Oracle R12.1.3 Costing Overview

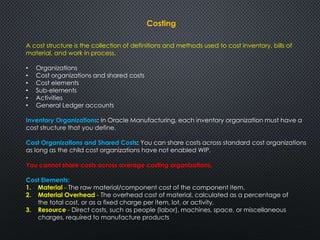

- 1. Costing A cost structure is the collection of definitions and methods used to cost inventory, bills of material, and work in process. • Organizations • Cost organizations and shared costs • Cost elements • Sub-elements • Activities • General Ledger accounts Inventory Organizations: In Oracle Manufacturing, each inventory organization must have a cost structure that you define. Cost Organizations and Shared Costs: You can share costs across standard cost organizations as long as the child cost organizations have not enabled WIP. You cannot share costs across average costing organizations. Cost Elements: 1. Material - The raw material/component cost of the component item. 2. Material Overhead - The overhead cost of material, calculated as a percentage of the total cost, or as a fixed charge per item, lot, or activity. 3. Resource - Direct costs, such as people (labor), machines, space, or miscellaneous charges, required to manufacture products

- 2. Costing 4. Overhead -Overhead is used as a means to allocate department costs or activities. For example, you can define multiple overhead sub-elements to cover both fixed and variable overhead, each with its own rate. 5. Outside Processing - This is the cost of outside processing purchased from a supplier. Sub-elements: 1. Material Sub-elements - Classify your material costs, such as plastic, steel, or aluminum. Define material sub-elements and assign them to item costs. 2. Material Overhead Sub-elements - Define material overhead sub-elements and assign them to item costs. 3. Resource Sub-elements 4. Overhead Sub-elements 5. Outside Processing Sub-elements Note: Negative item costs are not supported in Oracle Cost Management. Activities: An action or task you perform in a business that uses a resource or incurs cost. Basis Types: Basis types determine how costs are assigned to the item. 1. Item: Used with material and material overhead sub-elements to assign a fixed amount per item, generally for purchased components. 2. Lot: Used to assign a fixed lot charge to items or operations. 3. Resource Value: Used to apply overhead to an item, based on the resource value earned in the routing operation.

- 3. Costing Resource value earned in the operation x overhead rate Resource Units: Used to allocate overhead to an item, based on the number of resource units earned in the routing operation. Resource units earned in an operation X overhead rate or amount Total Value: Used to assign material overhead to an item, based on the total value of the item. Changing from Standard to Average Costing You cannot change the costing method of an organization once transactions have been performed.

- 4. Costing Transactions Details-Mass Changes: • Mass Editing Item Accounts: Mass edit account assignments for selected items. These accounts include: Cost of Goods Sold, Encumbrance, Expense, and Sales. You can edit your account assignments for all items, a category of items, or a specific item. • Mass Edit Material Cost: Apply new activity rates to item costs, Create new costs and change costs to a specified amount by a percentage or an absolute amount, Create new costs by averaging the purchase order price for open purchase orders or historical purchase order receipts, or actual accounts payable invoice prices for items. • Mass Edit Material Overhead Cost: To change the overhead cost assigned to items. Define Item Cost: • Navigate to the Item Costs window. Choose the Costs button from either the Item Costs Summary folder window or from the Item Costs Details window. • Select the cost element • Select the sub-element • Select the activity. The default activity you associated with the sub element is the default.

- 5. Costing • Select the basis. The default is the default basis associated with the sub-element. • Enter a percentage rate or a fixed amount, as appropriate for the basis. • Save Viewing Material Transaction Distributions: • Navigate to the Material Transaction Distributions window. • Enter the required search criteria. Viewing WIP Transaction Distributions • Navigate to the WIP Transaction Distributions window. • Enter your search criteria. Viewing WIP Value Summaries • Navigate to the WIP Value Summary window. • Select your search criteria.

