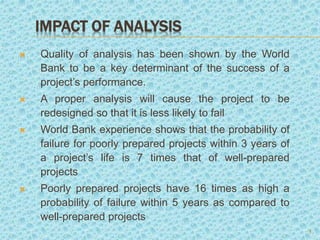

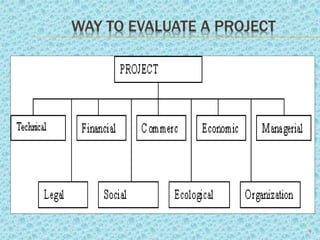

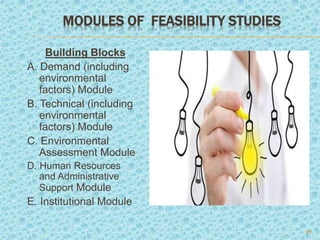

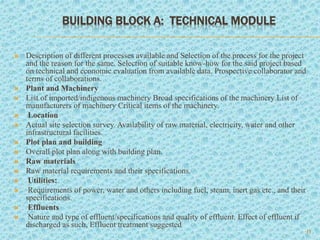

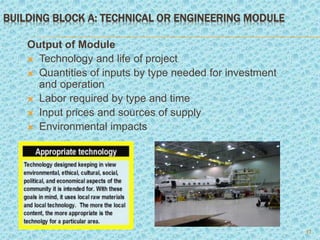

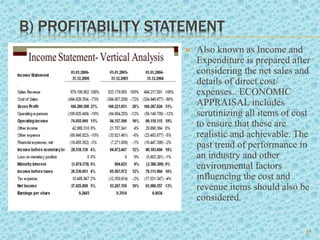

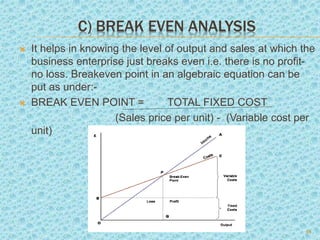

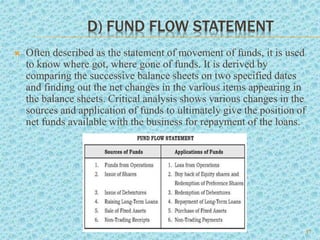

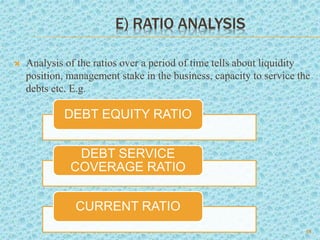

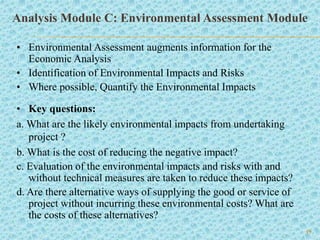

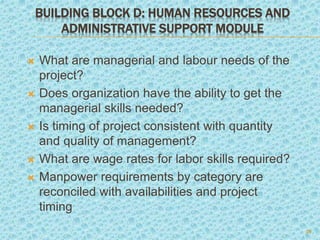

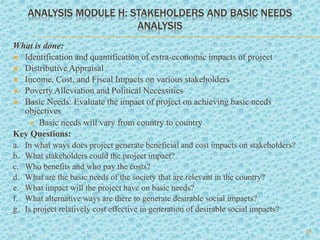

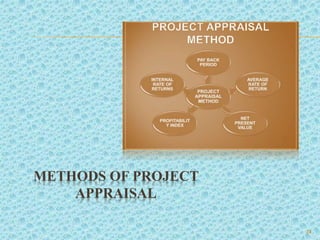

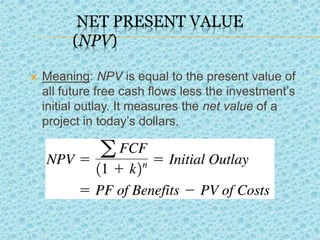

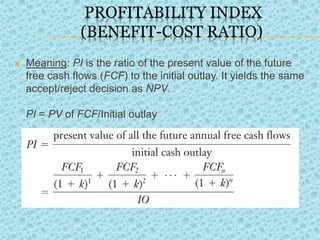

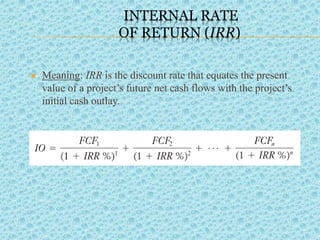

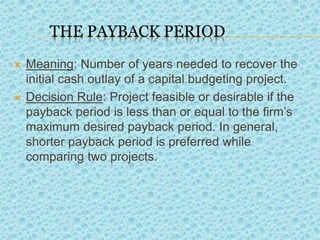

The document discusses project appraisal, which involves assessing the viability of investment propositions through methods like economic, financial, market, and technical analyses. It outlines the stages of project evaluation, including idea definition, pre-feasibility, feasibility studies, and environmental assessments, emphasizing the importance of a thorough analysis to minimize project failure rates. It also details various financial evaluation methods such as Net Present Value (NPV), Internal Rate of Return (IRR), and profitability index, alongside critical questions for each assessment stage.