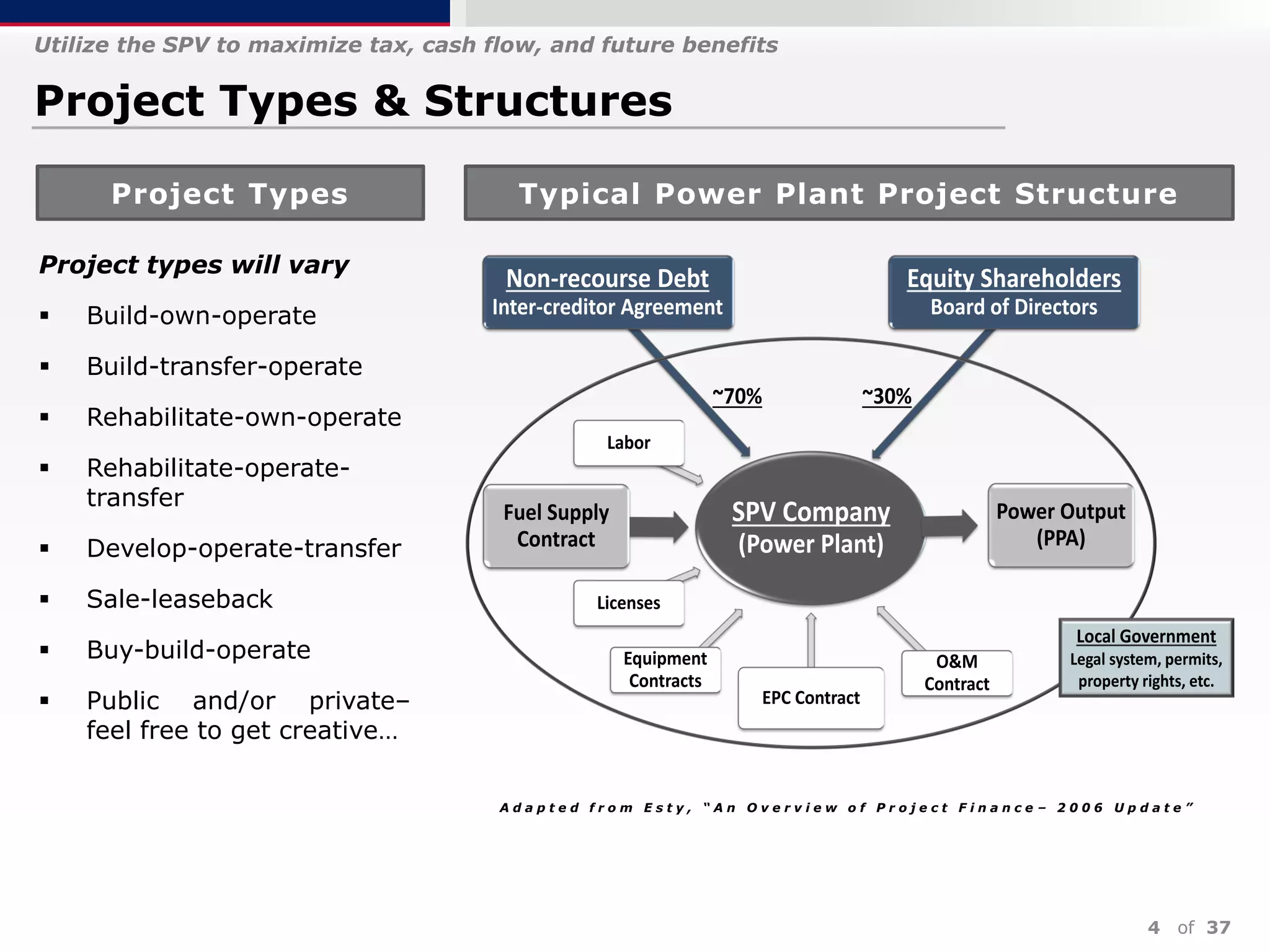

This document provides an overview of project finance for power generation projects. It defines project finance and differentiates it from other types of finance. Some key aspects covered include:

- Project finance uses a special purpose vehicle to finance infrastructure projects on a limited or non-recourse basis.