- 6. Costing Error Resubmission: If you are using Average Inventory Costing, including Project Manufacturing Costing, then you can resubmit cost transactions that have failed to cost, and projects that have failed to transfer. Use: Pending Material Transaction Form • Navigate to the Find Material Transactions window from the Cost function. • Select Error from the Costed or the Transferred to Projects drop–down list. • Navigate to the Costed column of the Reason, Reference tab in the View Material Transactions window. Select errored transactions to resubmit as follows: • All errors: Choose Submit all from the Tools menu • One error: Place the cursor in the error cell and execute a control–click • A range of errors: Select one error as above, then move the cursor to the next error and execute a shift–click. • Save your work

- 7. Costing Average Costing: Under average cost systems, the unit cost of an item is the average value of all receipts of that item to inventory. Each receipt of material to inventory updates the unit cost of the item received. Issues from inventory use the current average cost as the unit cost. Inventory value = average unit cost * quantity For purchased items, this is a weighted average of the actual procurement cost of an item. For manufactured items, this is a weighted average of the cost of all resources and materials consumed. Average Cost Updates: When you update average costs, items in all asset subinventories in your organization and inventory in in-transit that is owned by your organization are updated (revalued) by new specified cost. • Navigate to the Update Average Cost window • Select the Average cost update in the Type field. • Optionally, select a Source type for the transaction. • Select an average cost update Adjustment Account

- 8. Costing • If you increase average costs, then debit your subinventory accounts and credit the specified adjustment account. If you decrease average costs, then the reverse adjustments are generated. • If you are updating costs using a percentage change, then enter a default to use as the percentage change for individual item costs. • Select the item for the average cost update. • Select a Cost Group. Update the total unit average cost. Do one of the following: • Enter a New Average Cost. This value cannot be negative. On-hand inventory in all subinventories and intransit are revalued. • Enter a percentage change in the item's average cost. The item cost is updated by this percentage value. On-hand inventory in all subinventories and intransit is revalued. • Enter the amount to increase or decrease the current on-hand inventory value. To decrease the value, enter a negative amount. However, you cannot enter a value that drives the inventory value negative. Note : You cannot change the average cost value by this method unless the item has quantity on–hand.

- 9. Costing • Open the Value Change tabbed region and review the change in inventory value. • Optionally, choose Cost Elements to update average costs by element by level. Transferring Invoice Variance You can transfer variances between purchase order price and invoice price back to inventory, from your user-defined adjustment account, usually an IPV account. This lets you value your inventory at costs as close to actual as possible. The transfer process picks up only invoices that have been posted to GL to ensure that the invoices are approved for payment, and that variances can be added back to inventory. You can only run the transfer process for one organization at a time. Request: Transfer Invoice Variance to Inventory Valuation.

- 10. Costing Average Cost = (transaction value + current inventory value) / (transaction quantity + current on-hand quantity) Cost Updates @ Purchase Order Receipt to Receiving Inspection No Delivery from Receiving Inspection to Inventory Yes Purchase Order Receipt to Inventory Yes Return to Supplier from Receiving No Return to Supplier from Inventory Yes Miscellaneous Issue No (if default cost is used) Miscellaneous Receipt No (if default cost is used) Shipment Transaction/FOB Shipment: Sending Org No Shipment Transaction/FOB Shipment: Receiving Org Yes Direct Inter-Organization Transfer: Sending Org No

- 11. Costing Direct Inter-Organization Transfer: Receiving Org Yes Cycle Count No Physical Inventory No Sales Order Shipments No RMA Receipts Yes RMA Returns No Average Cost Update Yes

- 12. New Features in R12 - Deferred COGS- You must specify the Deferred COGS Account in the Organization Parameters window. Setting Up Revenue / COGS Matching 1. Navigate to the Organization Parameters window and select the Other Accounts tab. (N) Inventory > Setup > Organizations > Parameters (T) Other Accounts 2. Enter the Deferred COGS Account. There is no default for this account. Specify a Deferred COGS Account for each organization.

- 13. Deferred COGS: How to use this feature of Oracle Apps R12 Business Process: In R11i When a Sales order is shipped and interface trip stop is completed. This then generate following accounting. Cr Inventory Valuation account Rs. 25000 Dr COGS Account Rs. 25000 In R12 when a sales order is shipped and interface trip stop is completed the following accounting entries gets generated. Cr Inventory Valuation account Rs. 25000 Dr Deferred COGS Account Rs. 25000 After the AR invoice is generated and the revenue is recognized, following program will create COGS recognition transaction. This will reflect a change in the revenue recognition percentage for a sales order line. 1. Collect Revenue Recognition Information program Navigation: Cost > COGS Recognition > Collect Revenue Recognition Information 2. Generate COGS Recognition Events: This will create accounting entries as follow Navigation: Cost > COGS Recognition > Generate COGS Recognition Events Cr Deferred account Rs. 250 (Actual Revenue %) Dr COGS Account Rs. 250 (Actual Revenue %)

