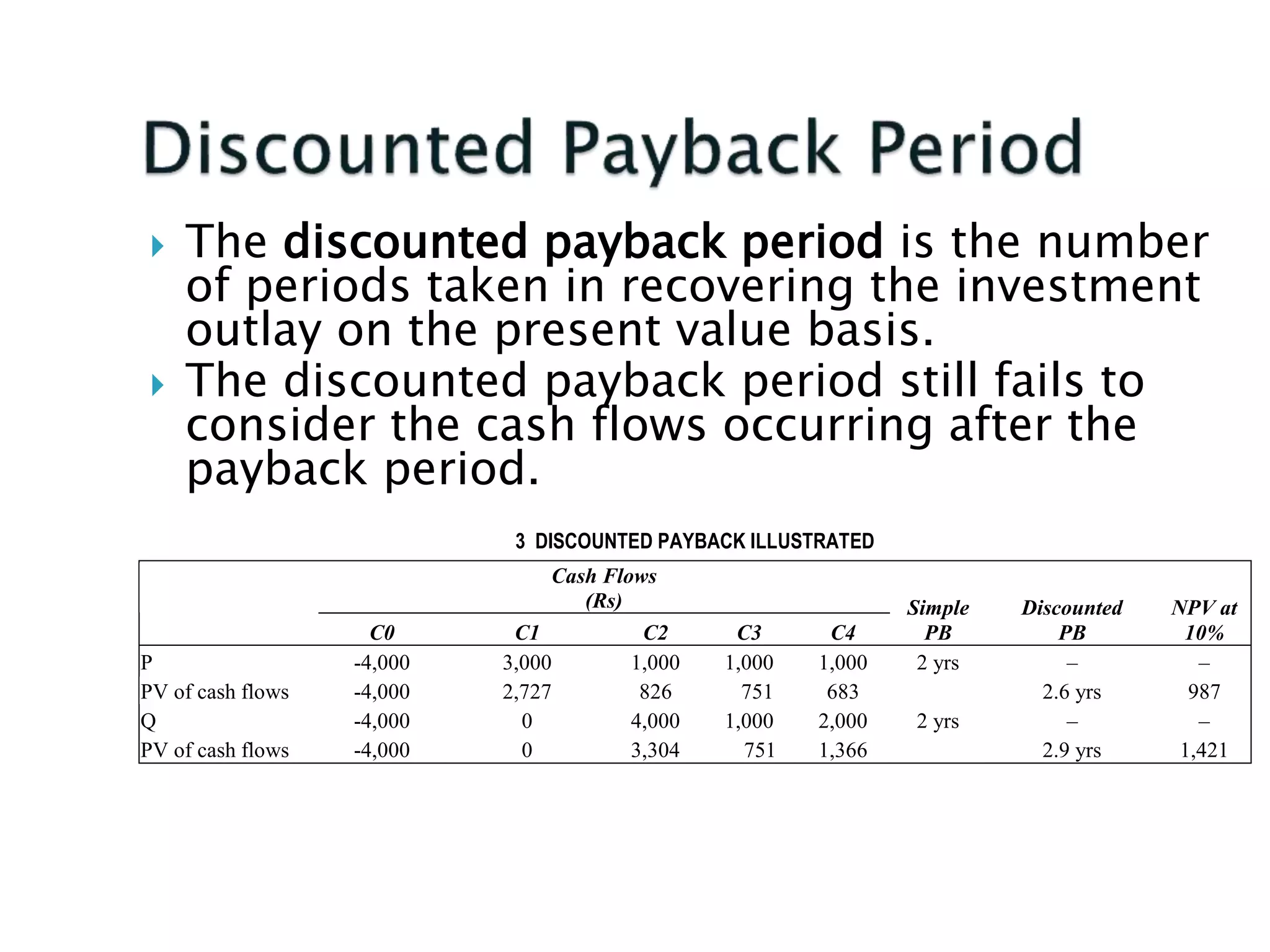

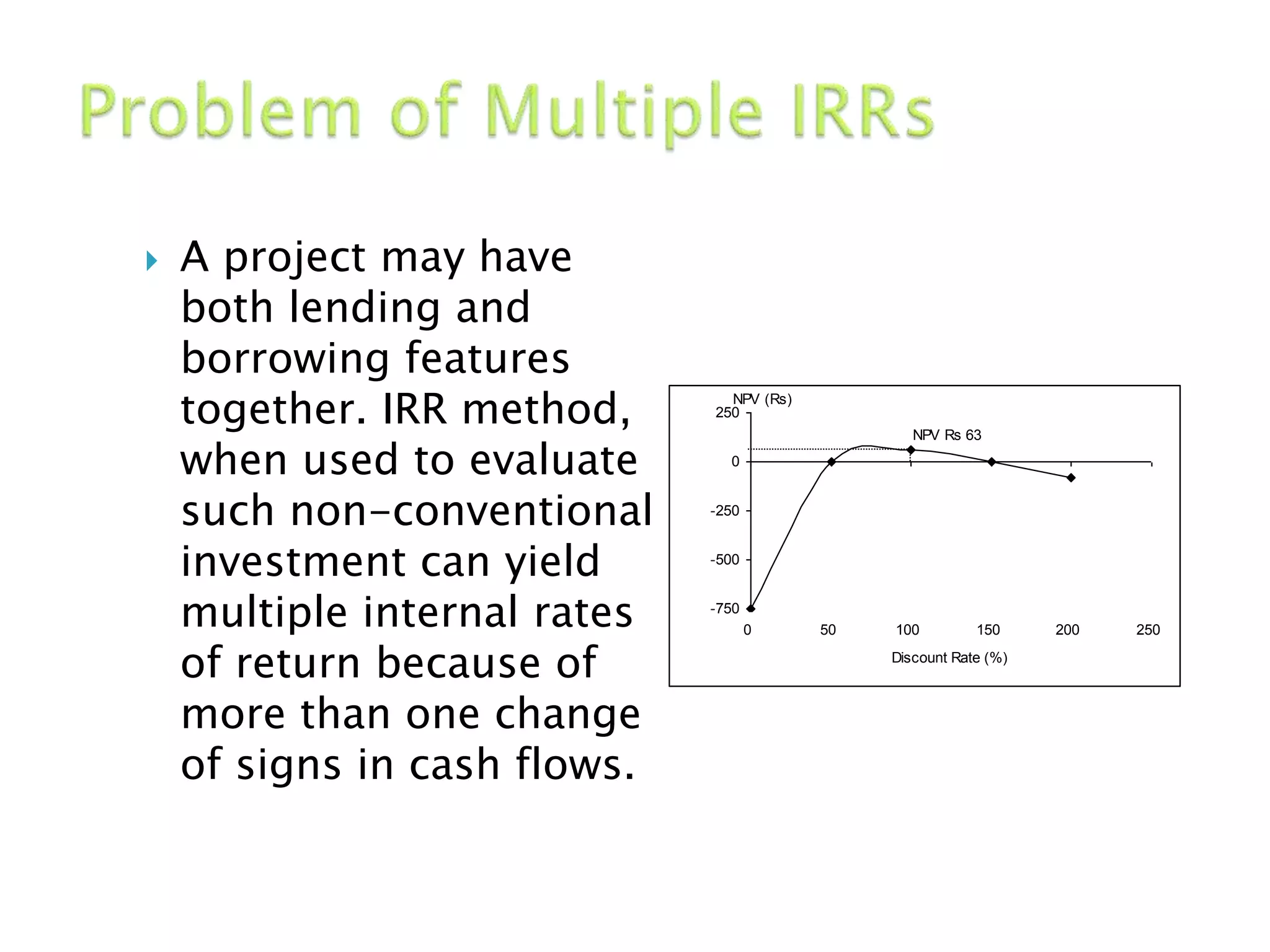

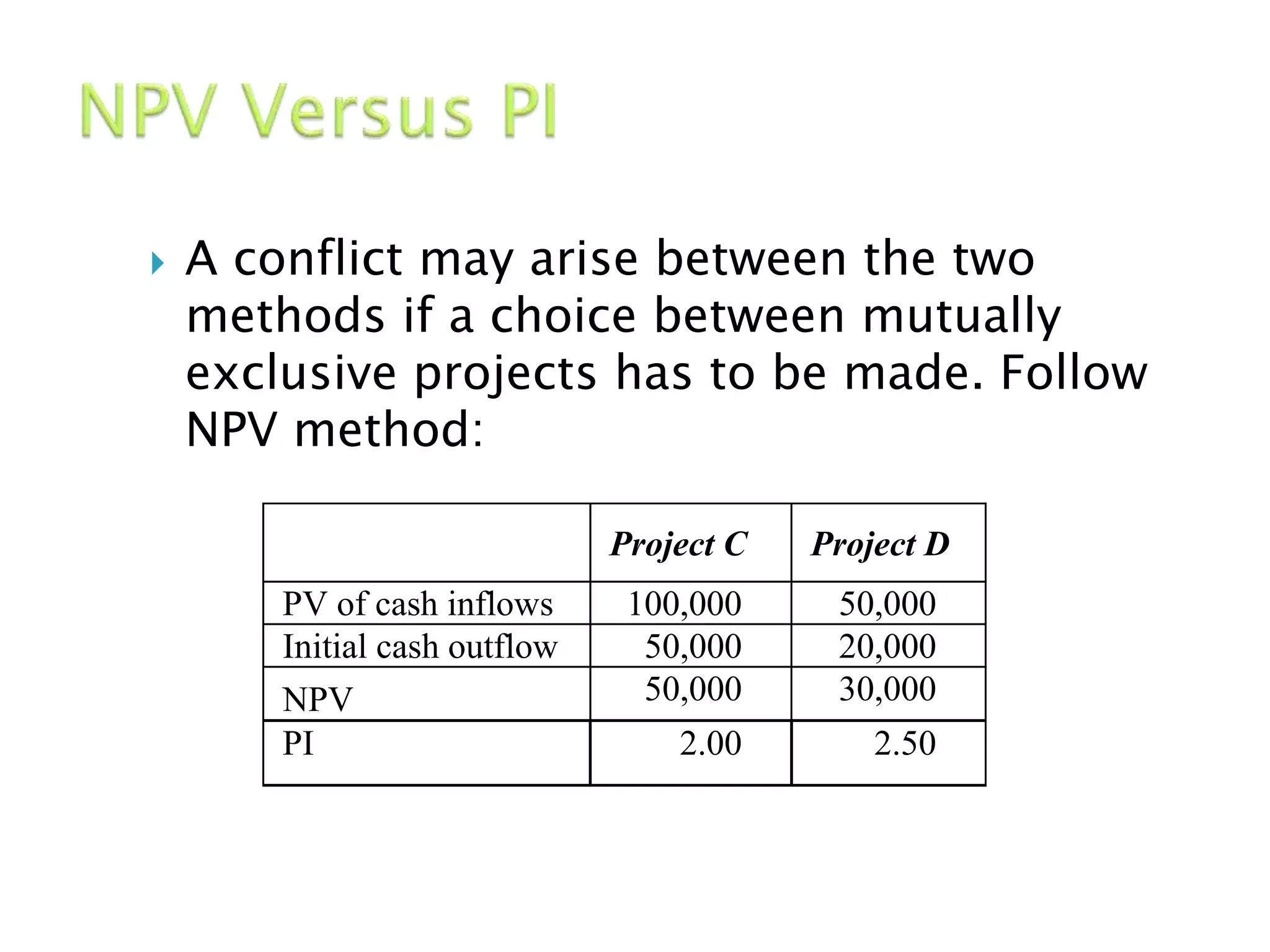

The document covers key investment evaluation methods, emphasizing discounted cash flow (DCF) techniques like net present value (NPV) and internal rate of return (IRR), along with non-DCF criteria such as payback period and accounting rate of return (ARR). It outlines the principles of making capital budgeting decisions, the importance of accurate cash flow forecasting, and the necessity of selecting projects that maximize shareholder wealth. Various investment criteria are compared, highlighting the benefits and limitations of each method, while also addressing the complexities involved in different types of investments.

