The document discusses key concepts related to consumption functions, including:

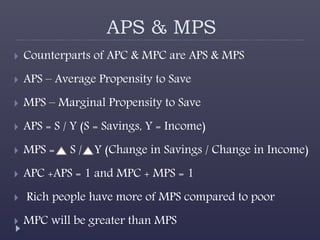

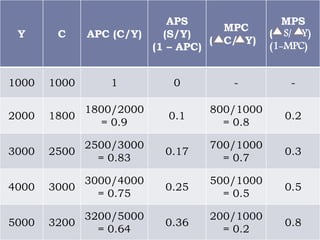

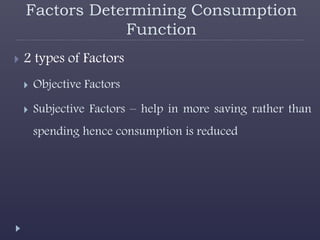

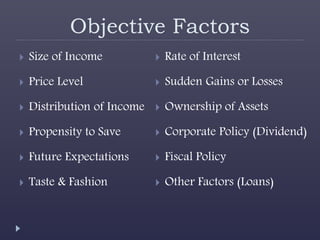

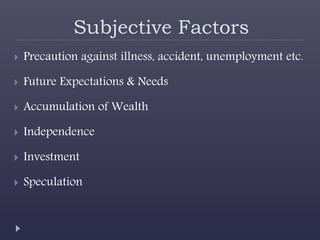

1) Consumption depends mainly on current income but is also influenced by other factors like interest rates and wealth. As income rises, consumption increases at a lower rate due to savings.

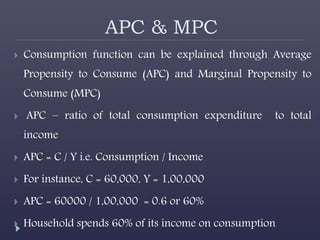

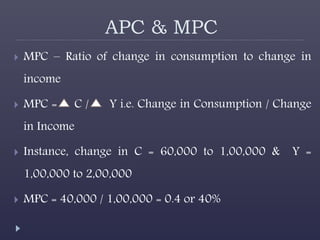

2) Average Propensity to Consume (APC) and Marginal Propensity to Consume (MPC) measure the relationship between consumption and income. APC is the ratio of total consumption to total income, while MPC is the change in consumption over a change in income.

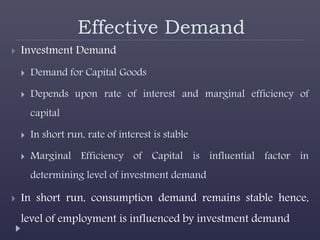

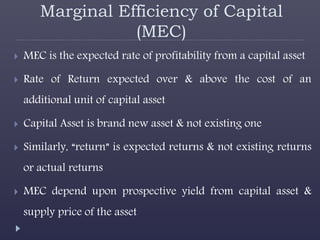

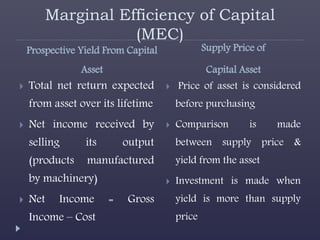

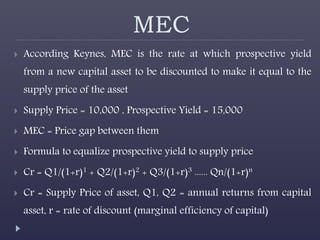

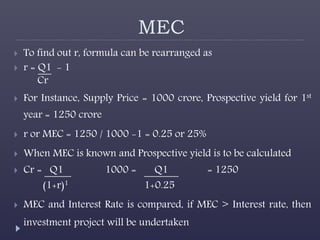

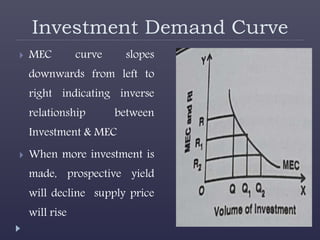

3) Effective demand, the combination of consumption and investment demand, must remain high to maintain employment levels. Investment demand depends on the marginal efficiency of capital (MEC).