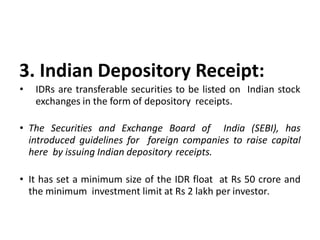

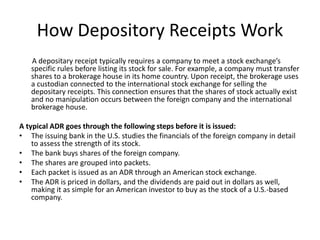

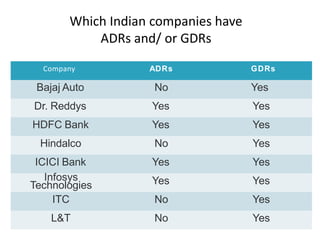

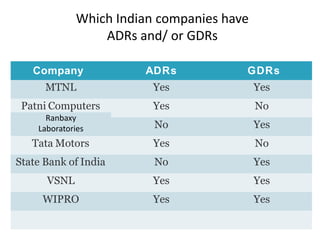

This presentation discusses depository receipts, which allow investors to hold shares in foreign companies. There are three main types: American Depository Receipts (ADR), which trade on US exchanges; Global Depository Receipts (GDR), which trade on European exchanges; and Indian Depository Receipts (IDR), which trade on Indian exchanges. The presentation provides details on the process for issuing and trading depository receipts and lists several major Indian companies that have ADRs and/or GDRs. It explains that IDRs provide benefits like increased access to capital and global visibility for companies while allowing foreign companies opportunities to raise funds for Indian business needs.