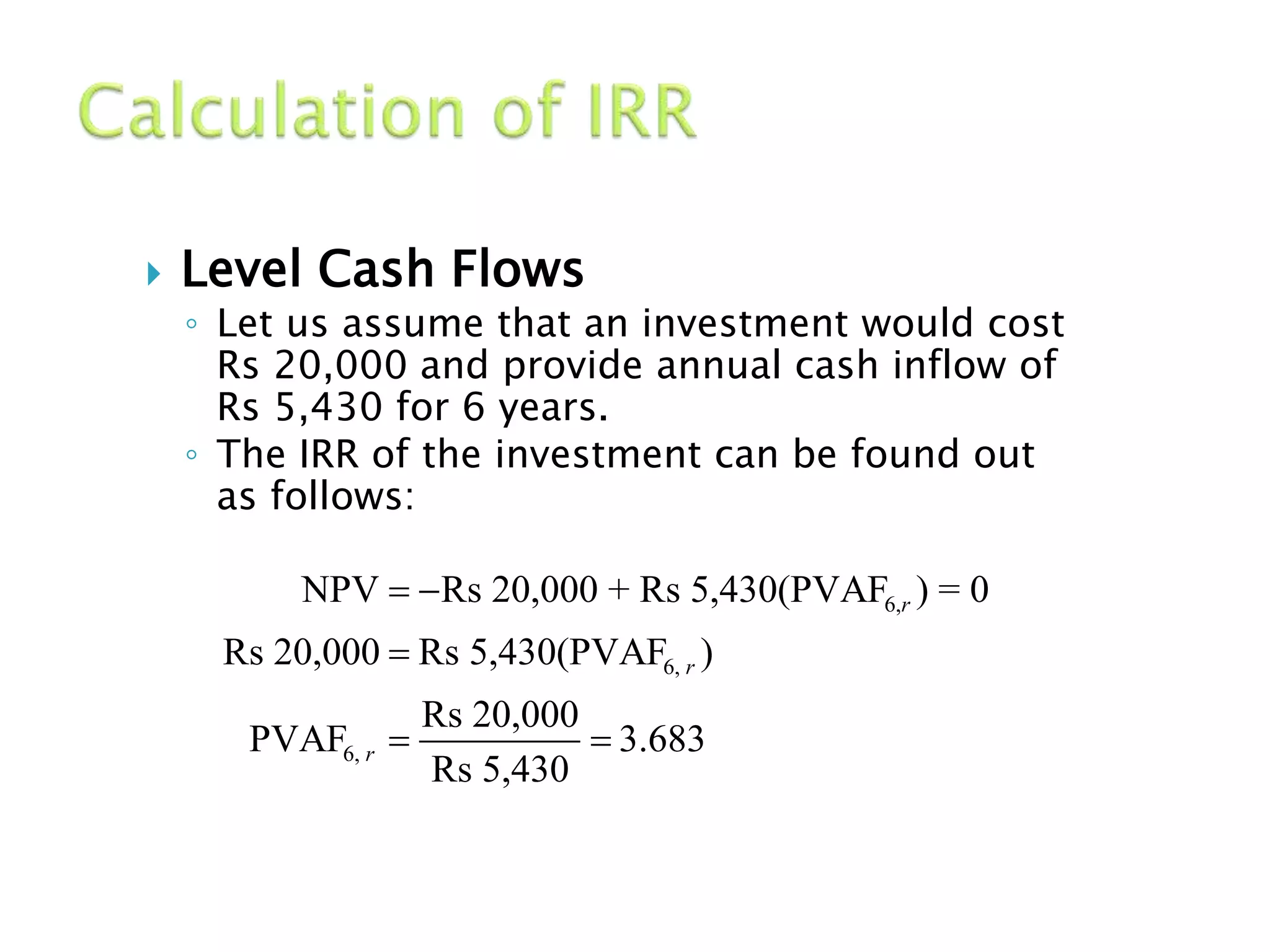

![ Assume that Project X costs Rs 2,500 now

and is expected to generate year-end cash

inflows of Rs 900, Rs 800, Rs 700, Rs 600

and Rs 500 in years 1 through 5. The

opportunity cost of the capital may be

assumed to be 10 per cent.

2 3 4 5

1, 0.10 2, 0.10 3, 0.10

4, 0.10 5, 0.

Rs 900 Rs 800 Rs 700 Rs 600 Rs 500

NPV Rs 2,500

(1+0.10) (1+0.10) (1+0.10) (1+0.10) (1+0.10)

NPV [Rs 900(PVF ) + Rs 800(PVF ) + Rs 700(PVF )

+ Rs 600(PVF ) + Rs 500(PVF

10)] Rs 2,500

NPV [Rs 900 0.909 + Rs 800 0.826 + Rs 700 0.751 + Rs 600 0.683

+ Rs 500 0.620] Rs 2,500

NPV Rs 2,725 Rs 2,500 = + Rs 225

](https://image.slidesharecdn.com/capitalbudgeting-200528081640/75/Capital-budgeting-11-2048.jpg)