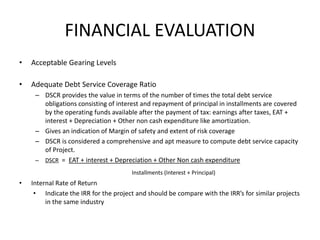

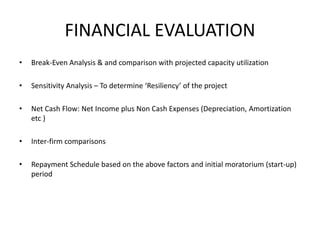

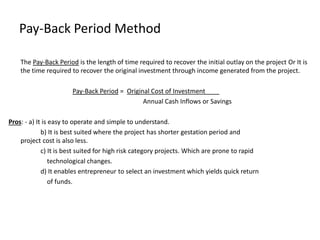

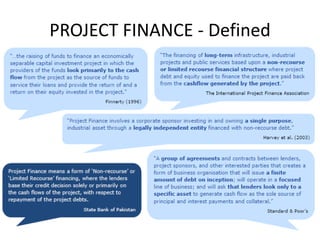

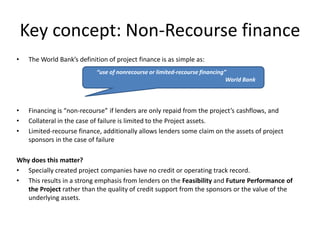

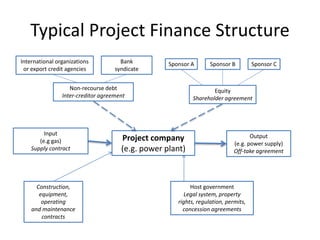

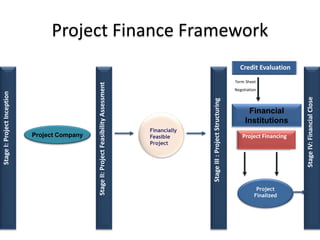

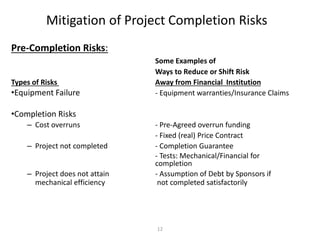

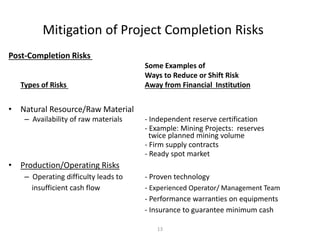

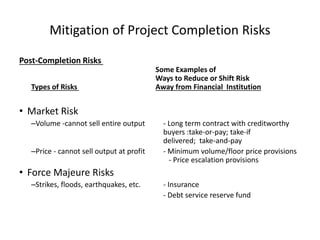

This document provides an overview of project finance and the credit appraisal/evaluation process for infrastructure projects. It defines infrastructure projects and examples. It also defines project finance as financing that is "non-recourse" where lenders are only repaid from the project's cashflows. The credit appraisal process for infrastructure projects focuses on assessing the technical, economic, financial, and commercial viability of projects, with an emphasis on evaluating the project's feasibility study and ability to service debt from cashflows rather than relying on sponsor balance sheets. Key areas of analysis include market demand, costs, financing plan, cashflow projections and sensitivity analysis.

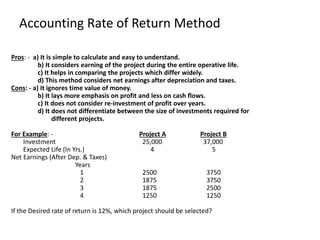

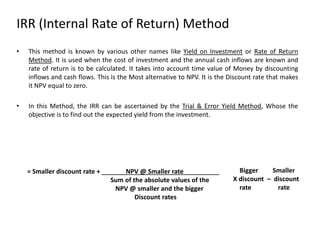

![Project Finance – Common Features

• Projects are usually large / expensive.

• Typically long term (15 years+).

• Undertaken via distinct legal entity [Special Purpose Vehicles (SPVs)],

• High debt to equity ratio (often 70%+ debt)

• Sponsors provide limited or no recourse to cash flow from other assets.

• Extensive contracting which governs inputs, off-take, construction & operations.

• Funding of Single Purpose Assets (main contractors often has equity stakes)

• Debt Holders rely on Project Cash Flows for Repayment.](https://image.slidesharecdn.com/creditappraisalandevaluation-150529045954-lva1-app6892/85/Credit-appraisal-and-evaluation-5-320.jpg)

![CREDIT APPRAISAL

• Credit appraisal in general is the process of evaluating the credit worthiness of the

loan applicant i.e. (financial condition & ability to repay back the loan in future).

[Reliance of Repayment on Financial Statements of Borrower and/or Sponsor]

• Three C’s of Credit

• Credit or Project Appraisal in Project Finance means an investigation/assessment

done by the Financial Institution prior to providing any Funding /Loan/Project

Finance, in which it checks the economic, financial & technical viability of the

proposed project [Reliance on Project Cash Flows & Assets]

Character Capacity Collateral](https://image.slidesharecdn.com/creditappraisalandevaluation-150529045954-lva1-app6892/85/Credit-appraisal-and-evaluation-15-320.jpg)