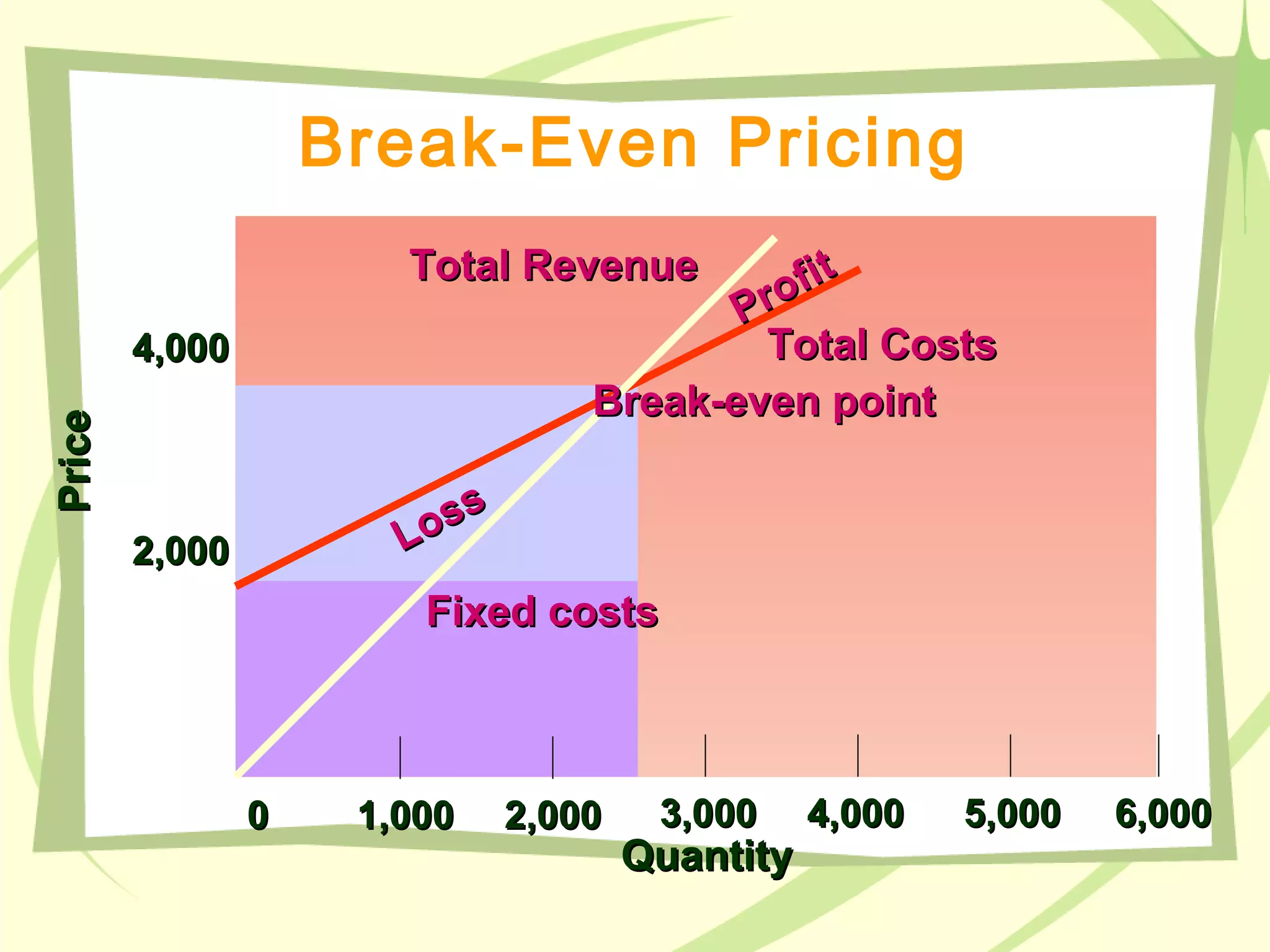

- The objective of for-profit firms is to maximize profits by setting the price where marginal revenue equals marginal cost, known as profit maximization.

- Profits are calculated as total revenue from sales minus the costs of resources used. Firms will produce as long as marginal cost is less than marginal revenue.

- In addition to profit maximization, firms may also pursue objectives like revenue maximization, sales maximization, or share price maximization to satisfy various stakeholders. However, achieving these other objectives ultimately depends on the firm's ability to earn profits.