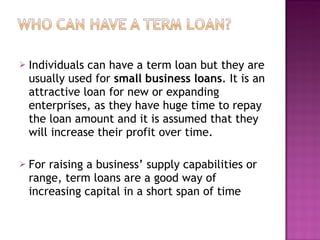

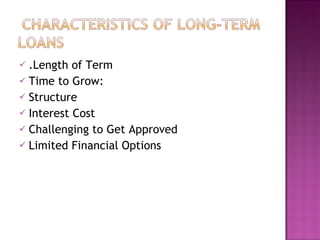

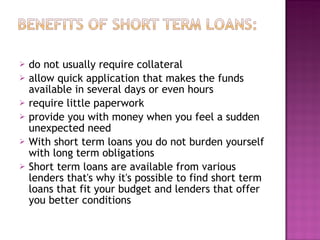

The document discusses various types of term loans including long-term loans, intermediate term loans, and short-term loans. Long-term loans mature between 1-7 years and are used for major business expenses. Intermediate term loans mature in less than 5 years and are used to purchase equipment and vehicles. Short-term loans mature within 1 year and provide quick access to funds but have higher interest rates.