DuPont Analysis Breakdown

- 1. DuPont Analysis Date: 27th June 2019

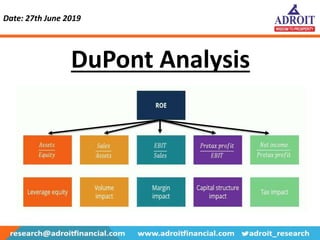

- 2. The Return on Equity ratio represents the amount of profit generated against the amount of money invested by the shareholders. But, mere ROE is not sufficient enough to convey the exact position of a company’s profitability, because there may be many different factors (internal or external) affecting the profits of the business. To make this assessment a little more convenient, DuPont Analysis helps break down ROE into three further components to identify the weight of each particular factor. As per the model, it is broken down into three components i.e. Net Profit Margin, Total Asset Turnover and Financial Leverage (Equity Multiplier). Introduction

- 3. Components of the DuPont Equation Profit Margin As the name suggests, profit margin indicates profitability. It is a measurement of how well a business strategizes its prices and how lower it can drive its costs. As an aspect of the DuPont model, if the profit margin of a company increases, each successive sale will bring in more cash flow to the company, ultimately leading to a higher overall return on equity. Asset Turnover Asset turnover is a financial ratio that measures how efficiently a business’s assets are used to contribute towards sales. Companies with poor profits tend to have a huge asset turnover because more and more assets are being contributed towards the increasing sales of the company. Financial Leverage Financial leverage (or Equity Multiplier) refers to the ratio of outside debt that a company needs to use to fund its everyday operations in relation to the equity capital being utilized for the same. Since dividend payments do not come under tax obligations, a high volume of debt in the company’s capital structure leads to better overall profitability.

- 4. The DuPont model is of great importance because it doesn't just want to know what return on equity is, rather it allows you to identify which specific variables are causing the ROE in the first place. By measuring and highlighting those underlying realities, it becomes easier to analyze & improve them (if required) and take better decisions. Relevance of components If you look closely at the formula, the net effect will still be net income against total equity. The extension gives us a better understanding as to which factor weighs more in contributing towards higher return on equity.

- 5. Example Ratio ABC XYZ Profit Margin 50% 35% Total Asset Turnover .30 3.0 Financial Leverage 3.5 .50 Return on Equity 0.5*.3*3.5 = .525 =0.35*3*.5 = .525 As we can see, both ABC and XYZ (that operate in the same industry) have the same ROE. But the weightage of different components varies, as explained below: • ABC has better profit margin which indicates that its cost of goods is relatively lower than that of XYZ. – Sales with lower costs lead to higher profits which can be seen in the case of ABC

- 6. • On the other hand, XYZ has humongous amount of sales which can be witnessed by a huge asset turnover – Profit margins might be small, but XYZ is turning over a large quantity of goods • When it comes to financial leverage, ABC is way ahead of XYZ by 7 times showing that the company is heavily dependent on outside debt to fund its operations – This might increase the ROE, but high leverage has equally negative impact on the overall position of the business The first two components ascertain the operations of the business. Higher these components, more will be the operating profits of the business. However, one must also take care of the type of industry in which the company operates as Net Profit Margin and Total Asset Turnover tend to swap each other at times. Analysis MACHINERY COMPANY • Poor turnover of assets and require extensive capital investments • Rely on a high profit margin to cover up for the low turnover. QUICK-SERVICE RESTAURANT CHAIN • High asset turnover but much smaller profit margin due to competitive prices in a shark-filled industry.

- 7. A five-step DuPont model isolates operations and financial impacts on ROE, where we try to see the effect of interest expense on the Net Profit Margin. Both the three-and five-step equations, give a better understanding by analysing all factors separately rather than just looking at a simple ratio. For example, when looking at two competitors, one may have a lower ROE. With the five- step analysis, one can see the reason behind it which may or not be: lenders see the company as riskier and charge it higher interest or the company is not properly managed and has a low equity multiplier or the company has higher COGS that lead to a poor profit margin. Identifying the core issue leads to a more comprehensive understanding of a company’s valuations, leading to a better investment decision. 5-step DuPont Model

- 8. Conclusion If there is an increase in the Net Profit Margin without a change in the Financial Leverage, it indicates that the profits of the company are increasing organically. But if the Financial Leverage is the sole reason behind a high ROE, it’s risky because the company is focused on utilizing its debt and that’s an alarming sign. Thus, we need to check whether the growth in company’s profitability is due to increase in Net Profit Margin or Asset Turnover Ratio (which is a good sign) or only due to Financial Leverage (which is bad news).

- 9. Disclaimer Prepared By: Research Intern [Sagnik Monga, BBA (Financial Investment Analysis)] Phone Number: 0120-4550300 Adroit Financial Services Private Limited (hereinafter referred to as “Adroit”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Adroit Financial Services Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide Registration Number INH100003084. Adroit or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Adroit or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Neither Adroit, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Adroit Financial Services Private Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. Disclosure The Research Analysts and /or Adroit Financial Services Private Limited do hereby certify that:- • The Research Analyst or Adroit Financial Services Private Limited or his/its Associates or his/its relative, may or may not have any holdings in the subject company (ies) covered in this report. • The Research Analyst or Adroit Financial Services Private Limited or his/its Associates or his/its relative, do not have actual/beneficial ownership of 1% or more in the subject company, at the end of the month immediately preceding the date of the publication of the research report. • The Research Analyst or Adroit Financial Services Private or his/its Associates or his/its relatives do not have any material conflict of interest at the time of publication of the research report. • The Research Analyst or Adroit Financial Services Private Limited or his/its Associates have not received compensation for investment banking or merchant banking or brokerage services or for product other than for investment banking or merchant banking or brokerage services from the companies covered in this report in the past 12 months. • The Research Analyst or Adroit Financial Services Private Limited or his/its Associates have not managed or co managed in the previous 12 months any private or public offering of securities for the company (ies) covered in this report. • The Research Analyst or Adroit Financial Services Private Limited or his/its Associates have not received any compensation or other benefits from the company (ies) covered in this report or any third party in connection with the Research Report. • The Research Analyst has not served as an officer, director or employee of the company (ies) covered in the research report. • The Research Analyst or Adroit Financial Services Private Limited have not been engaged in Market making activity of the company (ies) covered in the research report.