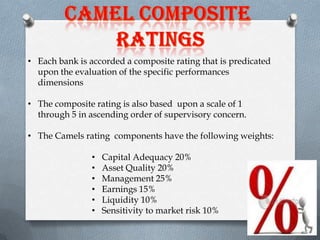

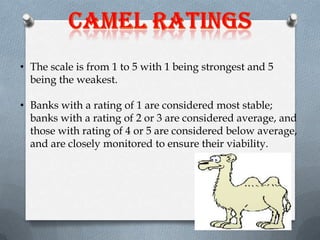

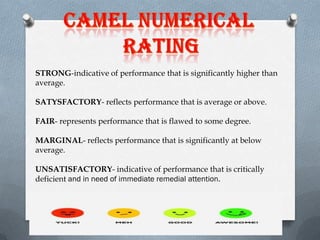

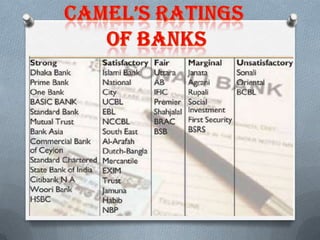

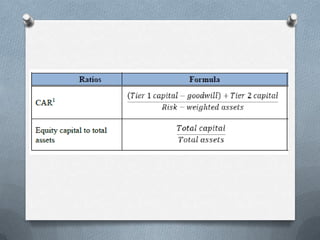

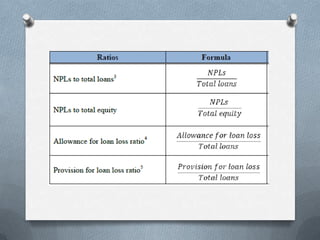

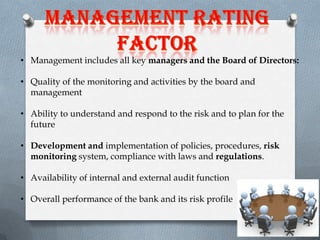

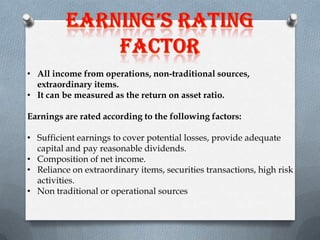

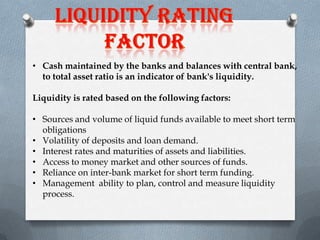

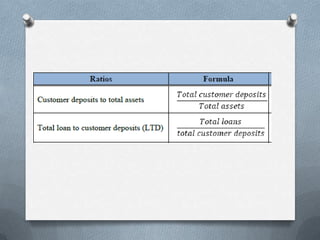

This document provides an overview of the CAMELS rating system used to evaluate the overall health and risk profile of banks. CAMELS stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity, and Sensitivity to market risk. Each component is rated on a scale of 1 to 5, with 1 being the strongest. The ratings are used by regulators in the US, India, and other countries to monitor banks and determine which may require support.