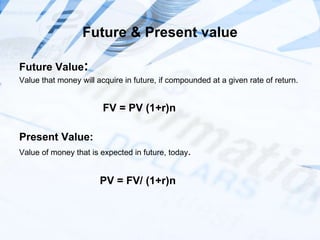

The document discusses various capital budgeting techniques used to evaluate long-term investment projects. It describes approaches like net present value (NPV), internal rate of return (IRR), profitability index, and payback period. It also discusses risks involved like stand-alone risk, corporate risk, and market risk. Scenario analysis and simulation analysis are presented as methods to incorporate risk analysis into the capital budgeting process.