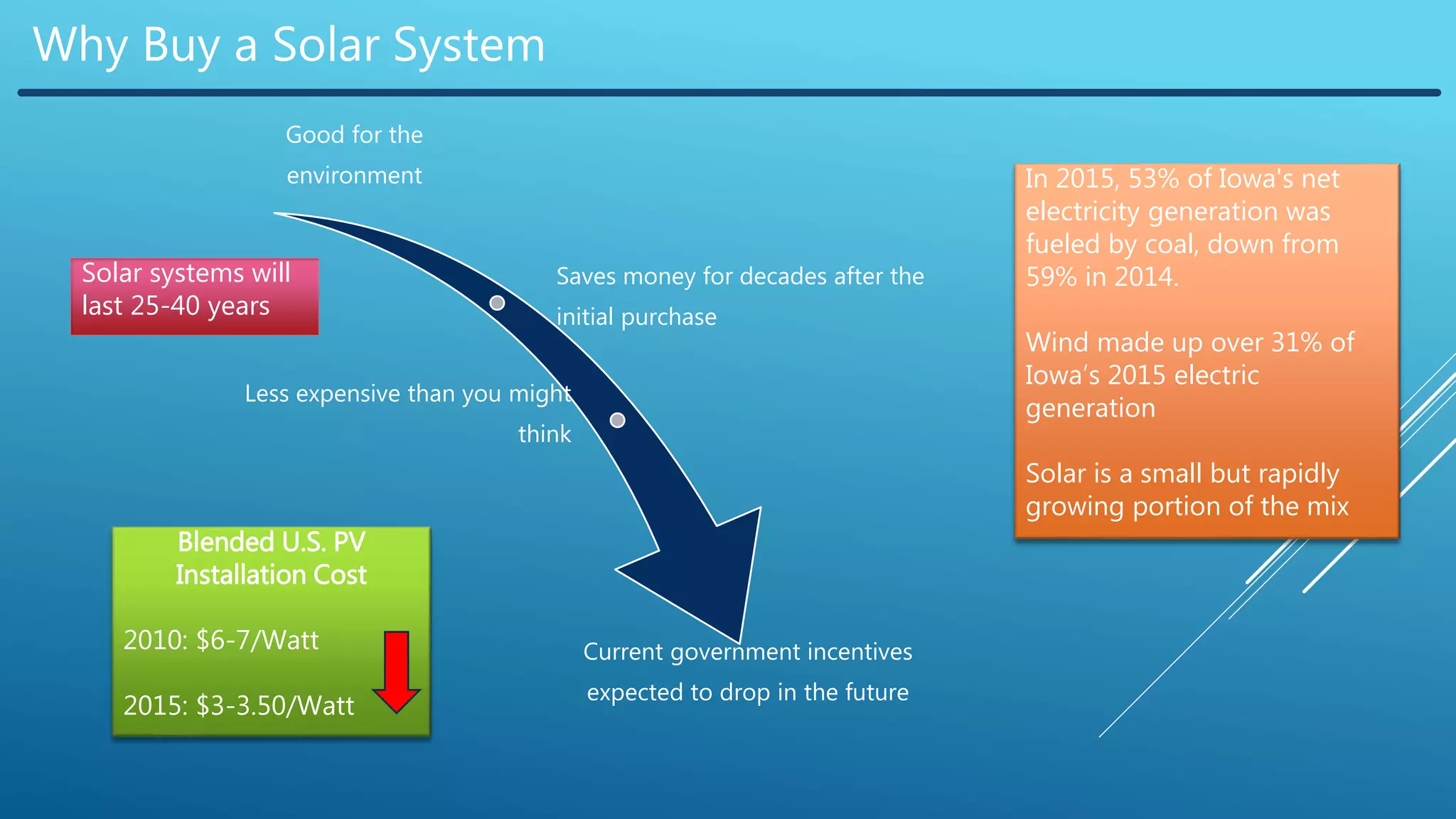

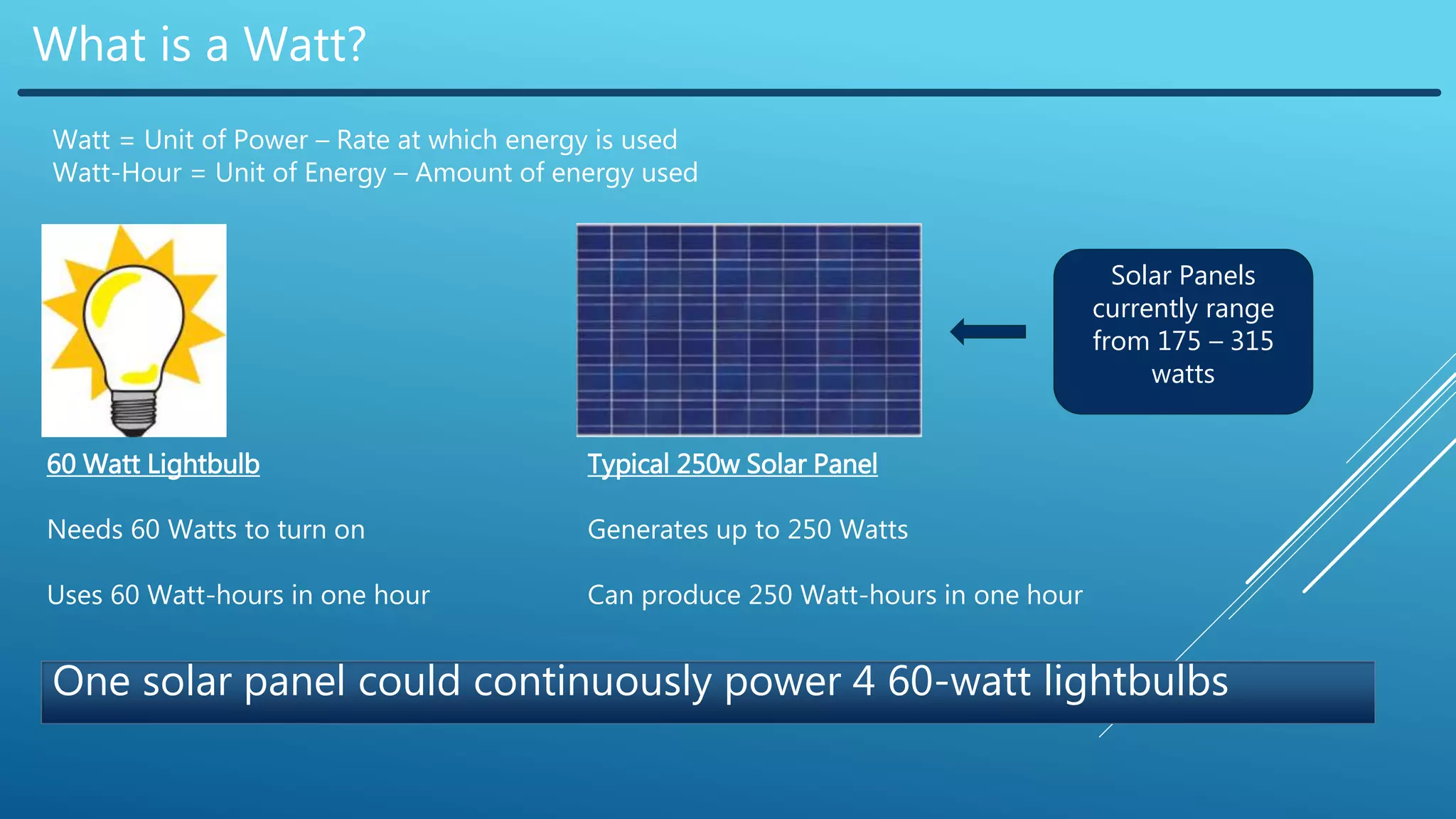

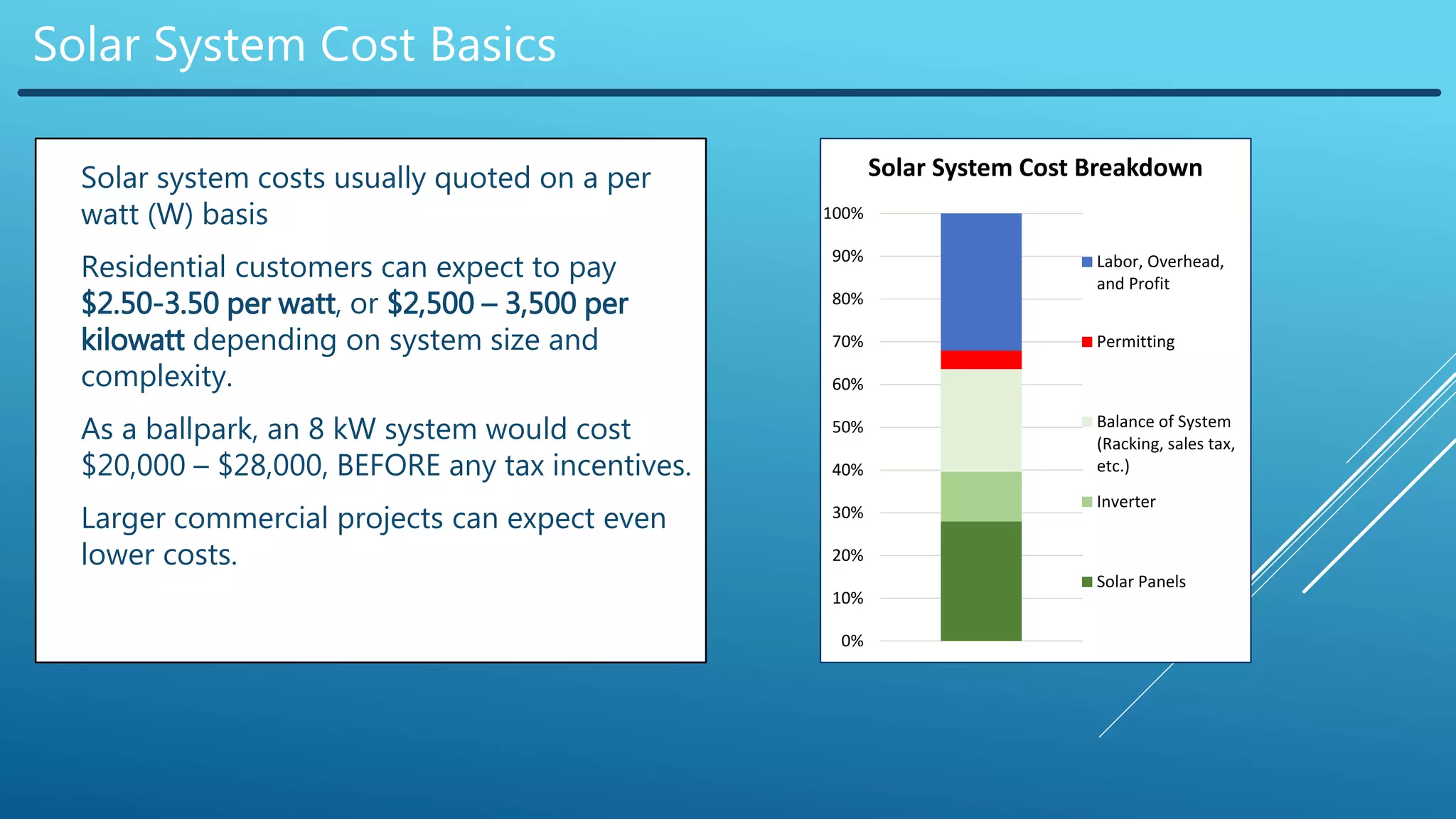

