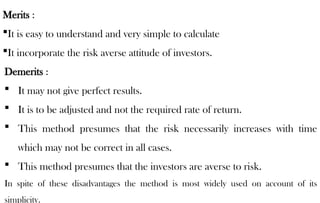

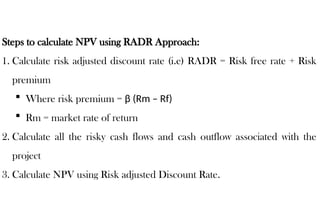

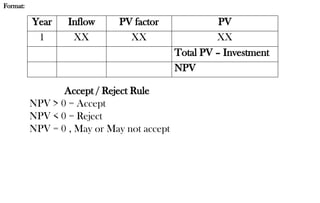

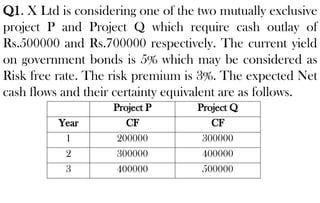

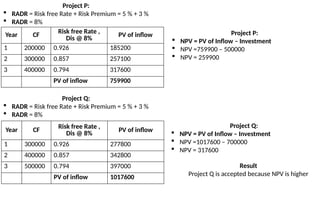

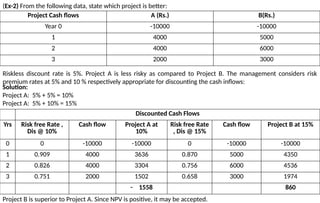

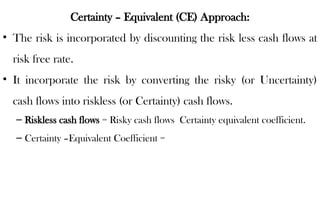

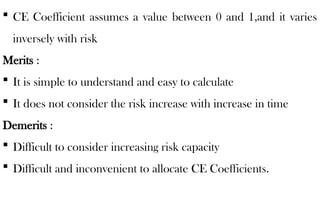

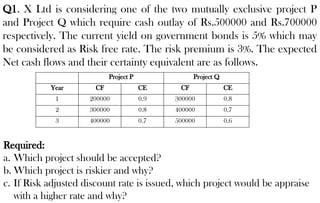

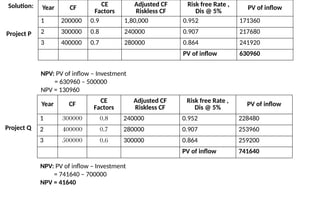

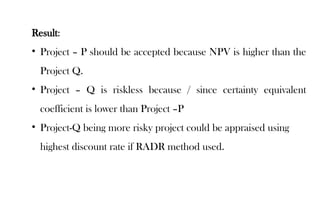

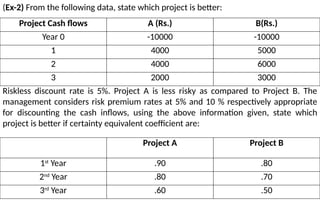

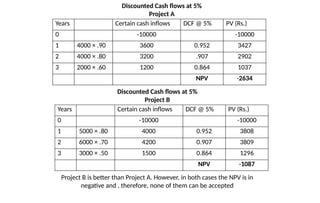

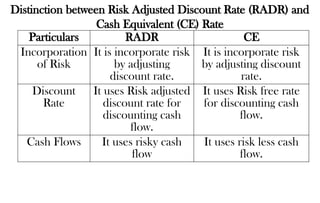

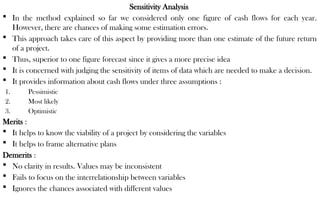

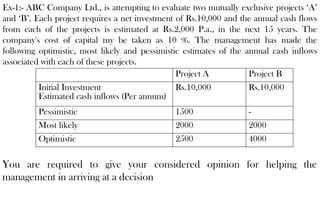

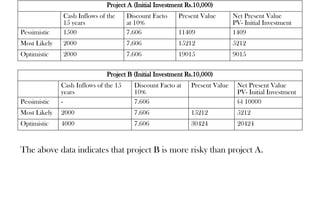

The document discusses advanced financial management focusing on risk analysis in capital budgeting, outlining the differences between risk and uncertainty, and various techniques for risk measurement such as the risk-adjusted discount rate and certainty equivalent method. It highlights the importance of adjusting for risk in capital budgeting decisions to assess the true value of expected cash inflows and includes examples of project evaluations. Additionally, it covers statistical methods for investment decisions including sensitivity analysis and simulation methods, along with their merits and demerits.