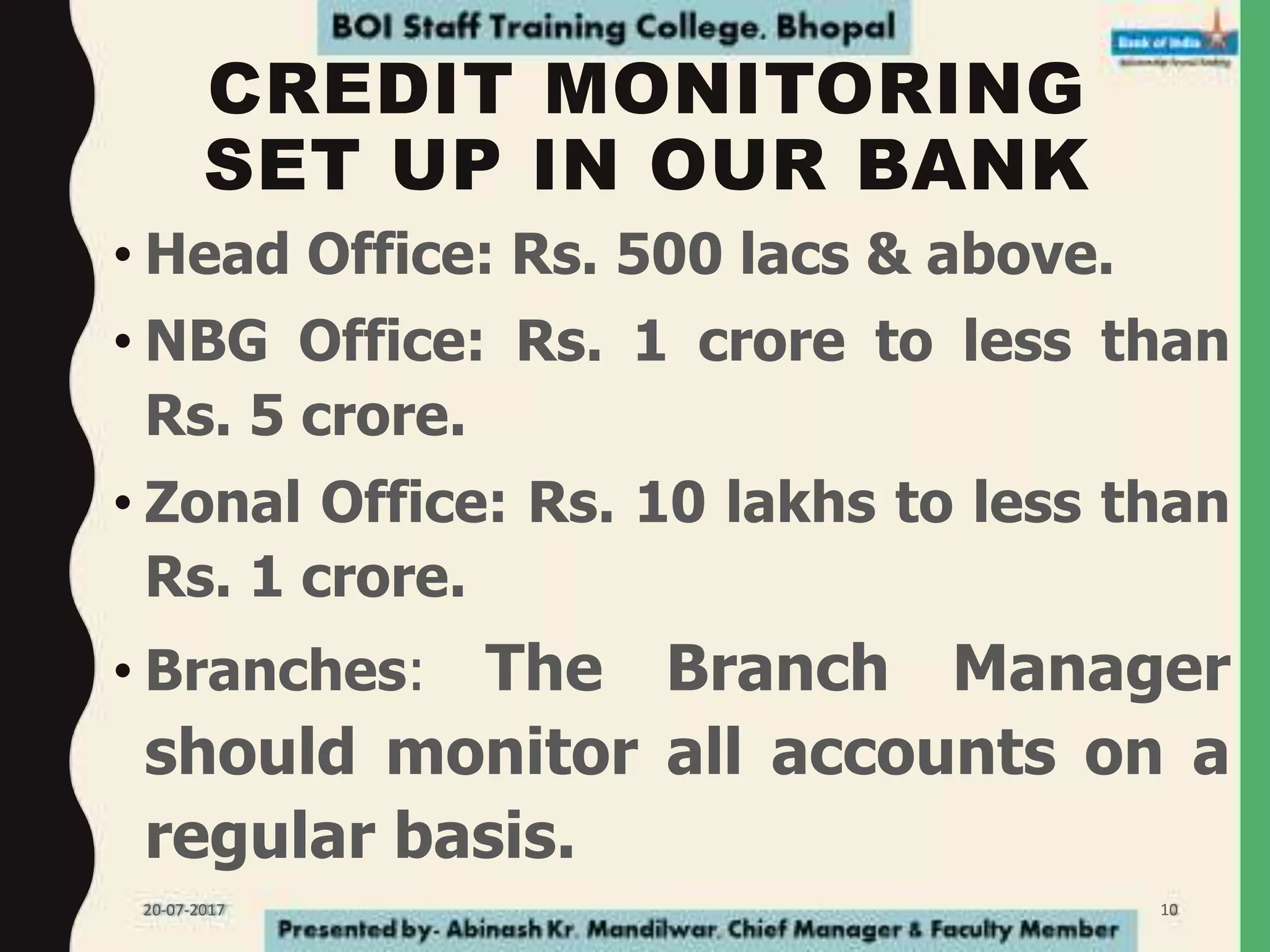

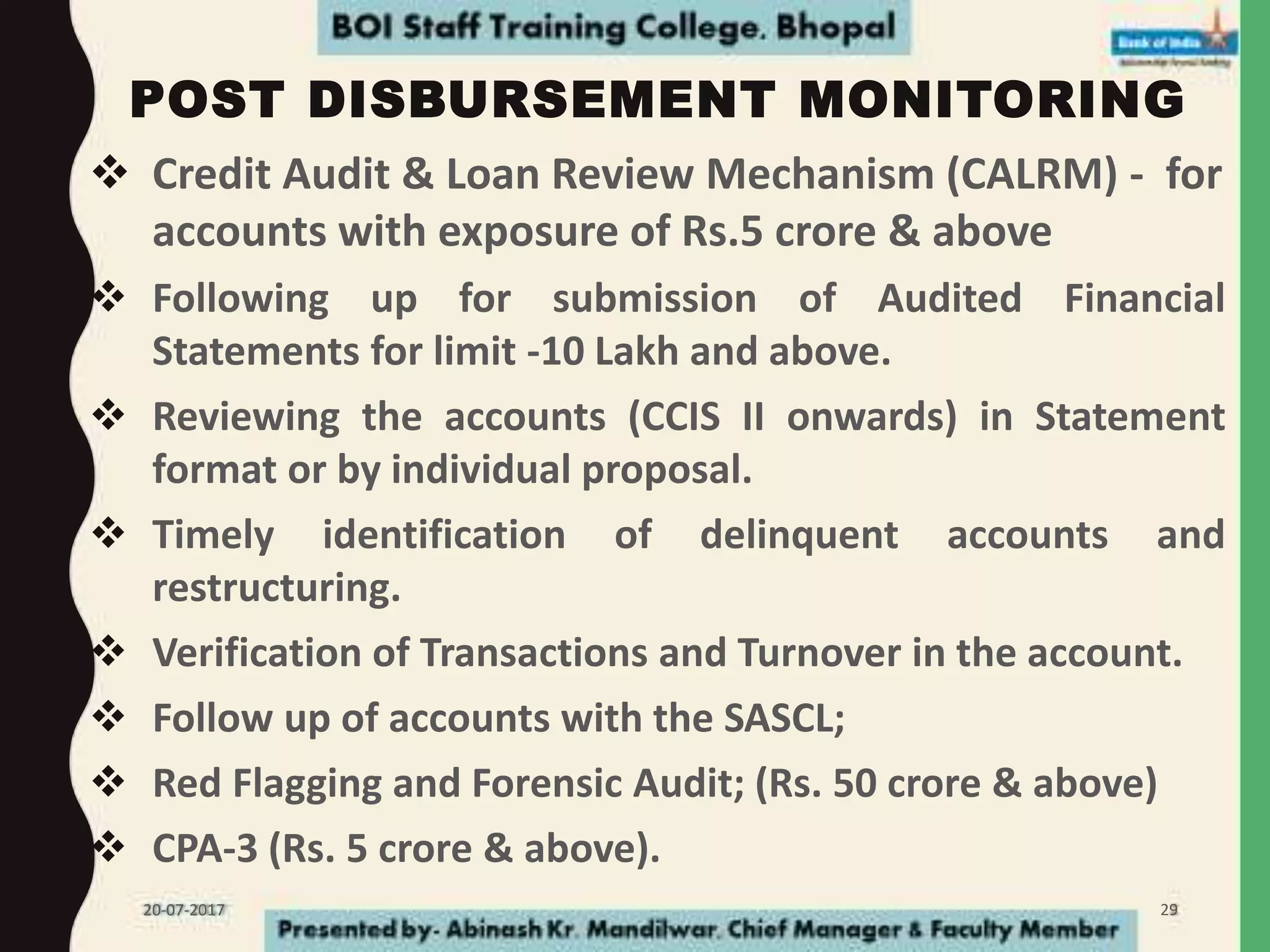

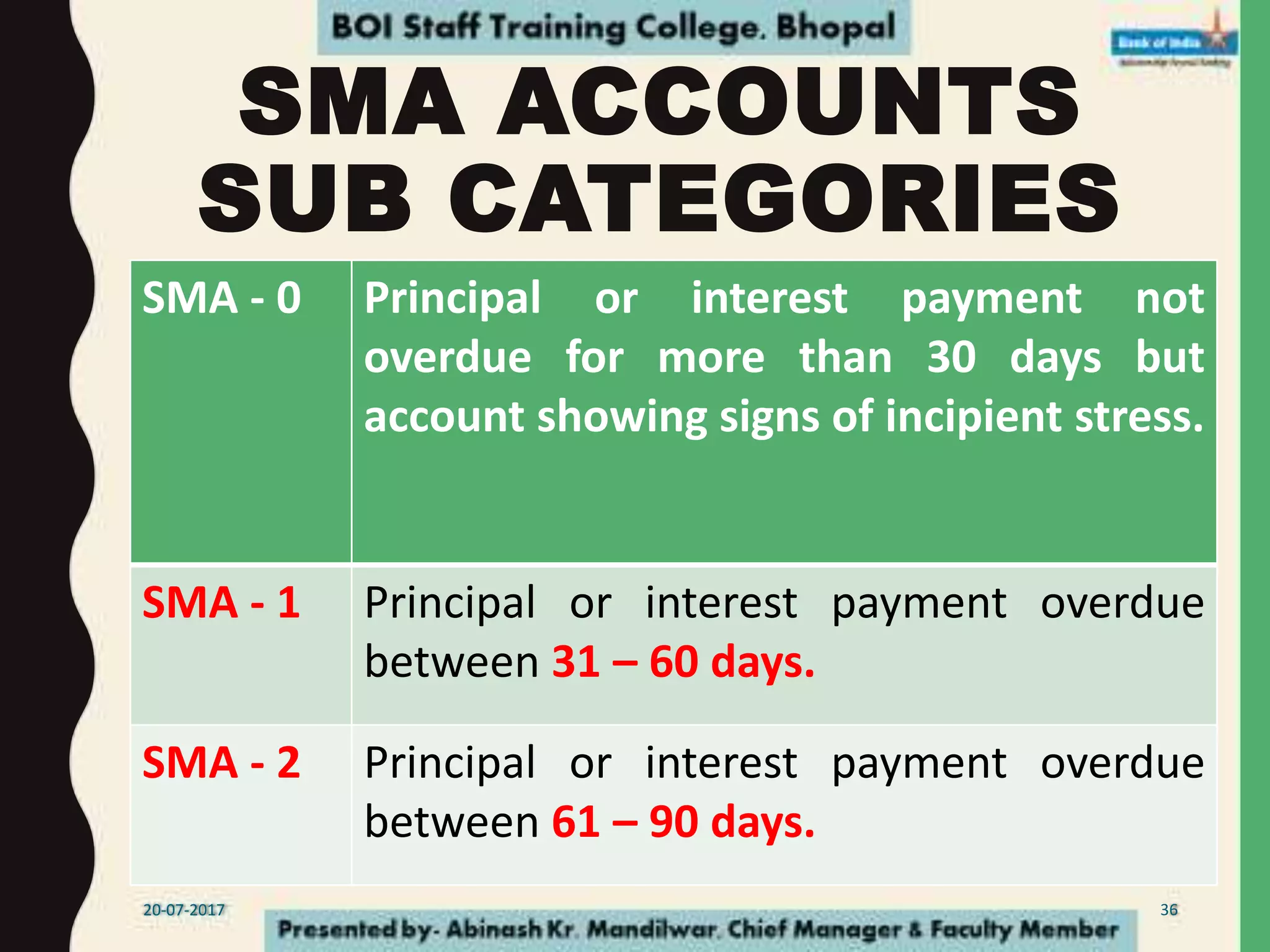

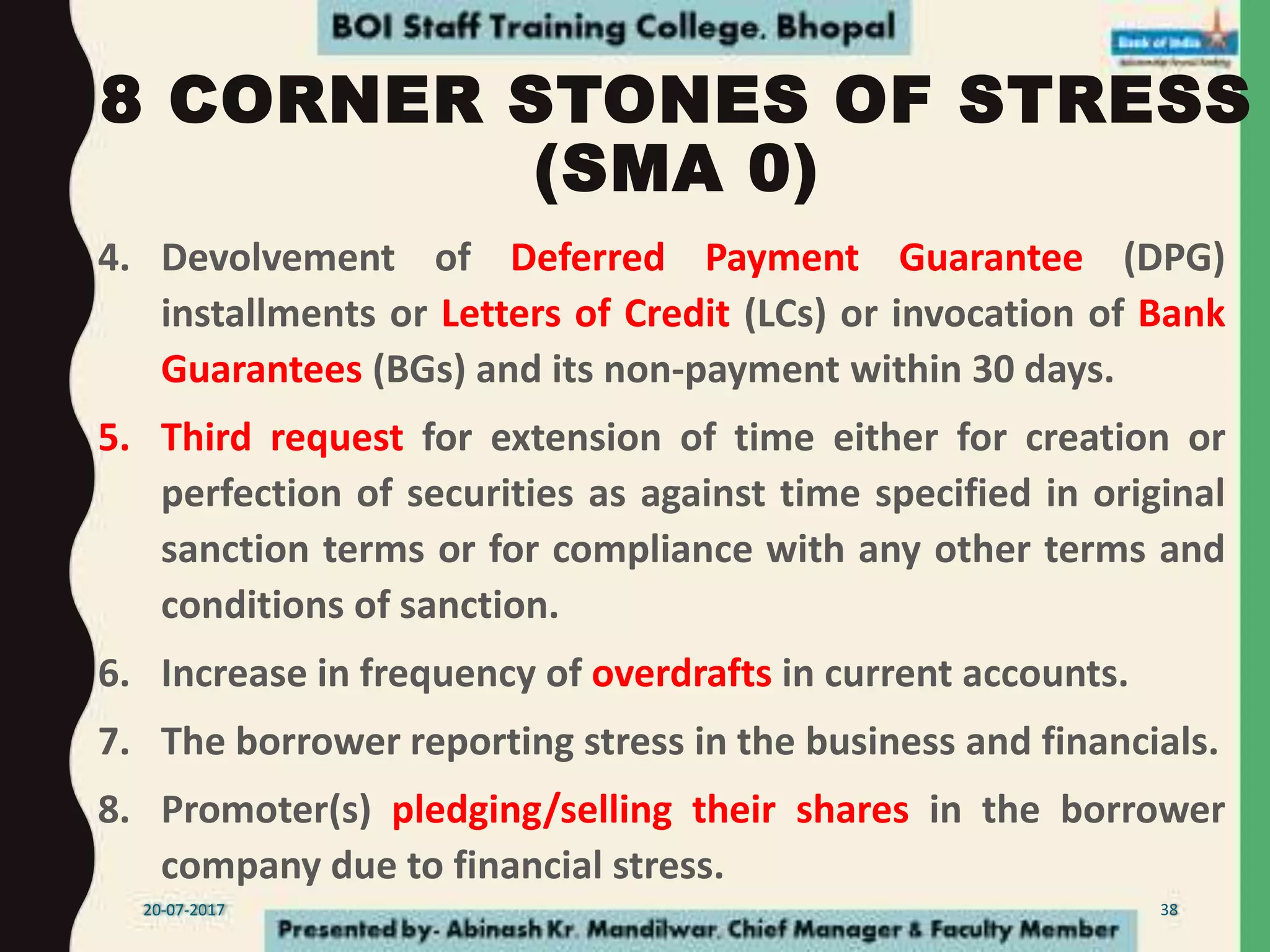

