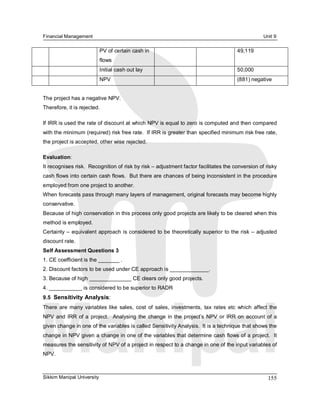

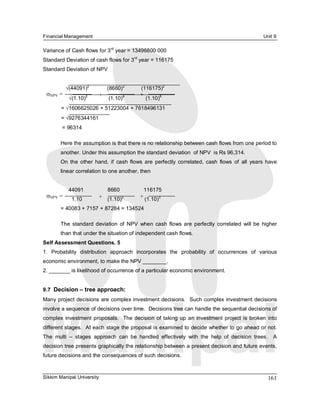

This document discusses risk analysis in capital budgeting. It defines risk as the variation between actual and expected cash flows from a project. There are three main types of risk: stand-alone, portfolio, and market risk. The sources of risk include project-specific risks, competitive risks, industry risks, and international risks. Specific industry risks mentioned are technological risks, commodity risks, and legal risks. The document outlines various methods that can be used to incorporate risk into capital budgeting decisions, including adjusting the discount rate and using certainty equivalents, sensitivity analysis, and probability distributions.