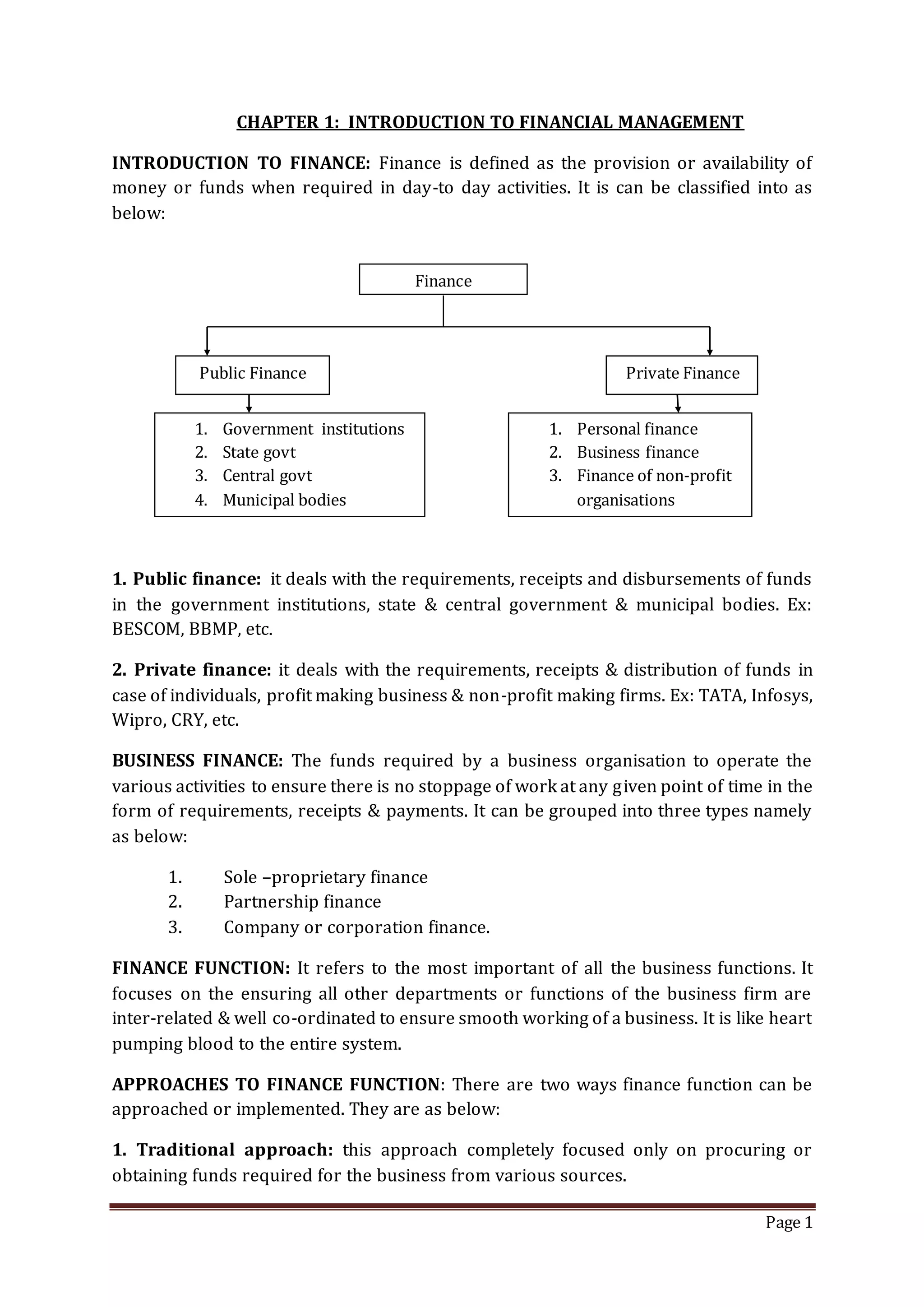

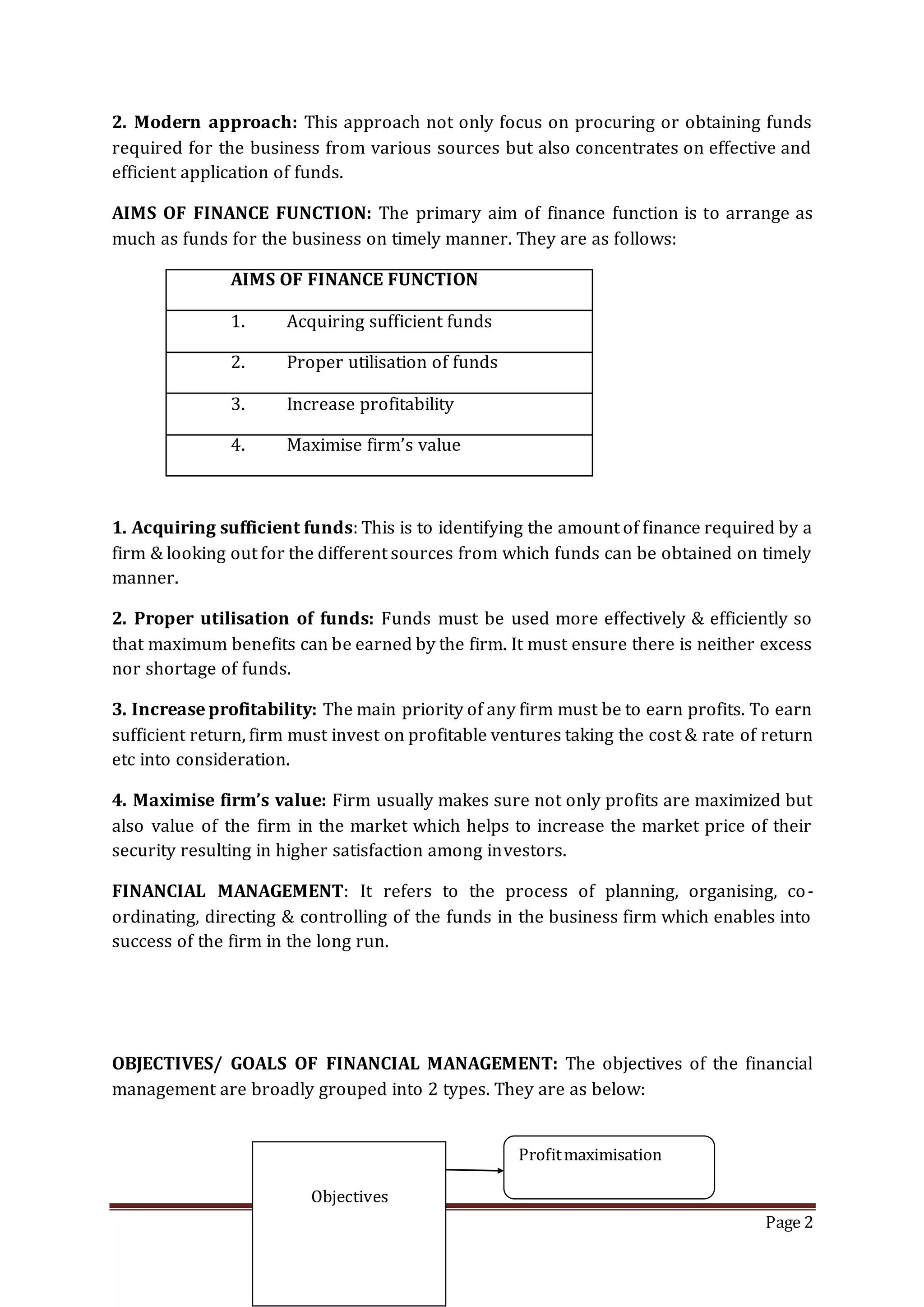

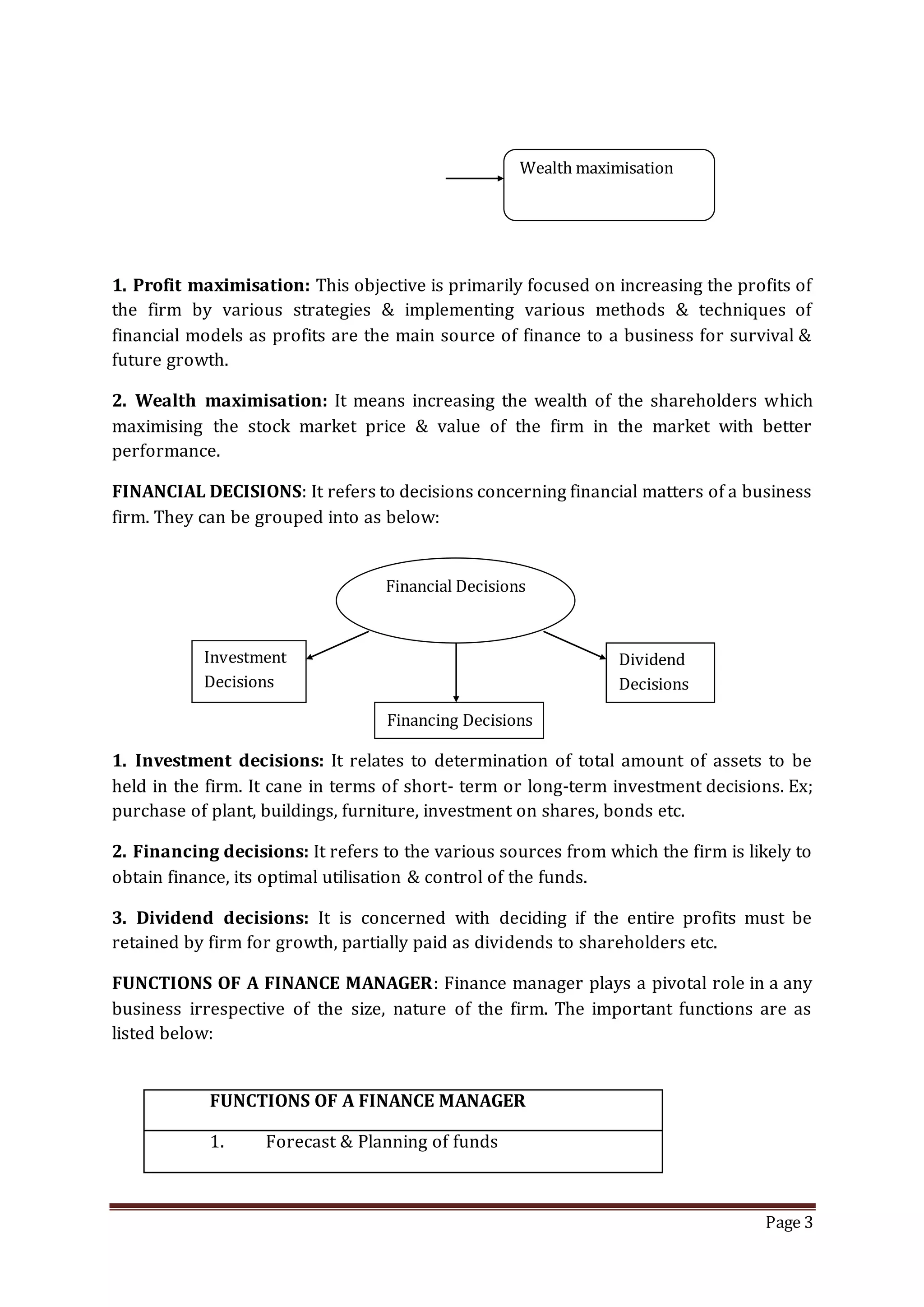

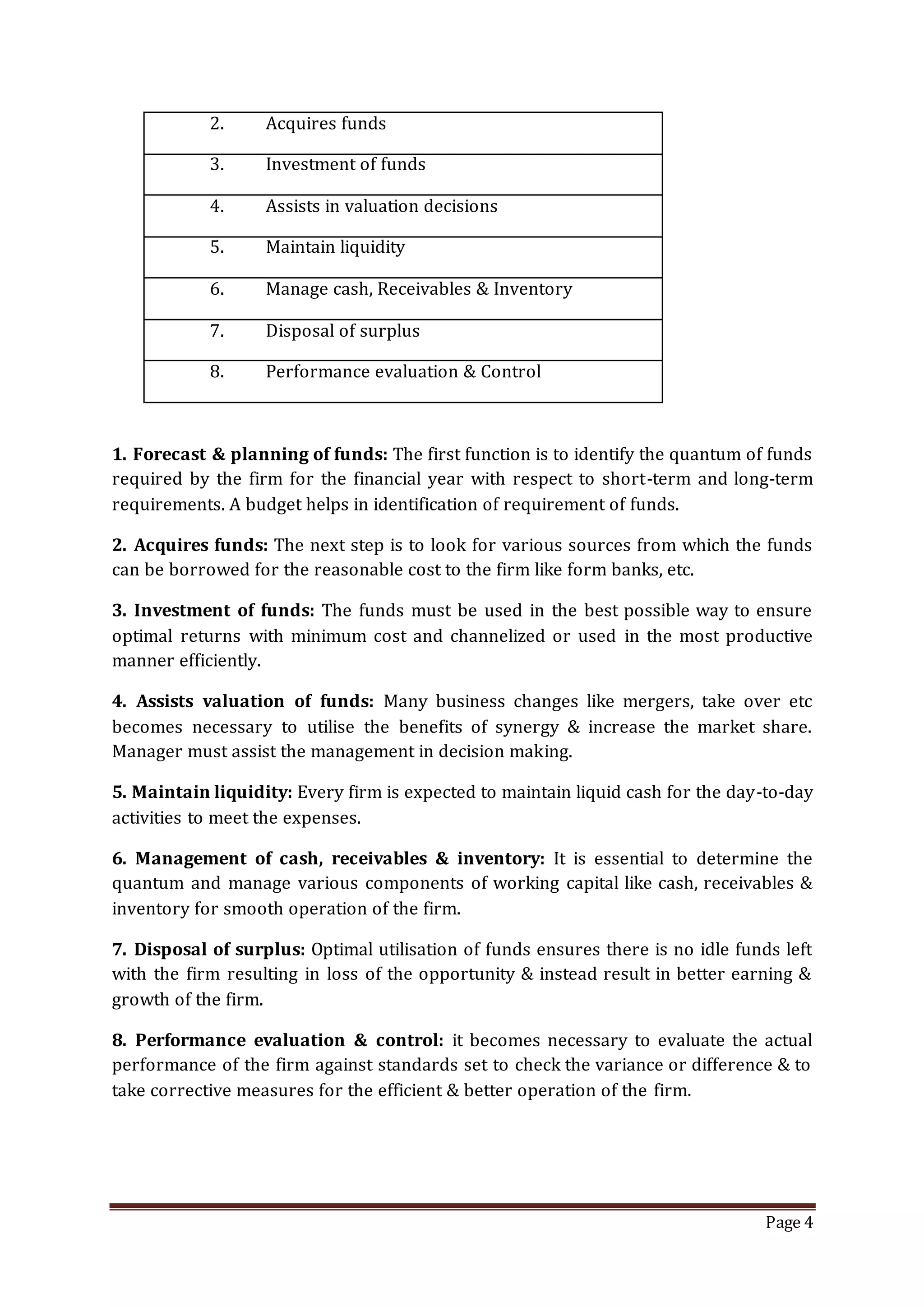

