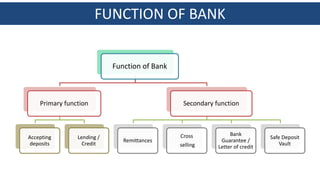

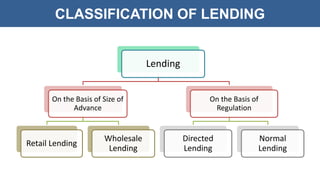

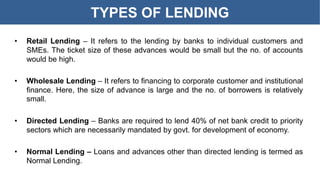

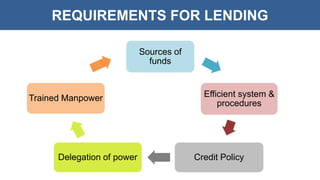

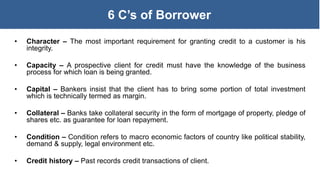

The document outlines the principles of credit management, including the functioning of banks, types of lending, and the requirements for granting credit. It details the classifications of lending such as retail, wholesale, directed, and normal lending, and introduces the 6 C's of borrowers which include character, capacity, capital, collateral, condition, and credit history. The importance of interest rate spread for bank operations is also highlighted.