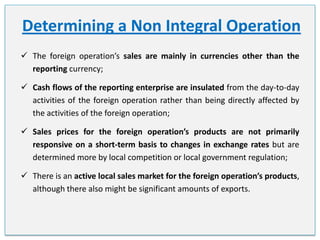

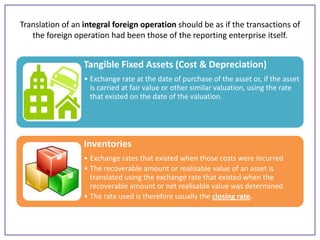

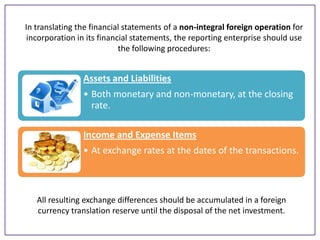

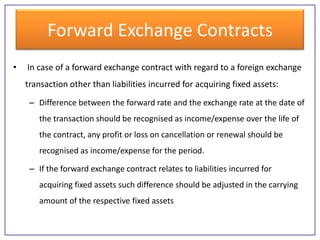

This document outlines accounting standards for foreign exchange rates. It discusses how to account for transactions in foreign currencies and translating financial statements of foreign operations. For transactions, the exchange rate on the transaction date is used. Monetary items in financial statements are translated at the closing rate, while non-monetary items are translated at historical rates. Exchange differences are generally recognized as income/expenses, except for differences related to net investments in non-integral foreign operations, which are accumulated in a foreign currency translation reserve until disposal of the net investment. Financial statements of integral foreign operations are translated as if their transactions were the reporting entity's, while non-integral operations use closing rates for assets/liabilities and transaction date rates for income/ex