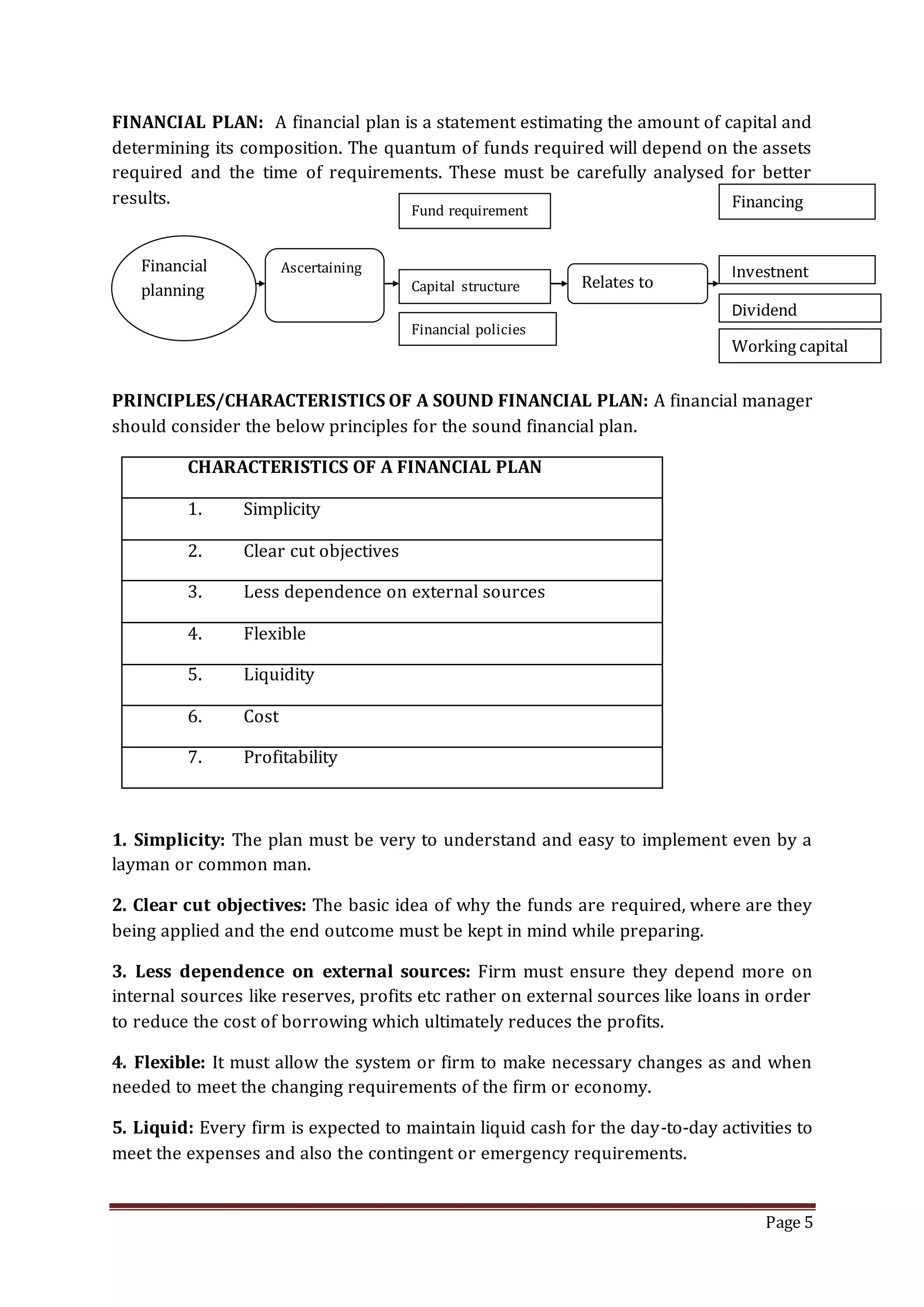

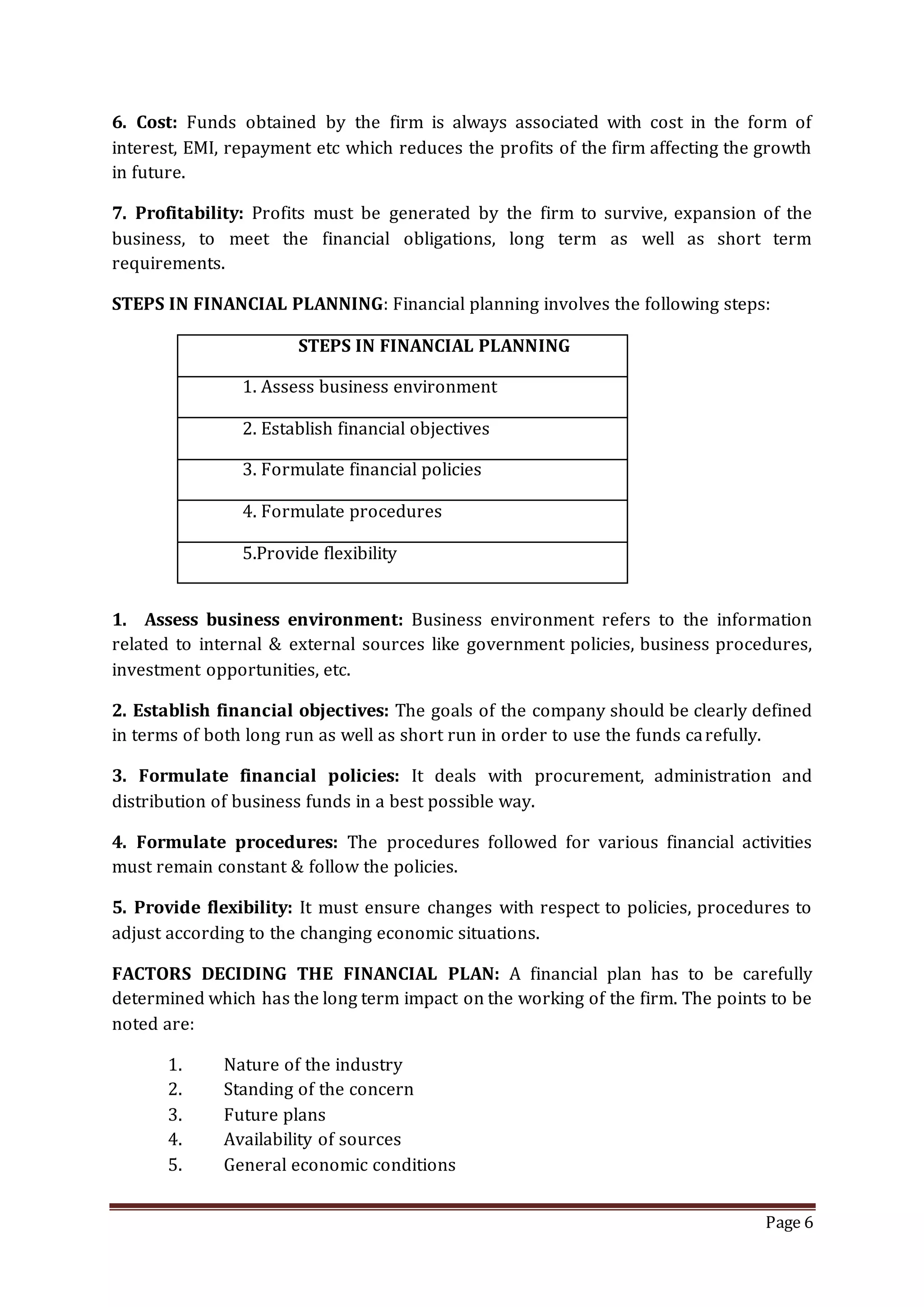

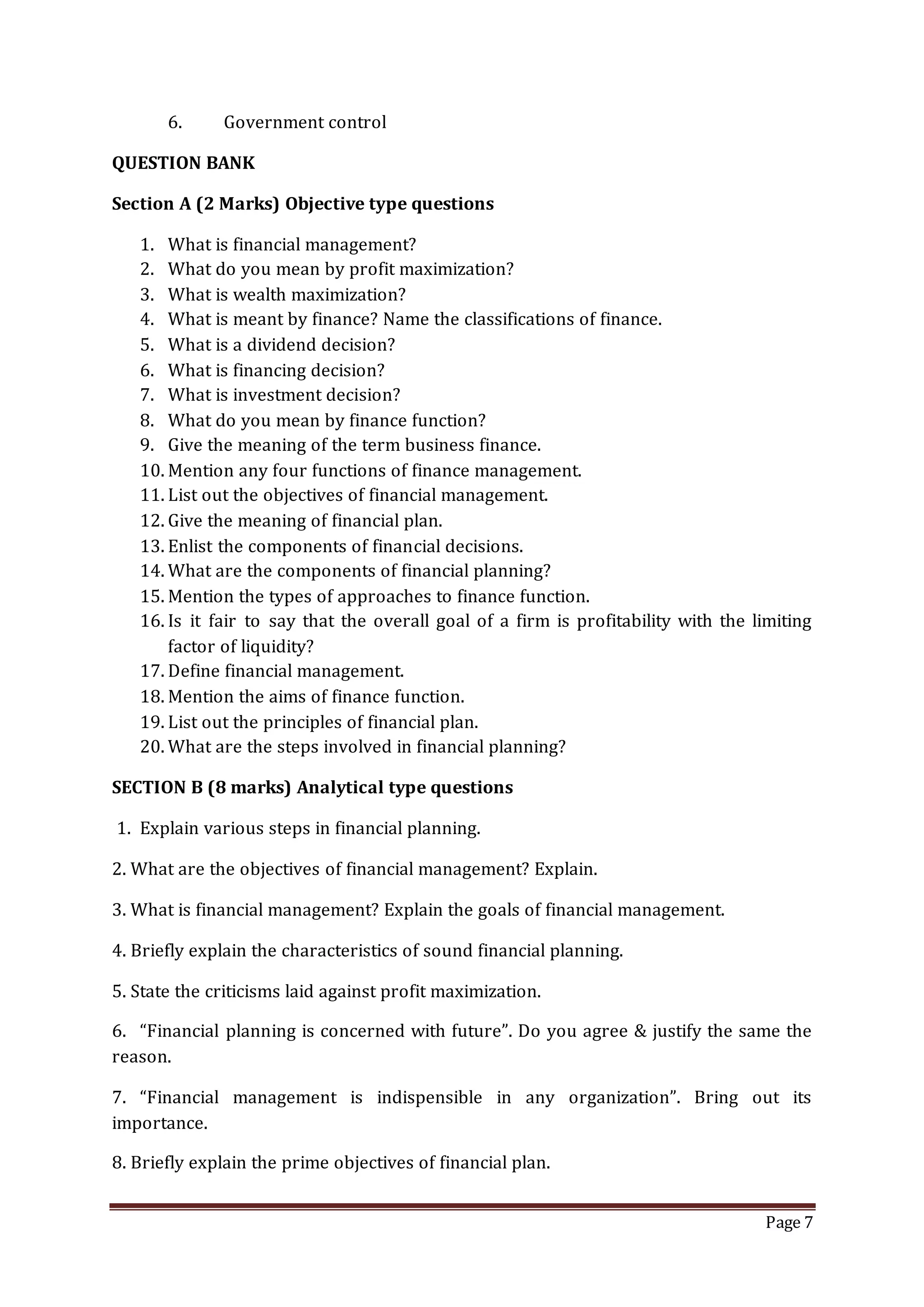

The document provides an introduction to financial management. It defines key terms like finance, public finance, private finance, and business finance. It describes the different approaches to the finance function - traditional and modern. The primary aims of the finance function are to acquire sufficient funds, properly utilize funds, increase profitability, and maximize firm value. Financial management is the process of planning, organizing, coordinating, directing, and controlling funds to enable a firm's success. The objectives of financial management are profit maximization and wealth maximization. Financial decisions include investment decisions, financing decisions, and dividend decisions. A finance manager's key functions are forecasting and planning funds, acquiring funds, investing funds, assisting with valuations, maintaining liquidity,