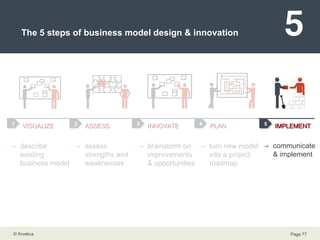

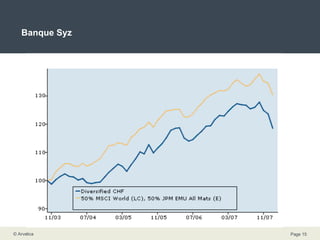

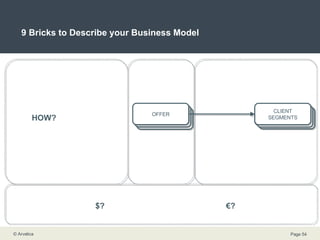

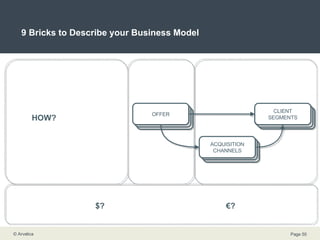

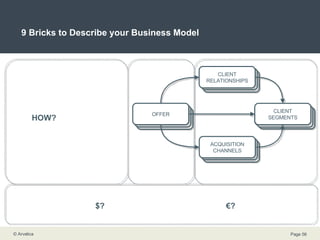

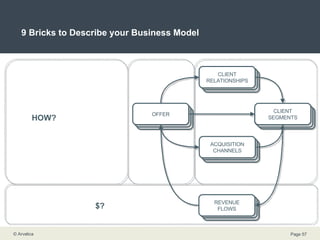

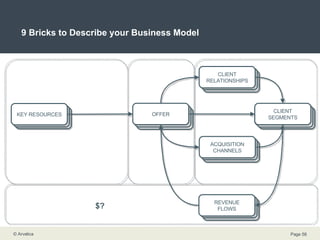

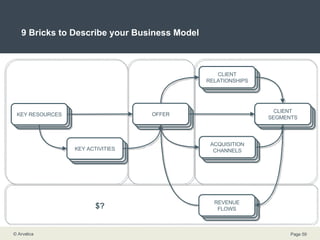

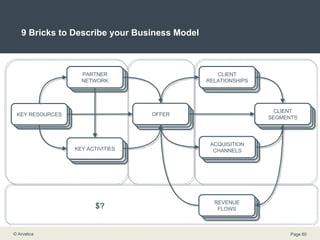

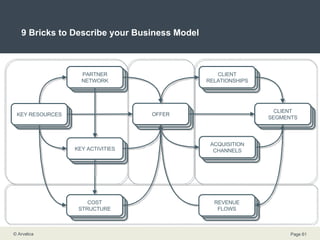

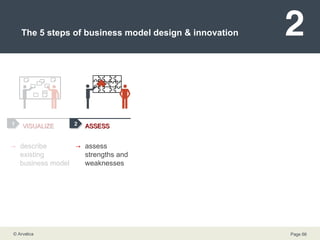

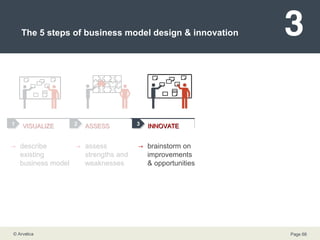

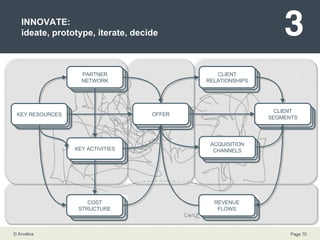

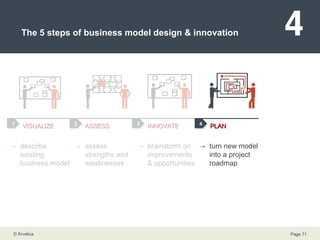

The document discusses various business models in private banking, detailing strategies employed by institutions like UBS, Investec, and Mirabaud to adapt to changing client needs and market dynamics. It outlines the importance of integrated services and relationship management, driven by a new breed of clients who require holistic approaches to wealth management. Additionally, it emphasizes the necessity for private banks to innovate their business models through structured assessments and strategic planning.

![PLAN: draw a project roadmap and align your enterprise Strategy direction new business model [Galbraith 2001]](https://image.slidesharecdn.com/private-banking-business-models-1204623708425803-5/85/Private-Banking-Business-Models-72-320.jpg)

![PLAN: draw a project roadmap and align your enterprise Strategy Structure power direction new business model [Galbraith 2001]](https://image.slidesharecdn.com/private-banking-business-models-1204623708425803-5/85/Private-Banking-Business-Models-73-320.jpg)

![PLAN: draw a project roadmap and align your enterprise Strategy Structure Processes power direction information new business model [Galbraith 2001]](https://image.slidesharecdn.com/private-banking-business-models-1204623708425803-5/85/Private-Banking-Business-Models-74-320.jpg)

![PLAN: draw a project roadmap and align your enterprise Strategy Structure Processes Rewards power direction motivation information new business model [Galbraith 2001]](https://image.slidesharecdn.com/private-banking-business-models-1204623708425803-5/85/Private-Banking-Business-Models-75-320.jpg)

![PLAN: draw a project roadmap and align your enterprise Strategy Structure Processes Rewards People power direction skills/mind-set motivation information new business model [Galbraith 2001]](https://image.slidesharecdn.com/private-banking-business-models-1204623708425803-5/85/Private-Banking-Business-Models-76-320.jpg)