- 14. Deferred COGS: How to use this feature of Oracle Apps R12 Business Process: With this feature the COGS recognition now requires few extra concurrent requests to be submitted. Revenue / COGS Recognition Process Flow When you ship confirm one or more order lines in Oracle Order Management and then run the applicable Cost Management cost and accounting processes, the cost of goods sold associated with the sales order line is immediately debited to a Deferred COGS account pending the invoicing and recognition of the sales order revenue in Oracle Receivables. When Oracle Receivables recognizes all or part of the sales revenue associated with a sales order line, you run a cost process that calculates the percentage of total billed revenue recognized. Oracle Inventory then creates a cost recognition transaction that adjusts the Deferred COGS and regular COGS amount for the order line. The proportion of total shipment cost that is recognized as COGS will always match the proportion of total billable quantity that is recognized as revenue. AR revenue need to be recognized to have COGS recognized This functionality is not optional as it is mandatory to be used in R12 To make the complete set of transactions visible in the Material Transaction screen, ‘Include Logical Transaction’ checkbox need to be checked.

- 15. Deferred COGS: How to use this feature of Oracle Apps R12 COGS Recognition and Concurrent Processes The matching and synchronization of the earned and deferred components of sales order revenue and COGS is accomplished by running the following COGS recognition concurrent processes at user-defined intervals: • Record Order Management Transactions (Optional) • Collect Revenue Recognition Information • Generate COGS Recognition Events (N) Cost > COGS Recognition

- 16. Important Reports COGS / Revenue Matching Report: The report displays earned and unearned (deferred) revenue, and cost of goods sold amounts for sales orders issues specified in the report's run-time parameters. The report displays shipped sales order and associated sales order lines, and shows the accounts where the earned and deferred COGS were charged. Detailed Item Cost Report Use the Detailed Item Cost Report to analyze item cost details for any cost type. Discrete Job Value Report The Discrete Job Value Report - Average Costing assists you in analyzing your standard discrete jobs and non-standard asset jobs in project and non-project environments. Elemental Cost Report Use the Elemental Cost Report to report and summarize item costs by cost element.

- 17. Important Reports Elemental Inventory Value Report - by Subinventory This report displays the current on hand elemental value by subinventory for a given organization. The report also displays on hand value as of a specified date Inventory Master Book Report Use the Inventory Master Book Report for reporting inventory transactions on a periodic basis to support internal and external auditing. Margin Analysis Reports Use the Margin Analysis Reports to report sales revenue, cost of goods sold, and gross margin information for each item shipped/invoiced within the specified date range. These report earned revenue versus recognized COGS, and you can print both summary and detail information. Period Close Reconciliation Report This concurrent program and report is used to create summarized transaction records, the final step in closing your accounting period. Period Close Pending Transactions Report The Period Close Pending Transactions Report provides details of transactions preventing period close. Receiving Value Report Use the Receiving Value Report to display item quantity, valuation, and detailed receipt information for the receiving inspection location

- 18. Cost Management Integration with Other Modules INV Receipt Trans & Exp Accr GENERAL LEDGER ACCOUNTS PAYABLE PURCHASING FIXED ASSETS ACCOUNTS RECEIVABLE INVENTORY ORDER ENTRY WORK IN Shipment PROCESS Transactions Invoice Info BILL OF MATERIAL MRP Repair RMA's SERVICE WIP Supply to MRP MRP Release to WIP S/O Requirements ENGINEERING COST MANAGEMENT BOM's/Routings for Roll Up Costs Values Trans ENG Items planned in MRP WIP Consumption & WIP Completions Asset Additions Invoices/ Payments Asset Cost Accum Depr Depr Exp PUR provides PO's and Receipts Delivery Trans Invoices/ Cash Receipt Trans Items BOM's Items from BOM's Matl Requirements Inventory/ WIP Trans Values Trans Values INV Stds Adj Misc Trans for Warranty Repair Parts CASH MANAGEMENT (Bank Recon)

