The document discusses various aspects of conducting a financial analysis for a new project, including:

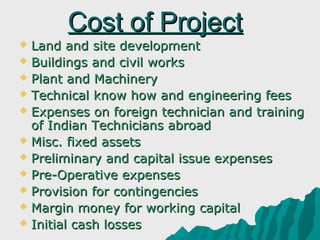

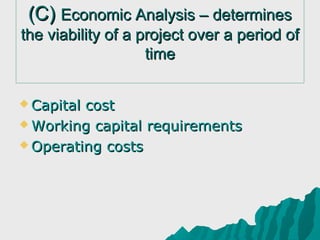

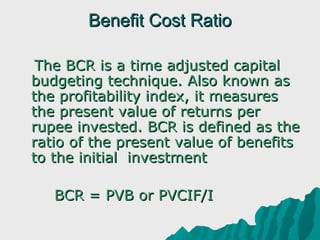

1. Calculating the total cost of the project, means of financing, production plans, and cost of production.

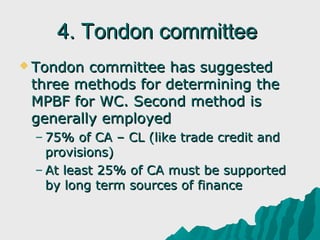

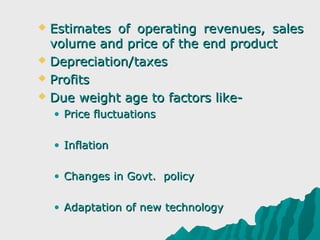

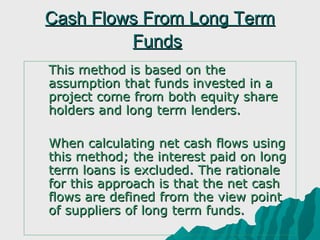

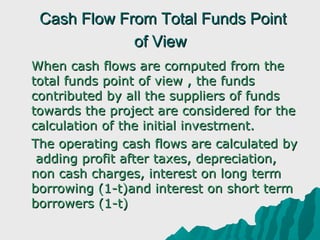

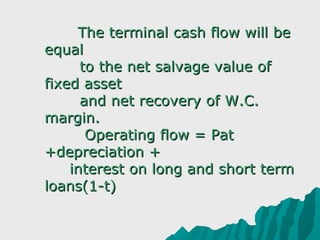

2. Estimating working capital requirements, sources of working capital financing, and projected sales, costs, profits, and cash flows.

3. Preparing financial statements like the balance sheet, cash flow statement, and cost flow statement to analyze the project's viability and profitability.

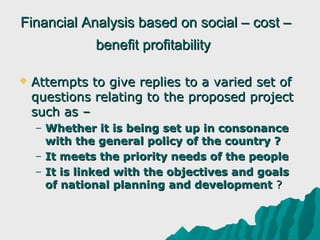

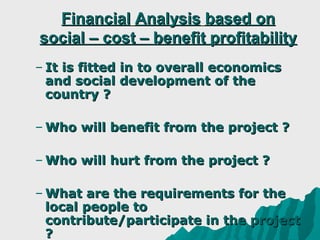

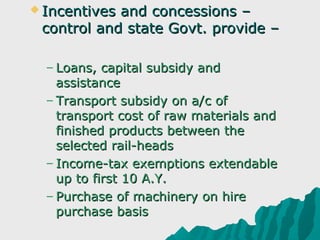

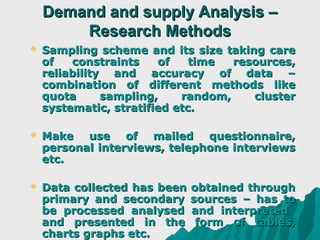

4. Considering factors like demand and supply, economic and financial analyses, and environmental impacts to comprehensively evaluate the project.