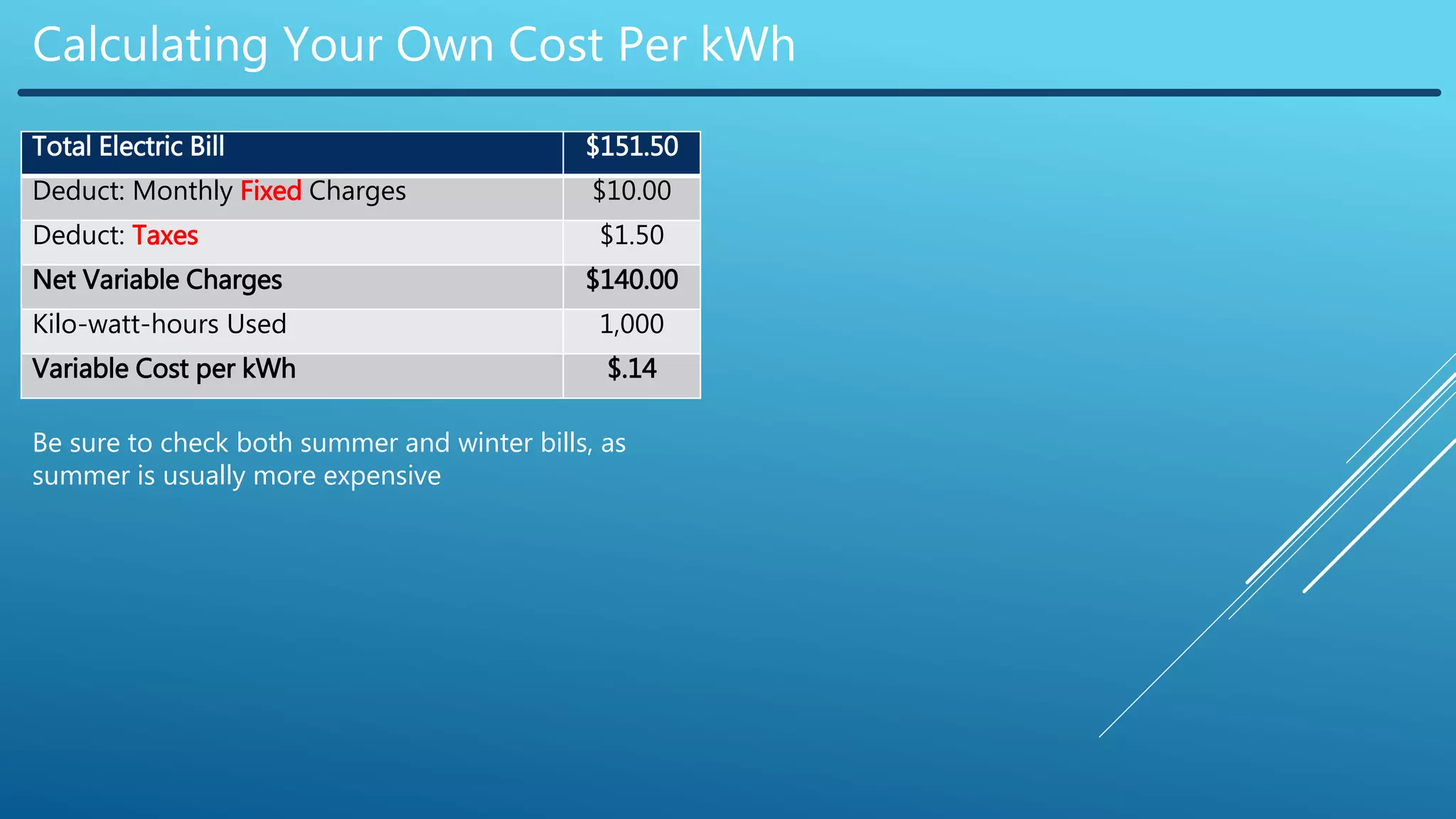

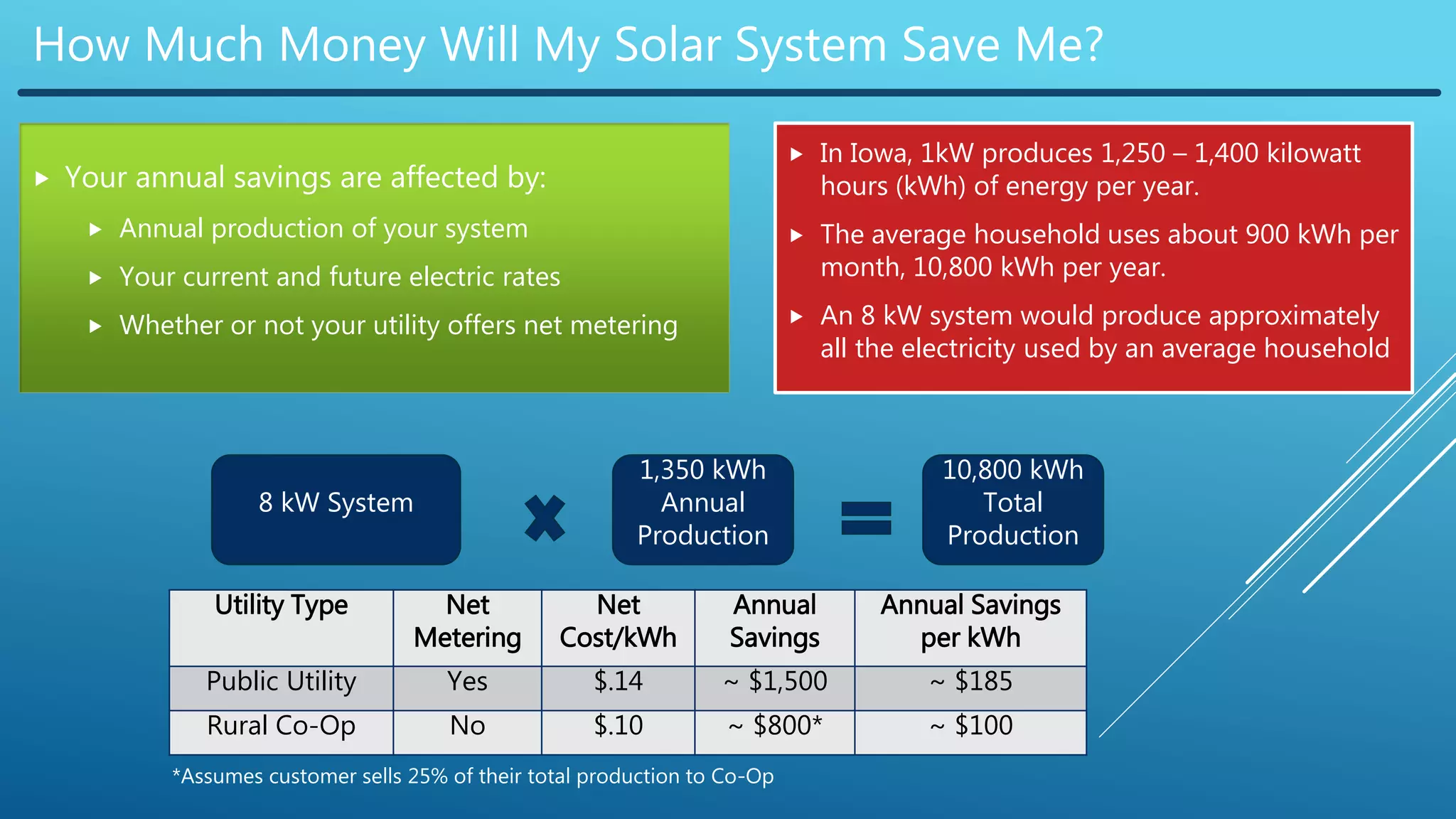

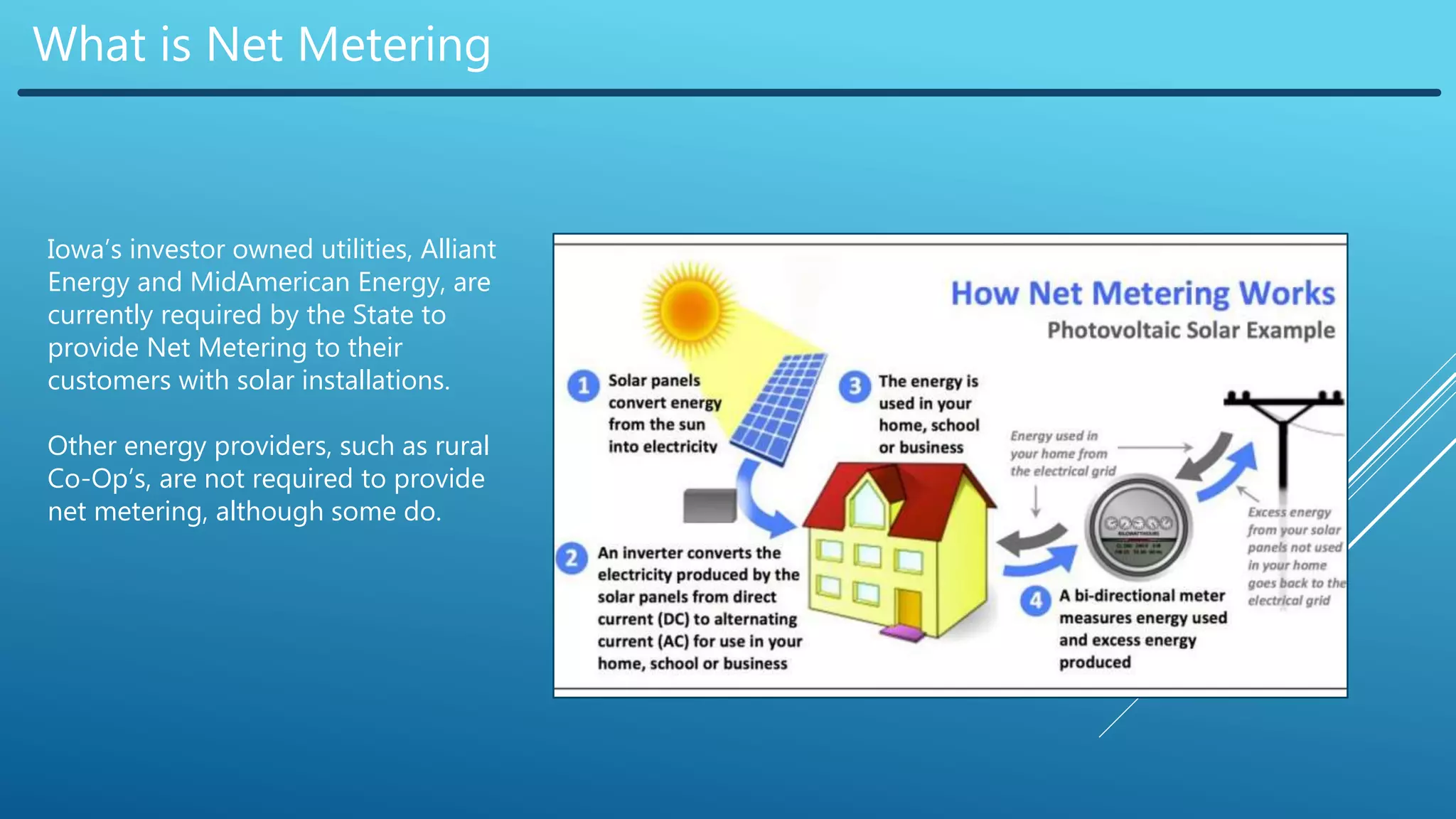