- 19. Reports Margin Analysis reports You can use cost management to determine profitability by analyzing costs associated with revenue-generating activities. Use the Margin Analysis Reports to report sales revenue, cost of goods sold, and gross margin information for each item shipped/invoiced within the specified date range. You can print reports in summary and in detail. The costing method of the organization is independent of margin analysis reporting and does not affect the procedure to run margin analysis reports. Gross Margin vs. Gross Profit Generally, direct cost of goods sold is shipped inventory valued at one of the costing methods. Gross Margin = Revenue – Direct Cost of Goods Sold Other cost of sales includes manufacturing variances, freight and duty, royalty, warranty and other indirect costs. Gross Profit = Gross Margin – Other Cost of Goods Sold

- 20. Reports Old Program/Report New Program/Report in R12 Assembly Cost Rollup Supply Chain Cost Rollup Consolidated Bill of Material Supply Chain Consolidated Bill of Material Indented Bill of Material Supply Chain Consolidated Indented Bill of Material Inventory Value Report Inventory Value Report – by Subinventory Inventory Value Report – W.Mgt Inventory Value Report – by Cost Group All Inventories Value Report All Inventories Value Report – by Subinventory All Inventories Value Report – Avg All Inventories Value Report – by Cost Group Elemental Inventory Value Report Elemental Inventory Value Report– by Subinventory Elemental Inventory Value Report– by Cost Group Inventory Master Book Report

- 21. Period End Processing • In R12, Oracle introduced two changes to help with identifying transactions that would prevent you from closing the period. • The first is the ability to drilldown to transactions from the Accounting Periods form. • The second is a Period Close Pending Transaction report

- 22. Integration with other Modules • In R12, there are three new modules that integrate with Cost Management 1. Subledger Accounting, 2. Oracle Process Manufacturing 3. Landed Cost Management.

- 23. Period Close Process R12 Period Close Dependencies

- 24. Period Close Process R12- Sequence 1. Order Management / Shipping 2. Cash Management / Treasury 3. Payables 4. Receivables 5. Purchasing 6. Inventory / Costing 7. Projects 8. Assets 9. General Ledger

- 25. Period Close Process R12- Process Order Management: • Complete All Transactions for the Period Being Closed • Ensure all Interfaces are Completed for the Period (Optional) • Review Open Orders and Check the Workflow Status • Review Held Orders • Review Discounts • Review Backorders • Review and Correct Order Exceptions • Reconcile to Inventory • Reconcile to Receivables (Optional) • Run Standard Period End Reports

- 26. Period Close Process R12- Process Cash Management: • Load Bank Statements • Reconcile Bank Statements • Create Miscellaneous Transactions • Review AutoReconciliation Execution Report • Resolve Exceptions on the AutoReceonciliation Execution Report • Run Bank Statement Detail Report • Run Transactions Available for Reconcilaition Report • Resolve Un-reconciled Statement Lines • Run the GL Reconciliation Report • Run the Account Analysis Report for the General Ledger Cash Account • Review the Account Analysis Report • Correct any Invalid Entries to the General Ledger Cash Account (Optional) • Perform the Bank Reconciliation

- 27. Period Close Process R12- Process Payables • Complete All Transactions for the Period Being Closed • Run the Payables AutoApproval Process for All Invoices / Invoice Batches • Review & Resolve Amounts to Post to the General Ledger • Reconcile Payments to Bank Statement Activity for the Period • Transfer All Approved Invoices Payments, Reconciled Payments to the General Ledger • Review the Payables to General Ledger Posting Process After Completion • Submit the Unaccounted Transactions Sweep Program • Close the Current Oracle Payables Period • Accrue Uninvoiced Receipts • Reconcile Oracle Payables Activity for the Period • Run Mass Additions Transfer to Oracle Assets • Open the Next Payables Period • Run Reports for Tax Reporting Purposes (Optional) • Run the Key Indicators Report (Optional) • Purge Transactions (Optional)

- 28. Period Close Process R12- Process Receivables • Complete All Transactions for the Period Being Closed • Reconcile Transaction Activity for the Period • Reconcile Outstanding Customer Balances • Review the Unapplied Receipts Register • Reconcile receipts. • Reconcile Receipts to Bank Statement Activity for the Period • Post to the General Ledger • Reconcile the General Ledger Transfer Process • Reconcile the Journal Import Process • Print Invoices • Print Statements (Optional) • Print Dunning (Reminder) Letters (Optional) • Close the Current Oracle Receivables Period • Reconcile Posted Journal Entries • Review Unposted Items Report • Open the Next Oracle Receivables Period • Run Reports for Tax Reporting Purposes (Optional) • Run Archive and Purge programs (Optional)

