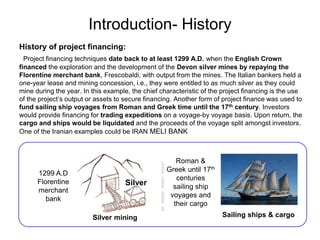

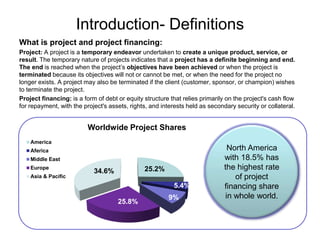

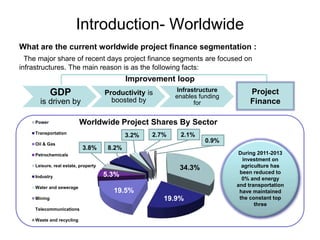

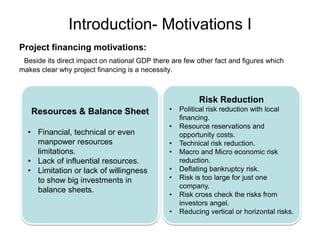

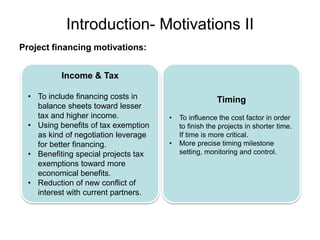

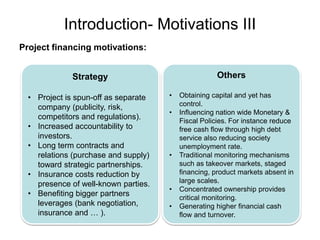

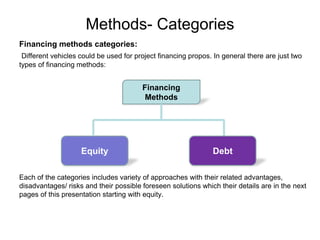

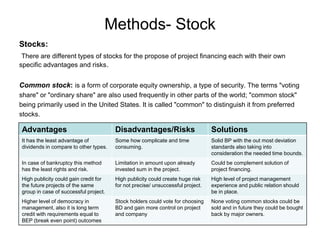

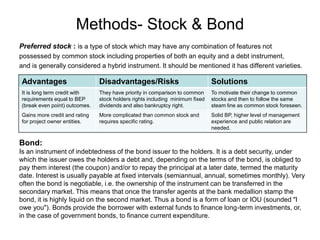

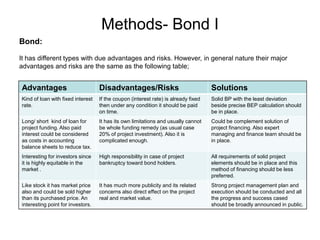

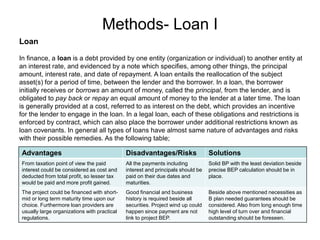

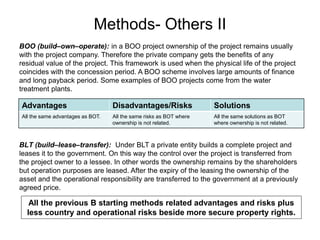

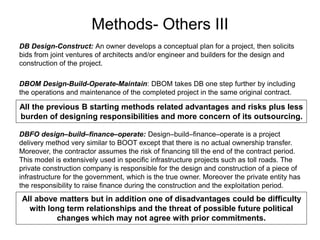

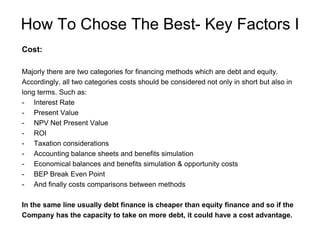

This document provides an overview of various project financing methods, including equity methods like common stock and preferred stock, debt methods like bonds and loans, and discusses their advantages and disadvantages. It also categorizes the major worldwide segments of project financing as infrastructure like power, transportation, oil and gas. Motivations for project financing include reducing risks, making use of tax benefits, and ensuring projects are completed on time. The document discusses the definitions of projects and project financing and provides a history of project financing dating back to the 13th century.