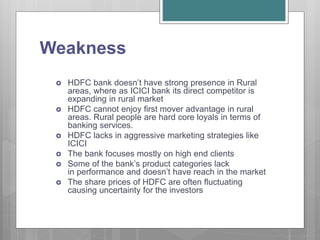

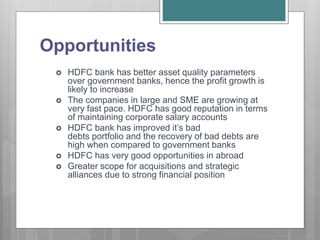

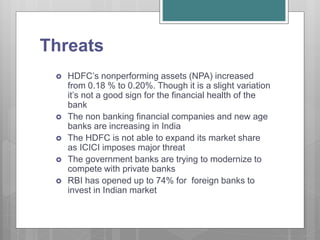

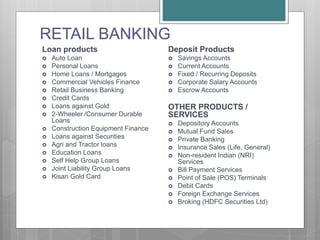

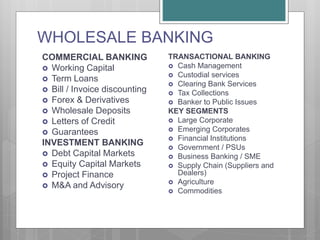

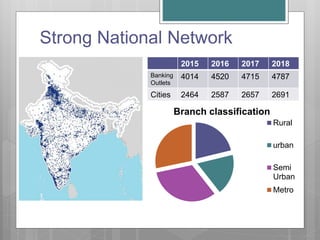

HDFC Bank, founded in 1977 and operational since 1995, is one of India's largest private sector banks with a strong presence in urban areas but limited reach in rural markets. The bank boasts high customer satisfaction and numerous awards, but faces challenges such as increasing non-performing assets and competition from both other banks and new financial institutions. HDFC Bank offers a wide range of products and services across various segments, maintaining a significant national network.