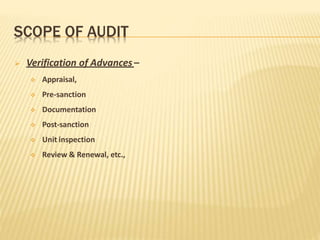

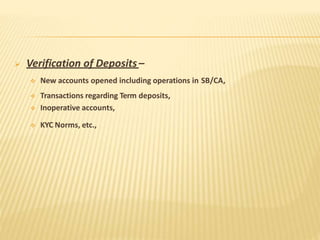

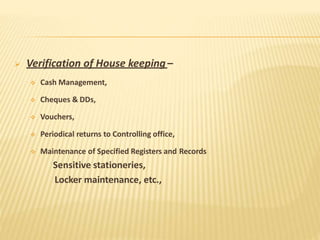

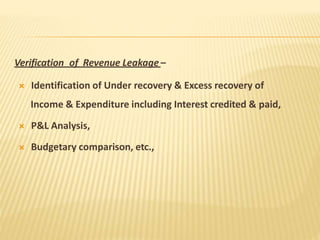

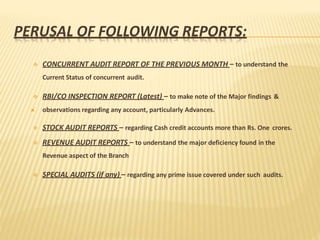

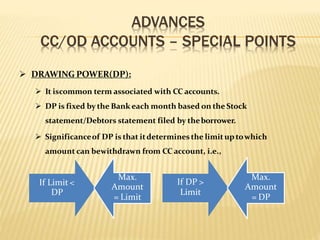

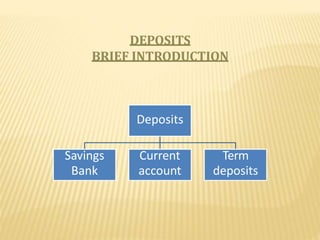

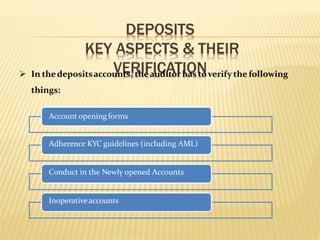

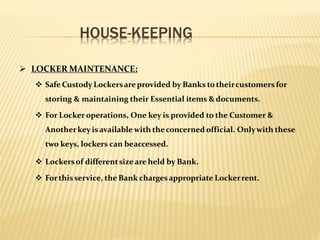

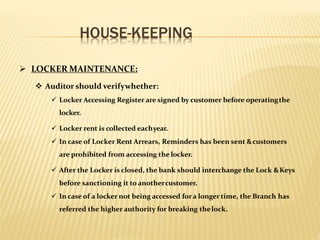

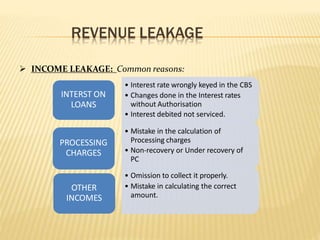

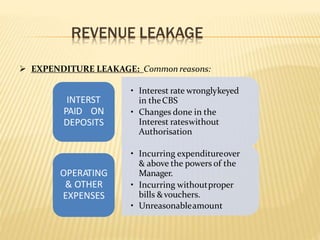

The document discusses the objectives and scope of concurrent bank audits. Concurrent audits are designed for continuous external control of bank branches to supplement internal checks and reduce the time between transactions and examination. The scope of concurrent audits includes verification of advances like loan appraisals and documentation, deposits like new accounts and KYC norms, housekeeping areas like cash and records, and identifying potential revenue leakage. Key areas like NPAs, deposits, advances like periodic loan assessment, and housekeeping functions like locker maintenance are also discussed.