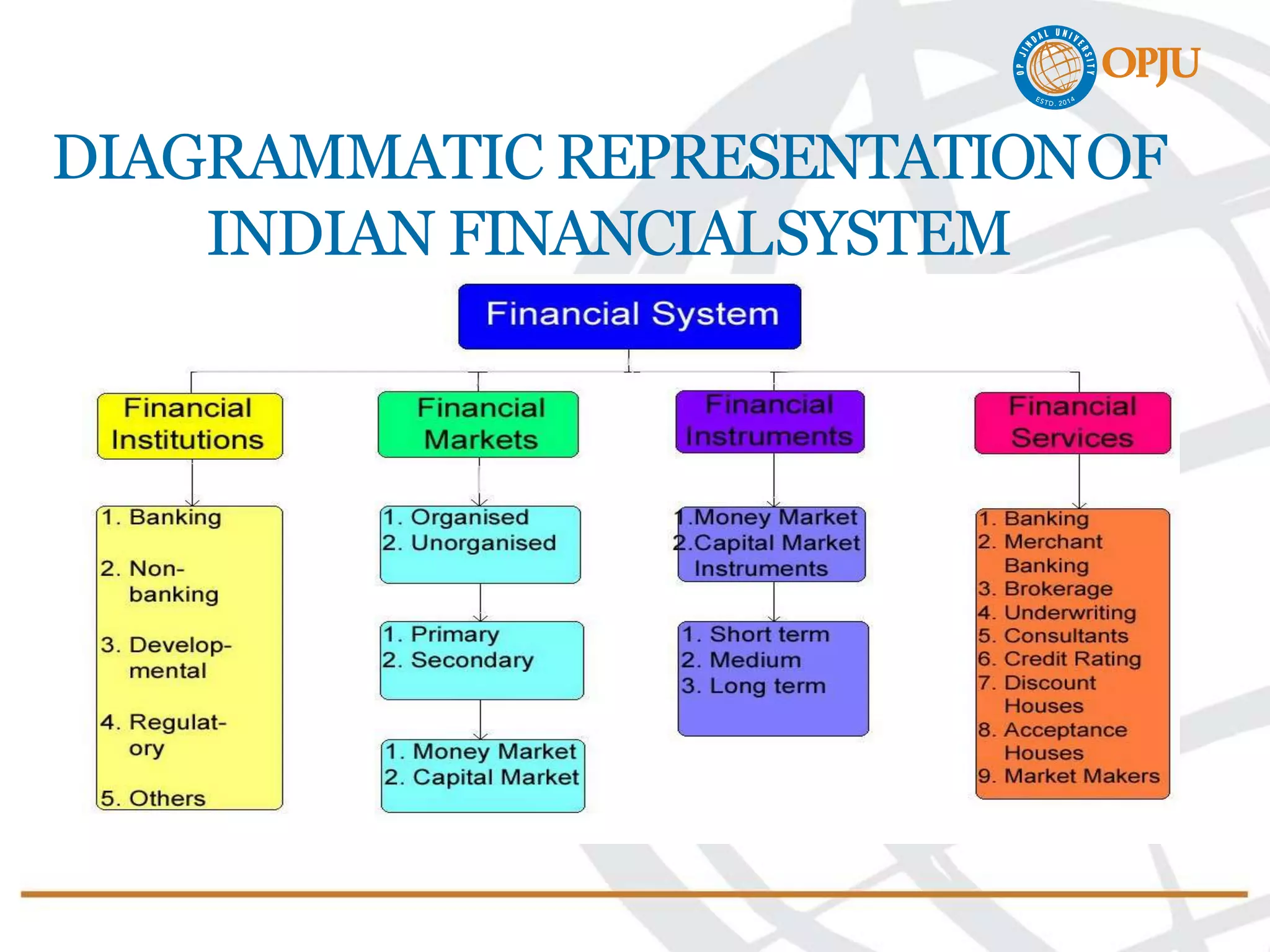

The document provides an overview of the Indian financial system. It discusses the key components of the financial system including financial assets, institutions, markets, and their various functions. It describes the major financial institutions in India like banks, mutual funds, insurance companies. It also explains various financial instruments in the money market and capital market that enable raising and deployment of funds. The document presents diagrams to illustrate the structure and flow of funds within the Indian financial system.