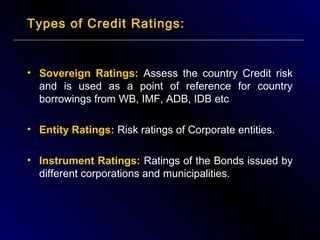

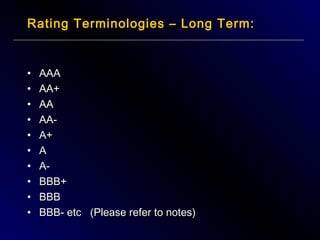

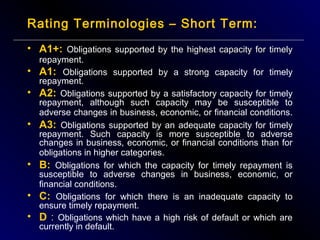

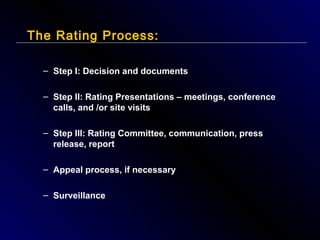

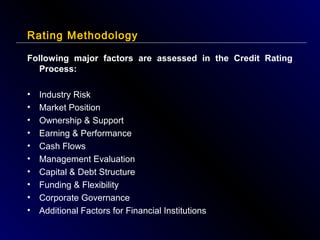

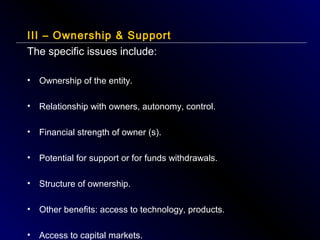

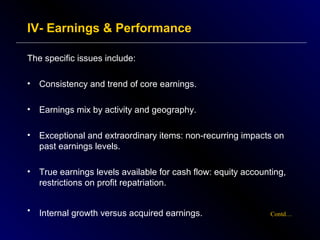

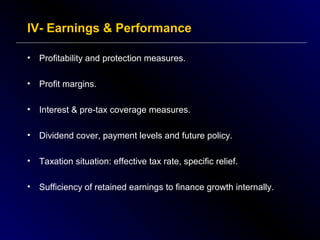

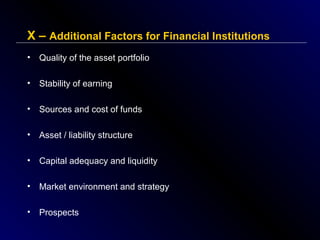

This document provides an overview of the credit rating process. It begins by defining a credit rating as a grade that summarizes an entity's willingness and ability to repay obligations. It then discusses the major credit rating agencies and why credit ratings are important for increasing investor acceptance and lowering borrowing costs. The rest of the document outlines the various types of ratings and terminologies used. It then describes the key factors analyzed in the rating process, including industry risk, market position, earnings performance, cash flows, management evaluation, capital structure, and corporate governance. The rating process itself involves initial documents, rating presentations, committee review, and ongoing surveillance.