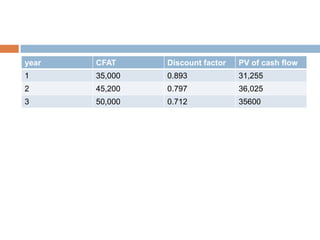

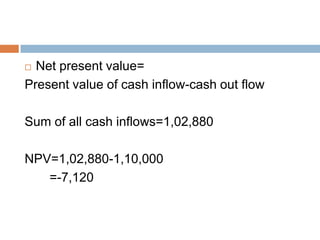

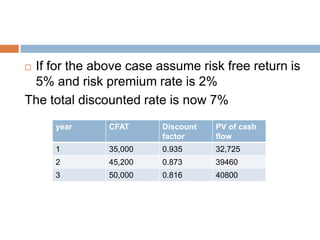

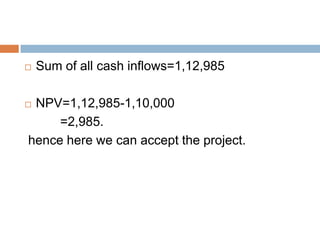

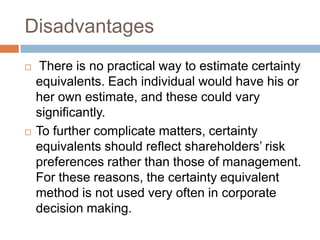

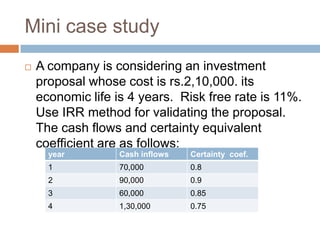

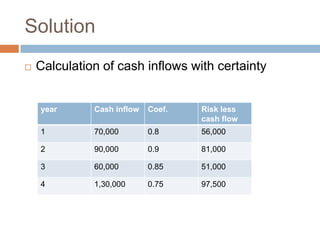

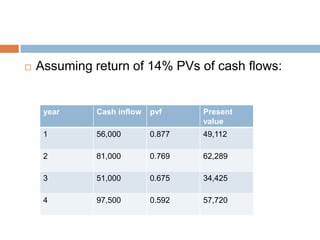

The document discusses methods for calculating risk-adjusted discount rates. It defines risk-adjusted discount rate as the sum of the risk-free rate and a risk premium. The risk premium depends on the risk aversion of the investor and perceived investment risk. The certainty equivalent method reduces cash flow forecasts to conservative levels by applying coefficients between 0 and 1. Both the risk-adjusted discount rate and certainty equivalent methods can be used with net present value and internal rate of return to evaluate investment projects.