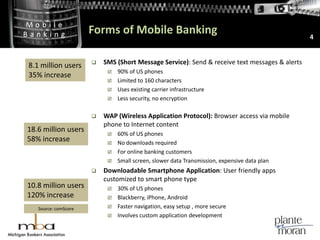

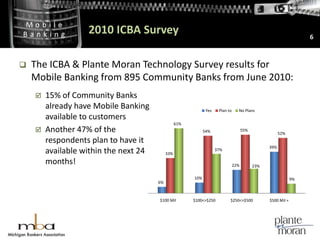

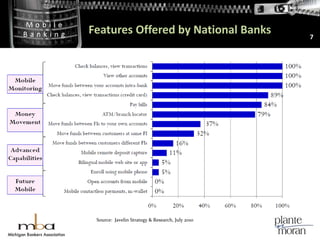

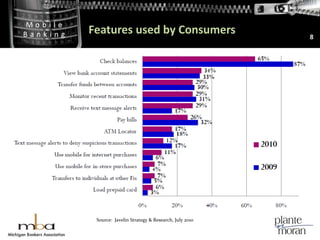

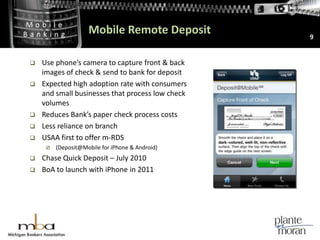

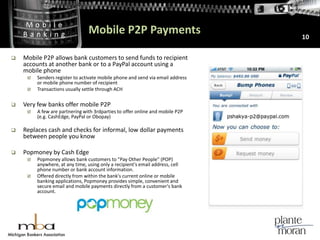

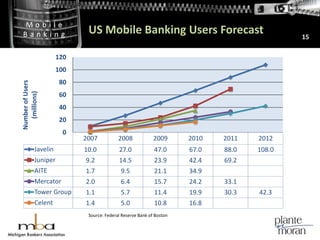

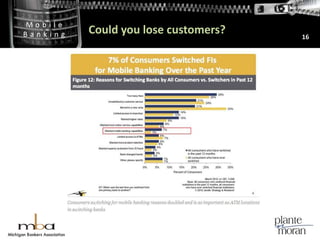

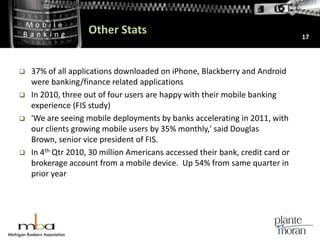

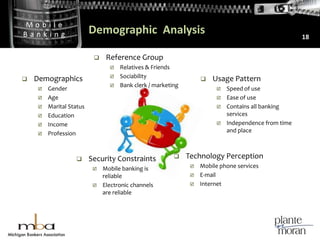

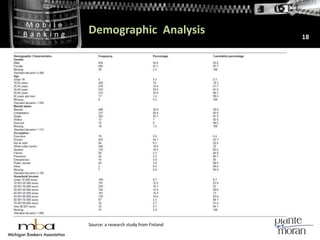

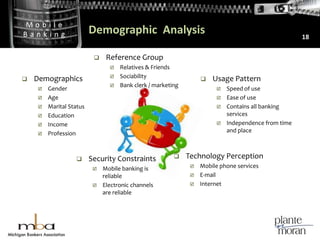

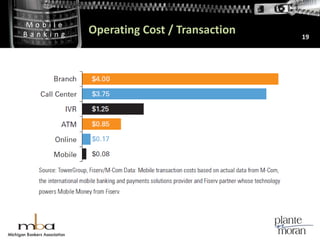

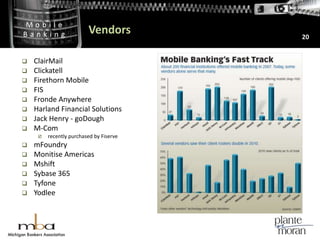

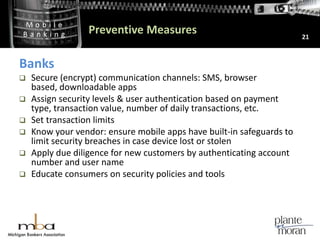

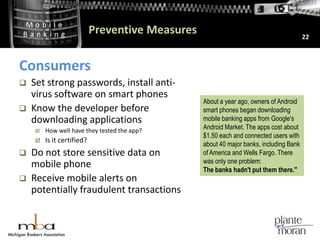

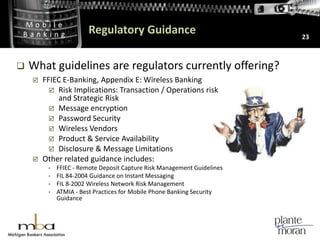

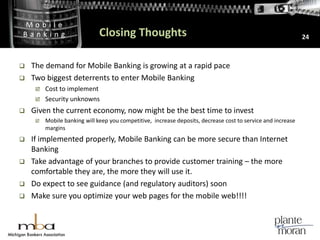

This document summarizes a presentation on mobile banking given to Michigan bankers. It discusses the evolution of customer banking channels and the rise of mobile banking. It covers trends like the growing popularity of smartphone apps over SMS/WAP access. The presentation addresses whether banks should adopt mobile banking and considerations like costs, security, and demographic analysis. It provides tips on preventive security measures and discusses relevant regulatory guidance. The closing thoughts encourage banks to offer mobile banking to remain competitive despite implementation costs and security unknowns.