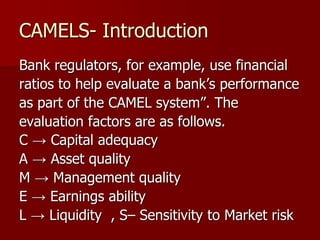

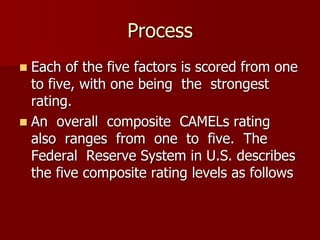

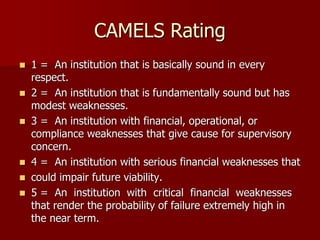

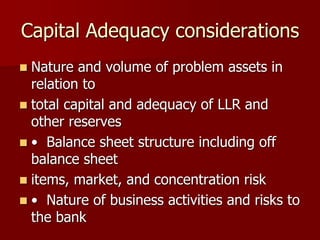

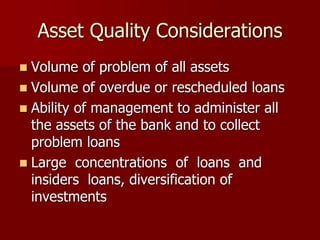

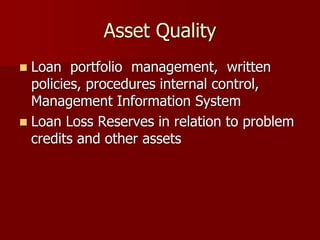

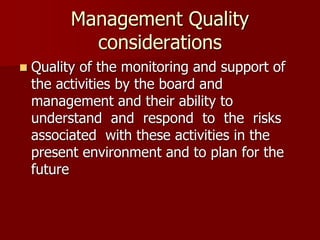

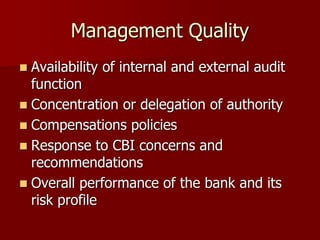

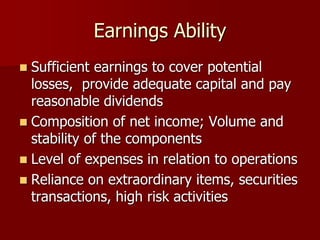

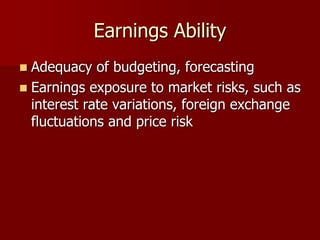

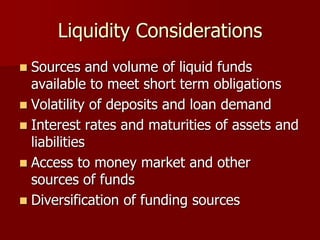

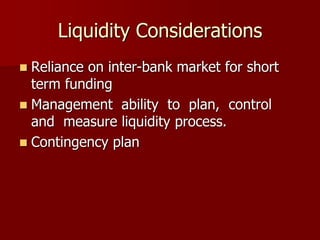

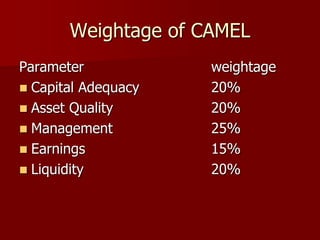

The CAMELS model is used by bank regulators to evaluate a bank's performance. The six factors evaluated are Capital adequacy, Asset quality, Management quality, Earnings ability, Liquidity, and Sensitivity to market risk. Each factor is scored 1-5 with 1 being the strongest rating. An overall composite rating is also given from 1-5. The document then provides details on how each of the six factors are evaluated.