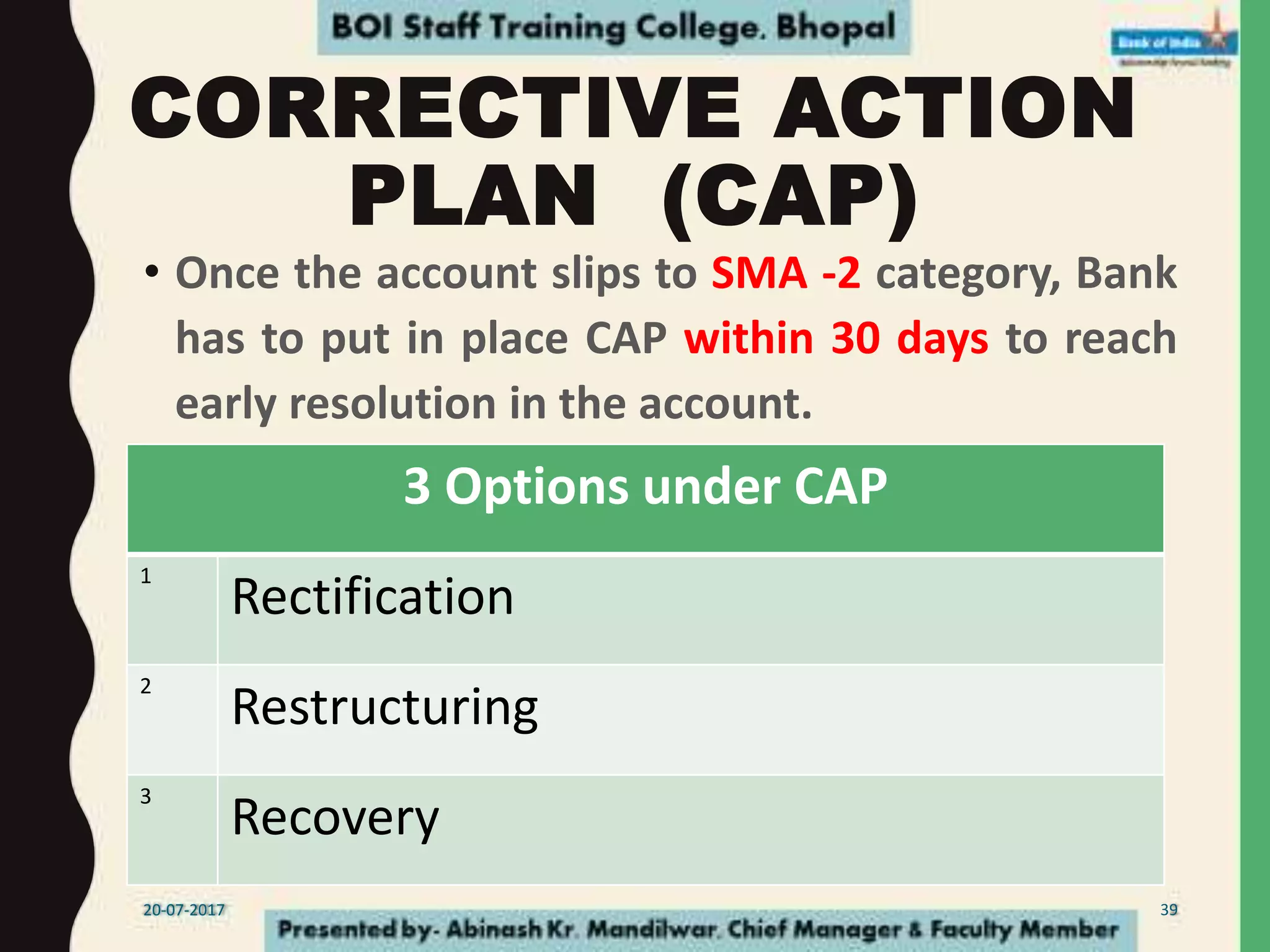

Credit monitoring is the ongoing supervision of a loan account to ensure the borrower continues to meet the terms of the loan sanction. It helps maintain asset quality and prevent slippage into NPA status. There are four stages of monitoring - pre-sanction, post-sanction pre-disbursement, during disbursement, and post-disbursement. Regular inspections, financial statement reviews, and verifying end-use of funds are some key monitoring activities. Early warning signs like delays in submission of documents or frequent requests for extensions should trigger corrective actions like discussions with the borrower to resolve issues impacting the business.