- 29. Period Close Process R12- Process Purchasing • Complete All Transactions for the Period Being Closed • Review the Current and Future Commitments (Optional) • Review the Outstanding and Overdue Purchase Orders (Optional) • Follow up Receipts-Check with Suppliers • Identify and Review Un-invoiced Receipts (Period End Accruals) • Follow Up Outstanding Invoices • Complete the Oracle Payables- Period End Process • Run Receipt Accruals – Period End Process • Reconcile Accounts – Perpetual Accruals • Perform Year End Encumbrance Processing. (Optional) • Close the Current Purchasing Period. • Open the Next Purchasing Period. • Run Standard Period End Reports (Optional)

- 30. Period Close Process R12- Process Inventory/WIP • Complete All Transactions for the Period Being Closed. • Check Inventory and Work In Process Transaction Interfaces. • Check Oracle Order Management Transaction Process. • Review Inventory Transactions. • Balance the Perpetual Inventory. • Validate Work In Process Inventory. • Transfer Summary or Detail Transactions • Close the Current Oracle Payables and Oracle Purchasing Periods • Close the Current Inventory Period • Open the Next Inventory Period • Run Standard Period End Reports (Optional)

- 31. Period Close Process R12- Process Projects • Change the Current Oracle Projects Period Status from Open to Pending Close • Open the Next Oracle Projects Period • Complete All Maintenance Activities • Run Maintenance Processes • Complete All Transaction Entry for the Period Being Closed • Run the Final Cost Distribution Processes • Interface Transactions to Other Applications (AP, GL, FA) • Generate Draft Revenue for All Projects • Generate Invoices • Run Final Project Costing and Revenue Management Reports • Transfer Invoices to Oracle Receivables • Interface Revenue to General ledger (Project Billing Only) • Run Period Close Exception and Tieback Reports • Change the Current Period Oracle Projects Status from Pending Close to Closed • Advance the PA Reporting Period (Optional) • Update Project Summary Amounts • Restore Access to User Maintenance Activities • Permanently Close the Oracle Projects Period (Optional) • Reconcile Cost Distribution Lines with General Ledger (Optional)

- 32. Period Close Process R12- Process Assets • Complete All Transactions for the Period Being Closed • Assign All Assets to Distribution Lines • Run Calculate Gains and Losses (Optional) • Run Depreciation • Create Journal Entries • Rollback Depreciation and/or Rollback Journal Entries (Optional) • Create Deferred Depreciation Journal Entries (Optional) • Depreciation Projections(Optional) • Review and Post Journal Entries • Reconcile Oracle Assets to Oracle General Ledger Using Reports. • Run Responsibility Reports (Optional) • Archive and Purge Transactions (Optional)

- 33. Period Close Process R12- Process General Ledger • Ensure the Next Accounting Period Status is Set to Future Entry • Complete Oracle Sub-ledger Interfaces to Oracle General Ledger • Upload Journals from ADI (Applications Desktop Integrator) to Oracle General Ledger • Complete Non-Oracle Sub-ledger Interfaces to Oracle General Ledger (Optional) • Generate Reversal Journals (Optional) • Generate Recurring Journals (Optional) • Generate Mass Allocation Journals (Optional) • Review and Verify Journal Details of Unposted Journal Entries • Post All Journal Batches • Run General Ledger Trial Balances and Preliminary Financial Statement Generator Reports (FSGs) • Revalue Balances (Optional) • Translate Balances (Optional) • Consolidate Sets of Books (Optional) • Review and Correct Balances (Perform Reconciliations) • Enter Adjustments and / or Accruals and Post • Perform Final Adjustments • Close the Current Oracle General Ledger Period • Open the Next Oracle General Ledger Period • Run Financial Reports for the Closed Period • Run Reports for Tax Reporting Purposes (Optional) • Perform Encumbrance Year End Procedures (Optional)

- 34. Period Close Process R12- Navigation Period Navigation Purchasing : Purchasing Responsibility > Setup > Financials > Accounting > Control Purchasing Periods Inventory : Inventory Responsibility > Accounting Close Cycle > Inventory Accounting Periods GL: General Ledger Responsibility > Open/Close AP: Payables Responsibility > Setup > Calendar > Accounting > Accounting Periods AR: Receivables Responsibility > Control > Accounting > Open/Close Period