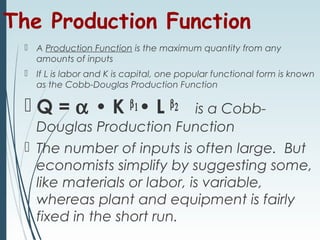

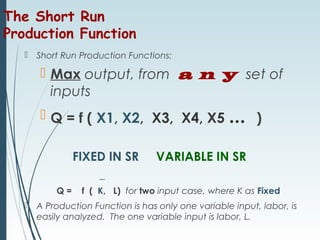

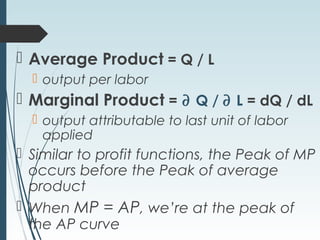

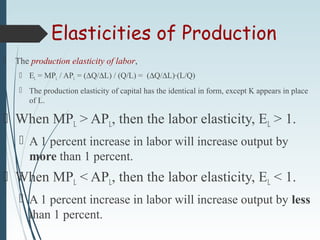

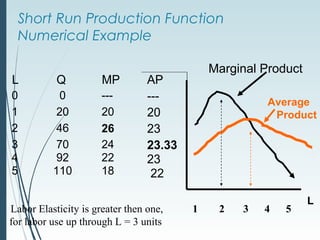

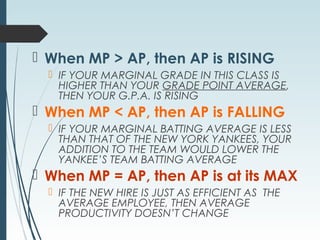

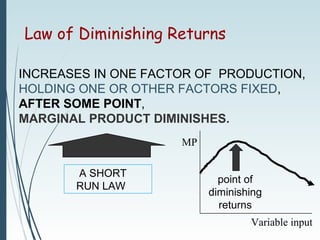

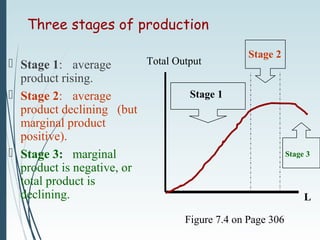

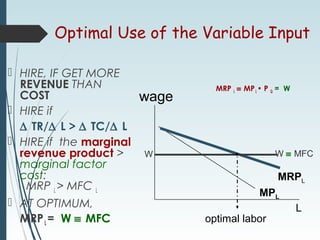

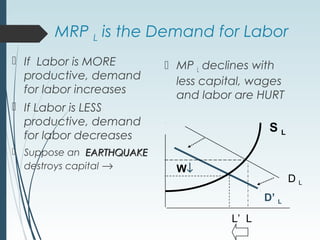

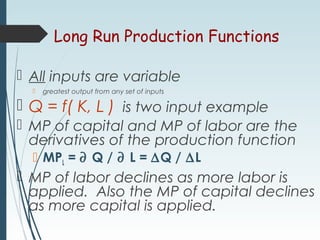

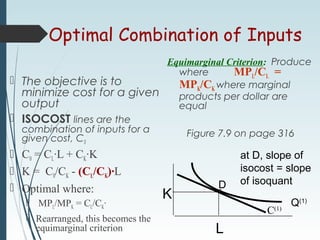

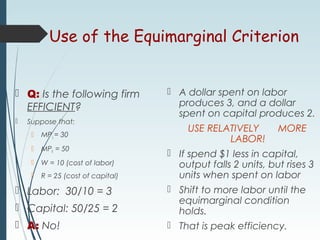

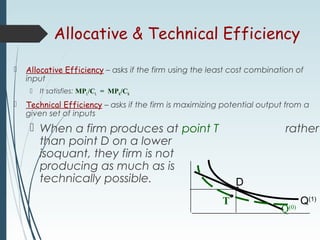

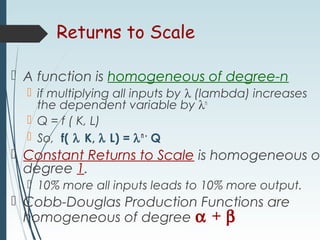

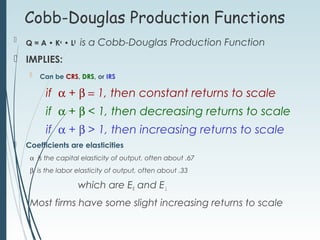

This document discusses production functions and their properties. It begins by defining a production function as relating the maximum output that can be produced from a given set of inputs. It then discusses short-run and long-run production functions, the properties of average and marginal product, diminishing returns, and how to determine the optimal input mix by equalizing marginal products per dollar spent on each input. It also introduces Cobb-Douglas production functions and the concept of returns to scale.