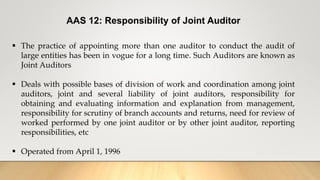

This document provides an overview of the Auditing & Assurance Standards (AAS) issued by the Institute of Chartered Accountants of India. It summarizes 35 AAS standards, beginning with AAS 1 on basic principles governing an audit issued in 1985. The standards cover topics such as audit evidence, risk assessment, internal control, reliance on internal/other auditors, representations, materiality, analytical procedures, sampling, going concern, quality control, estimates, subsequent events, laws/regulations, related parties, service organizations, comparatives, terms of engagement, communication with governance, auditor reporting, computer systems auditing, confirmations, compilation/review of financial statements, agreed upon procedures, and prospective financial information. The