- Risks are allocated optimally through contracts between the project consortium members.

- Credit ratings consider the standalone credit profile of the project based on operational and construction risk factors.

- Projects require diligence on financial modeling, engineering reviews, market assessments, and ensuring permits and commitments are in place.

- Exhibits provide more details on engineering procurement construction management, legal structures, and benchmarking power plant costs

![of 37

EIA U.S. Plant Cost Data ($2012)

Benchmarking plant costs

Coal

Single Unit Advanced PC 650 8,800 $3,246 $37.80 $4.47

Dual Unit Advanced PC 1,300 8,800 $2,934 $31.18 $4.47

Single Unit Advanced PC with CCS 650 12,000 $5,227 $80.53 $9.51

Dual Unit Advanced PC with CCS 1,300 12,000 $4,724 $66.43 $9.51

Single Unit IGCC 600 8,700 $4,400 $62.25 $7.22

Dual Unit IGCC 1,200 8,700 $3,784 $51.39 $7.22

Single Unit IGCC with CCS 520 10,700 $6,599 $72.83 $8.45

Natural Gas

Conventional CC 620 7,050 $917 $13.17 $3.60

Advanced CC 400 6,430 $1,023 $15.37 $3.27

Advanced CC with CCS 340 7,525 $2,095 $31.79 $6.78

Conventional CT 85 10,850 $973 $7.34 $15.45

Advanced CT 210 9,750 $676 $7.04 $10.37

Fuel Cells 10 9,500 $7,108 $0.00 $43.00

Uranium

Dual Unit Nuclear 2,234 N/A $5,530 $93.28 $2.14

Biomass

Biomass CC 20 12,350 $8,180 $356.07 $17.49

Biomass BFB 50 13,500 $4,114 $105.63 $5.26

Wind

Onshore Wind 100 N/A $2,213 $39.55 $0.00

Offshore Wind 400 N/A $6,230 $74.00 $0.00

Solar

Solar Thermal 100 N/A $5,067 $67.26 $0.00

Photovoltaic 20 N/A $4,183 $27.75 $0.00

Photovoltaic 150 N/A $3,873 $24.69 $0.00

Geothermal

Geothermal – Dual Flash 50 N/A $6,243 $132.00 $0.00

Geothermal – Binary 50 N/A $4,362 $100.00 $0.00

Municipal Solid Waste

Municipal Solid Waste 50 18,000 $8,312 $392.82 $8.75

Hydroelectric

Conventional Hydroelectric 500 N/A $2,936 $14.13 $0.00

Pumped Storage 250 N/A $5,288 $18.00 $0.00

Plant Plant Costs (2012$)

Nominal

Capacity

Heat Rate

(Btu/kWh)

Overnigh

t Capital

Fixed

O&M

Variable

O&M

Source: http://www.eia.gov/forecasts/capitalcost/

These are average costs and should only serve as benchmarks

16

Notes

1) Nominal capacity quoted in megawatts

(MW)

2) BTU = British thermal unit

3) KWh = Kilowatt hour (power generation

is quoted in hours)

4) KW = Kilowatt

5) 1 MW = 1,000 KW

6) Overnight capital quoted as $/KW.

Example:

Natural gas conventional CC =

620 MW * 1,000 = 620,000 KW * $917

= $568.54mm Overnight capital

7) Fixed O&M quoted as $/KW

8) Variable O&M quoted as $/MWh

(megawatt hour)

9) You cannot calculate generation hours

from this table.

10) Additional calculations to know:

A: Generation (MWh) = Capacity (MW) *

365 [or 366] * 24 * capacity factor %

/

B: MMBTU consumption = Generation

(MWh) * Heat Rate (BTU/KWh) / 1000](https://image.slidesharecdn.com/harvardseminarpowerplantprojectfinanceoverview-191018041002/75/Power-plant-project-finance-overview-17-2048.jpg)