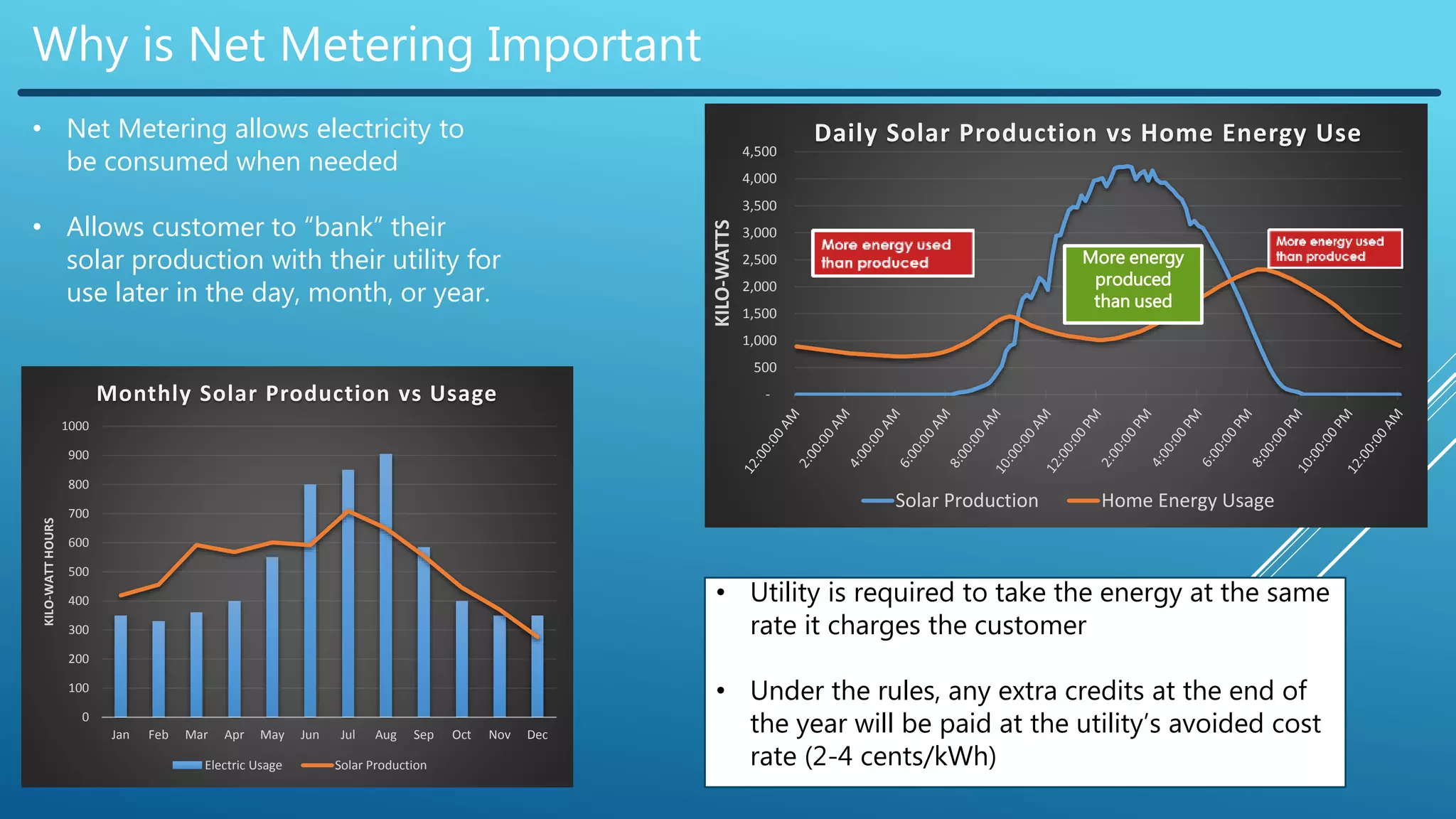

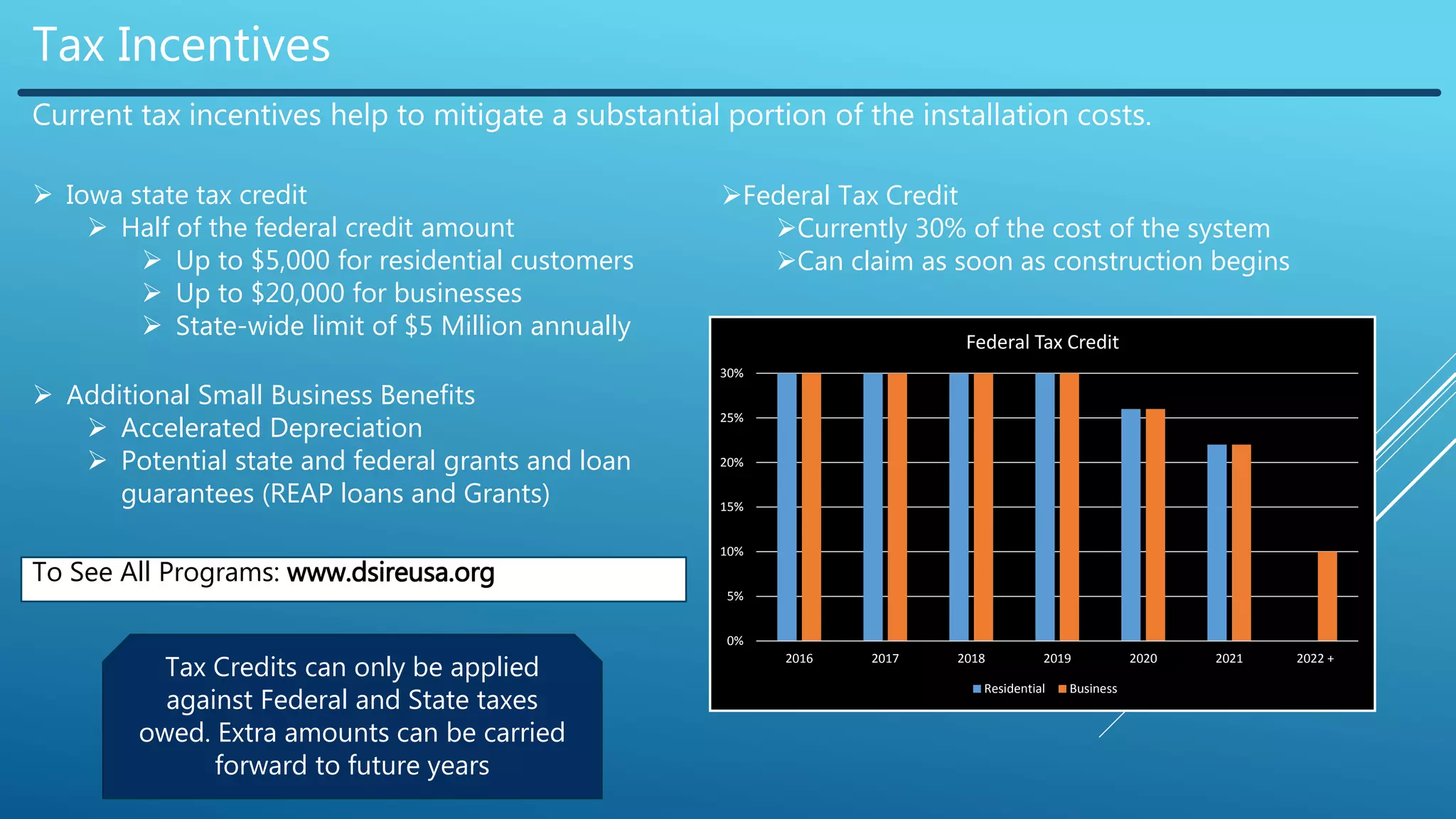

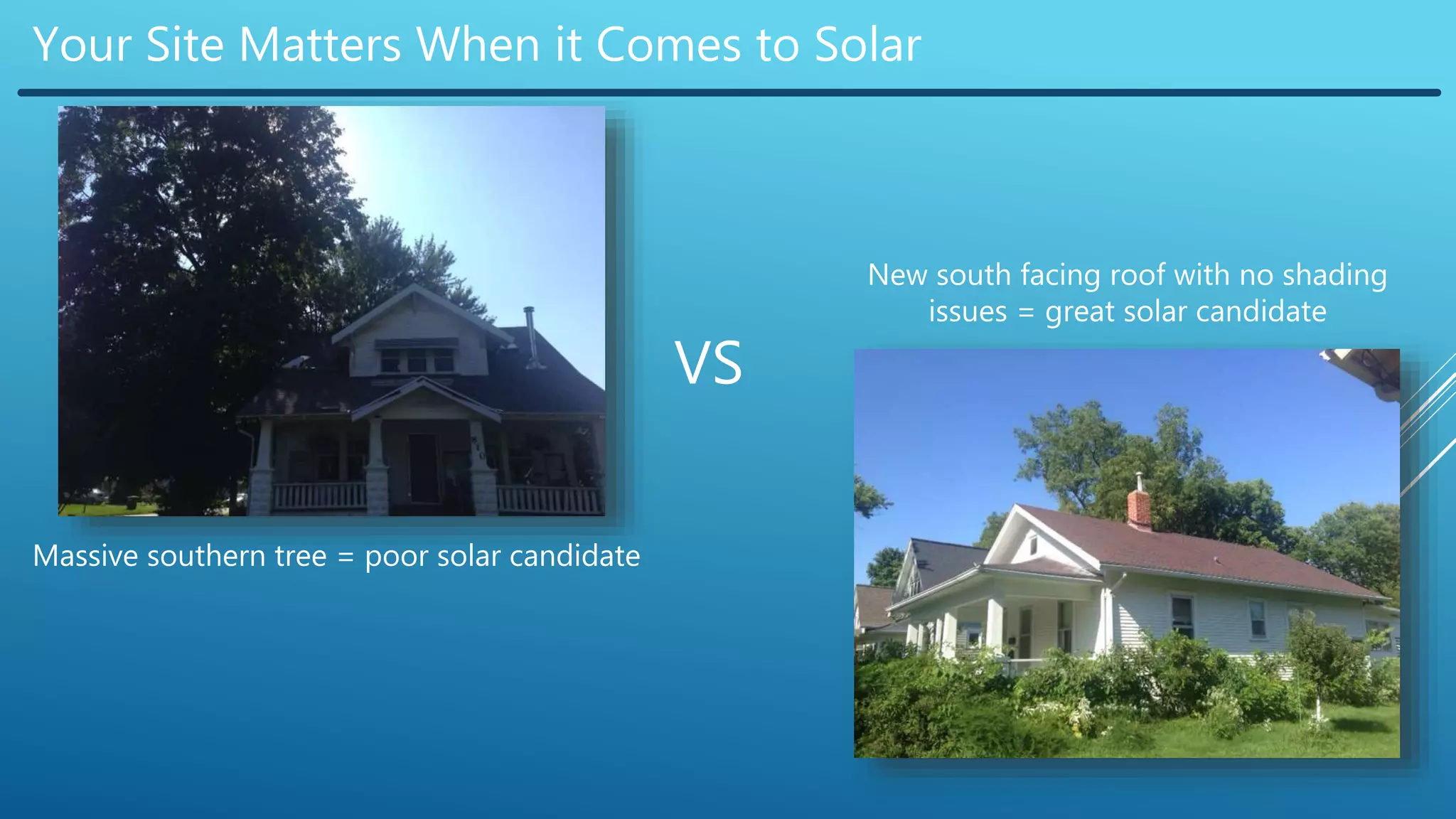

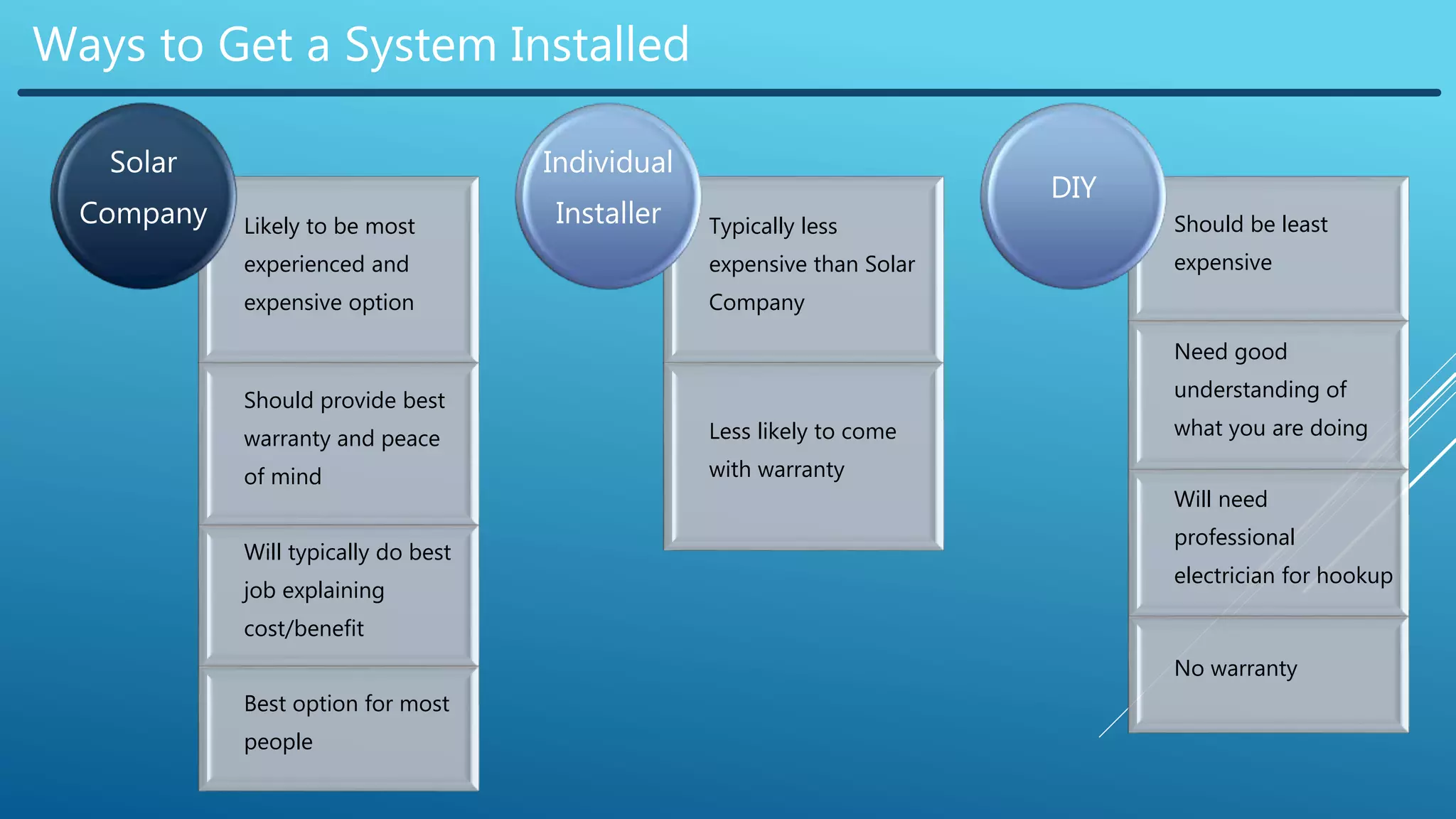

