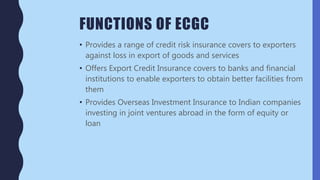

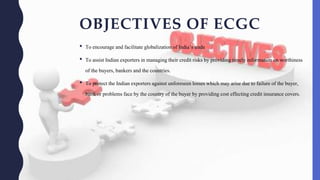

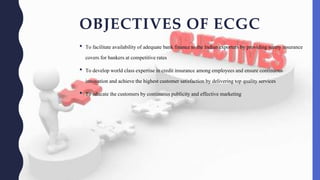

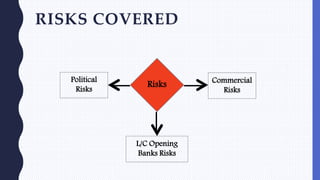

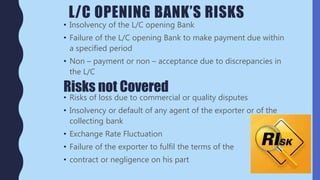

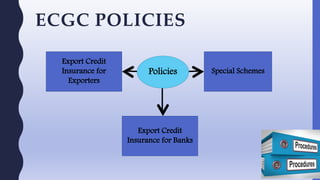

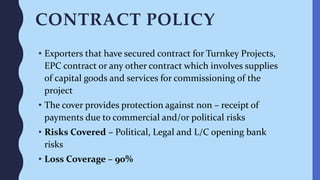

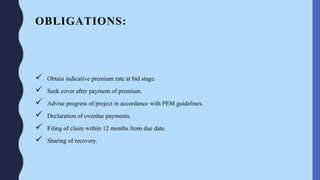

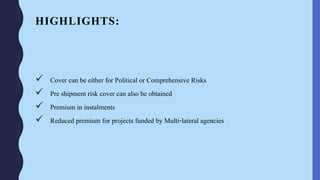

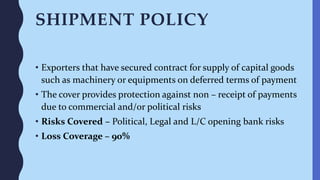

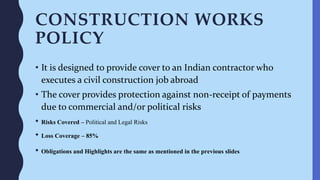

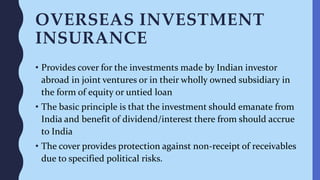

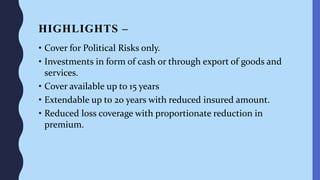

This document provides information about export credit and the Export Credit Guarantee Corporation of India (ECGC). It discusses the risks involved in export credit, defines ECGC and its role in providing credit insurance to exporters and banks in India. It outlines the functions, objectives, policies and schemes of ECGC, including key policies like contract, shipment, services and construction works policies as well as overseas investment insurance. The document aims to explain how ECGC helps exporters by offering various insurance covers and credit risk management services.