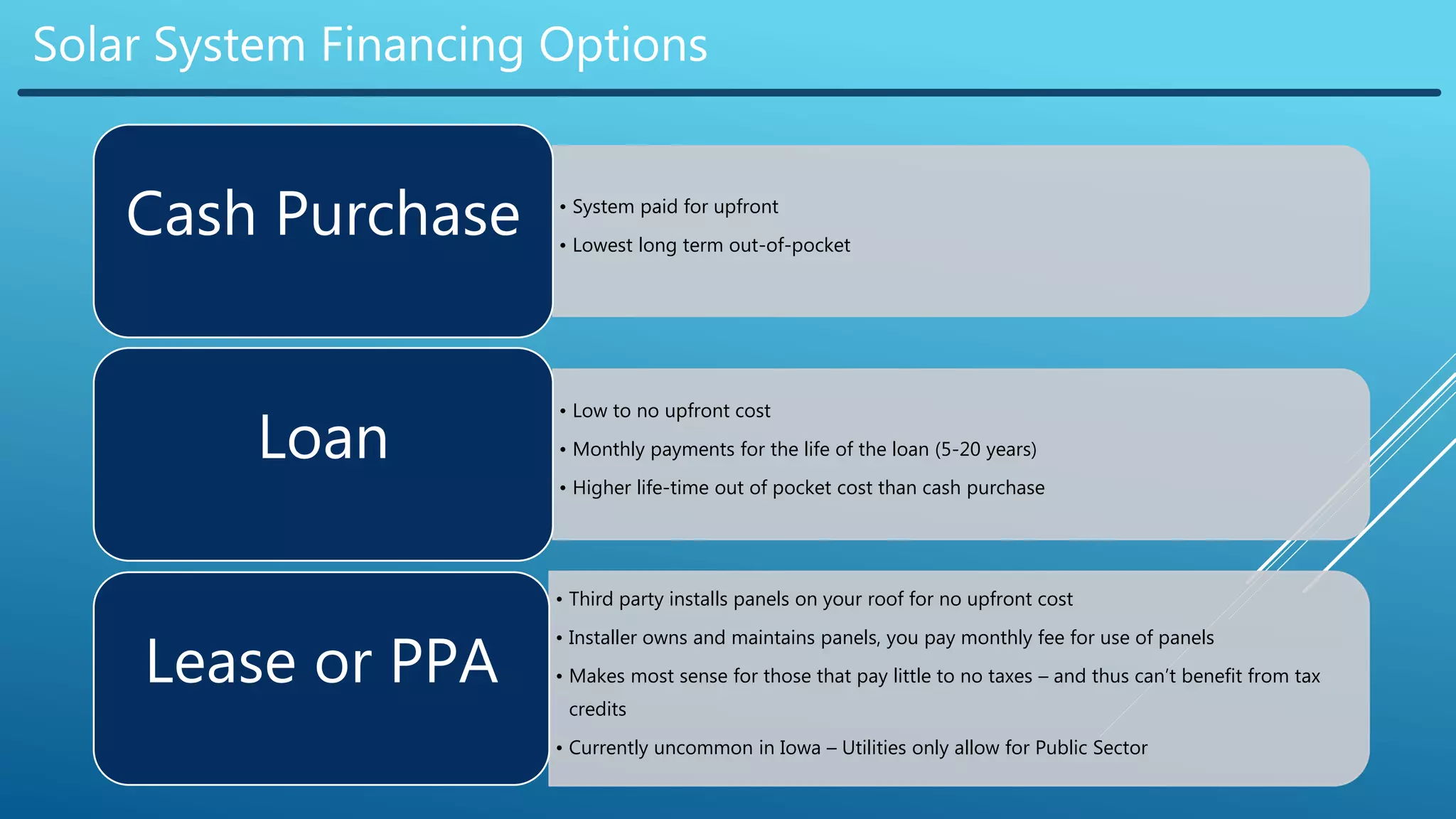

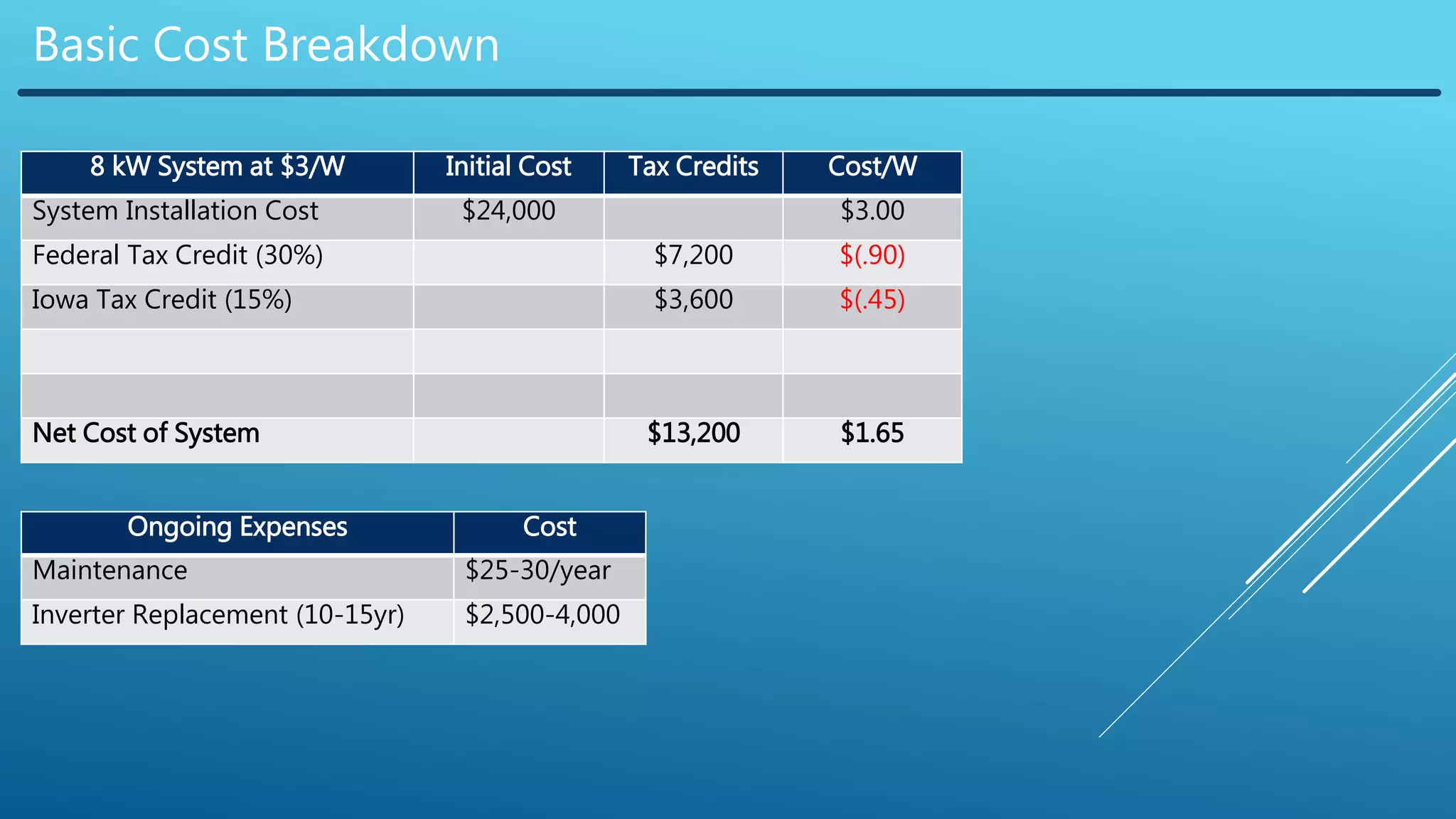

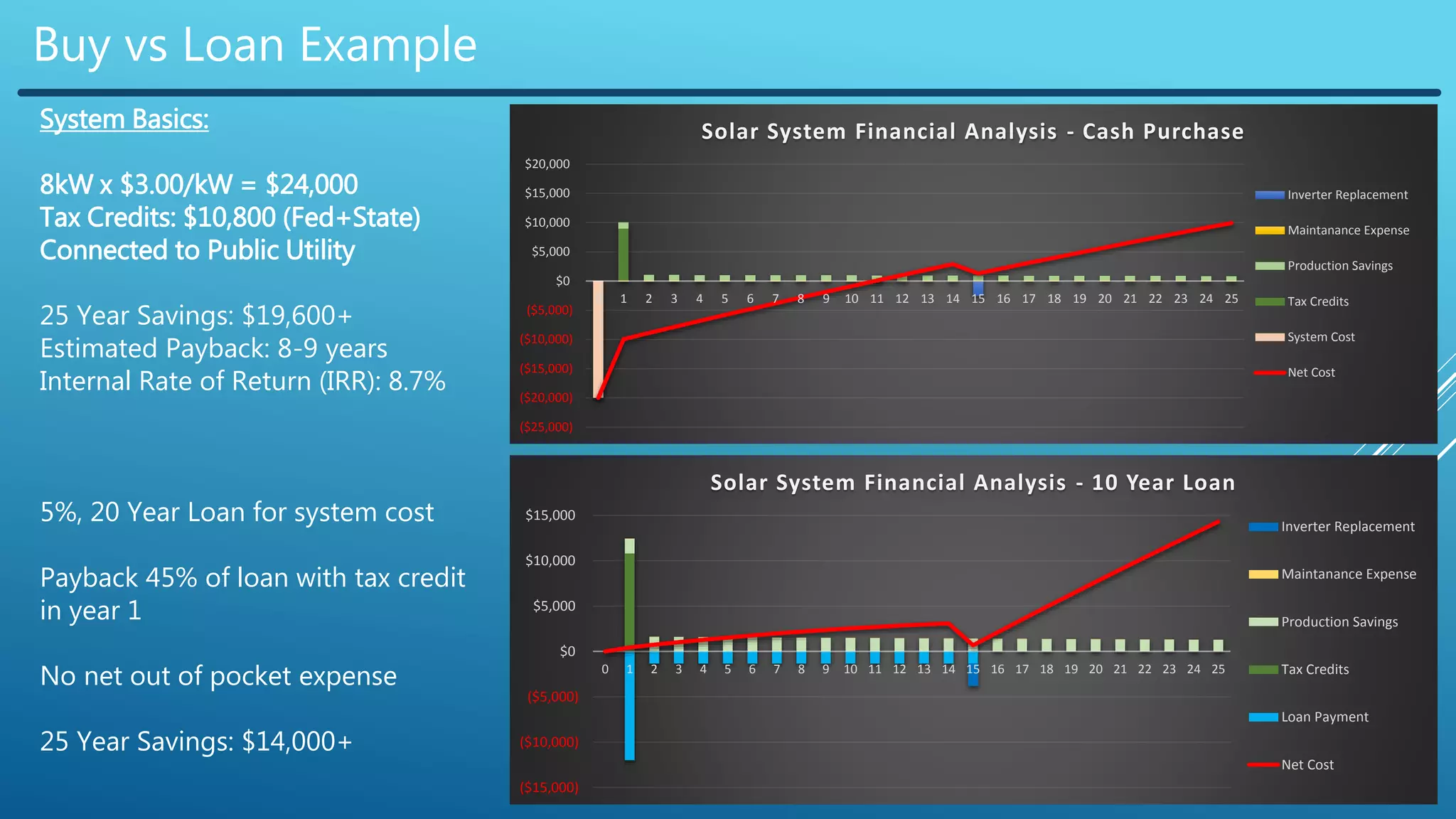

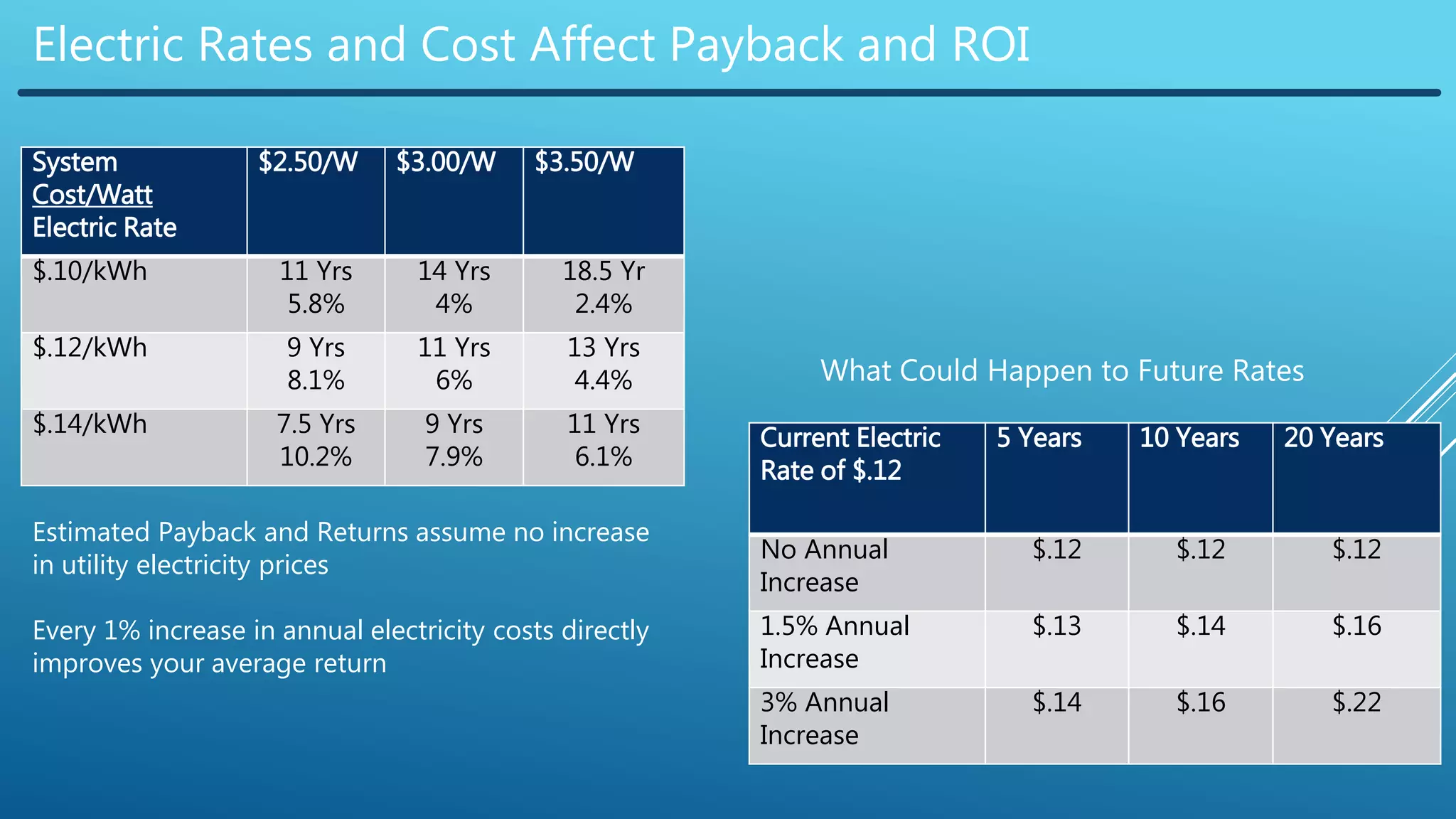

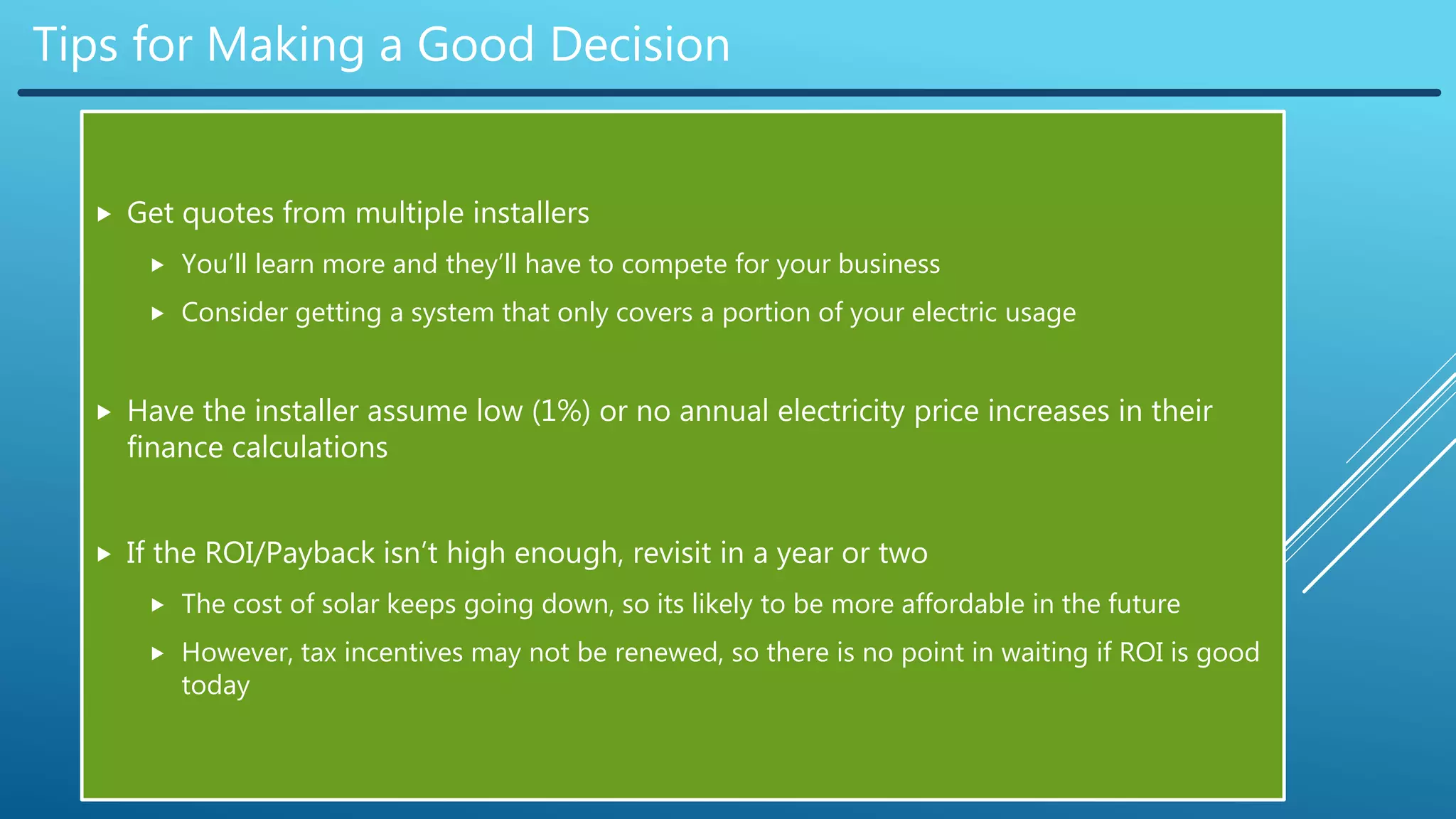

The document provides an overview of solar financing, emphasizing the importance of evaluating costs, savings, and incentives when considering solar installations. It details solar system costs, net metering, and tax incentives available for residential and commercial installations, highlighting the financial benefits over time. Additionally, it offers tips for selecting installers and making informed decisions regarding solar energy investments.