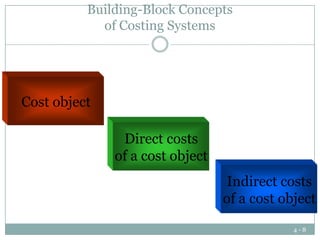

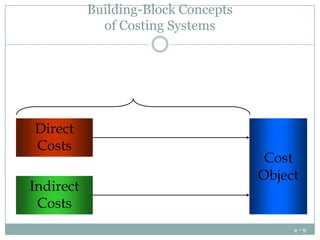

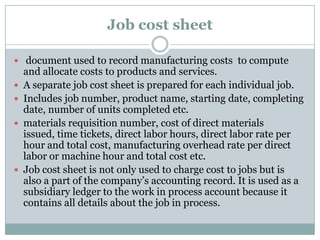

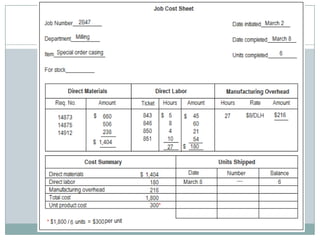

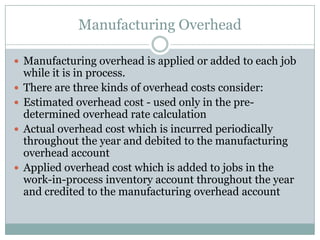

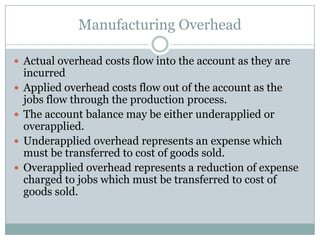

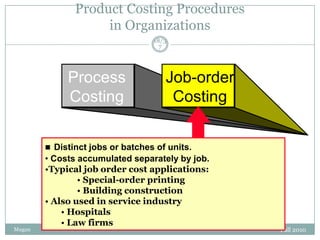

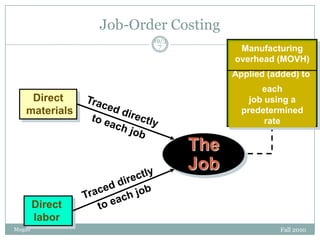

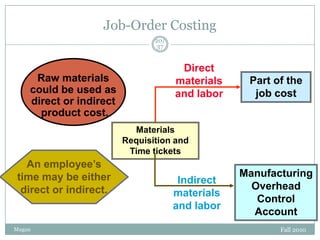

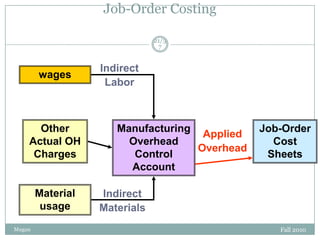

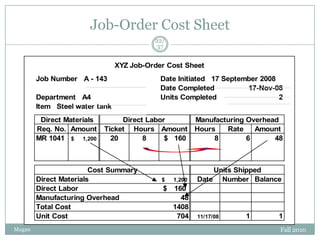

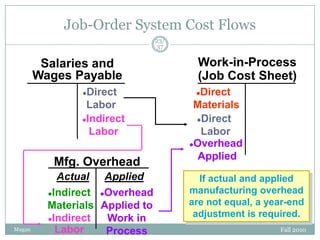

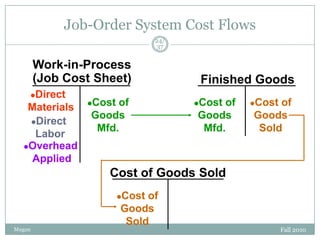

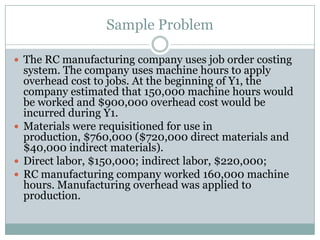

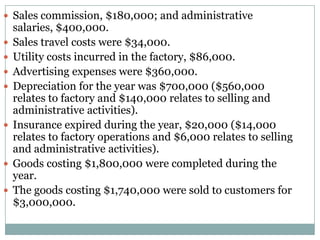

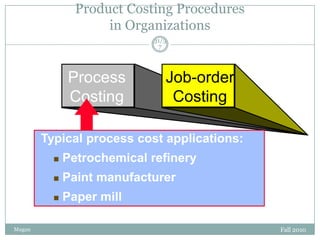

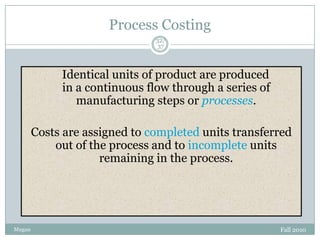

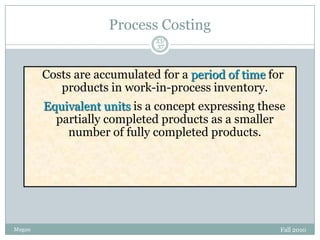

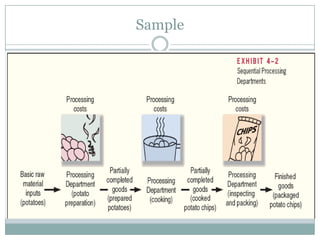

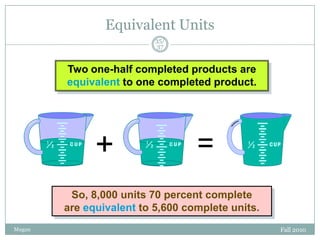

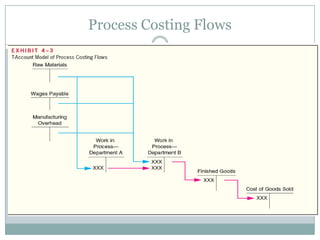

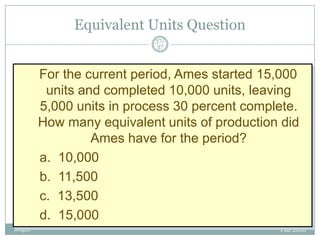

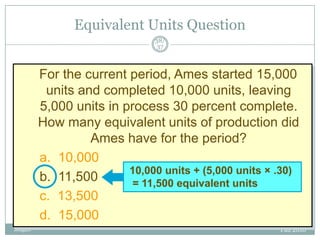

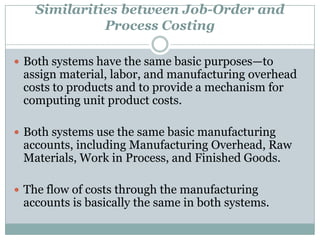

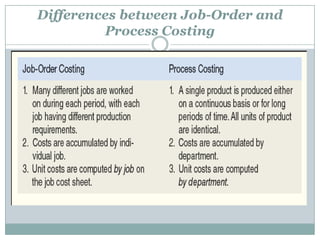

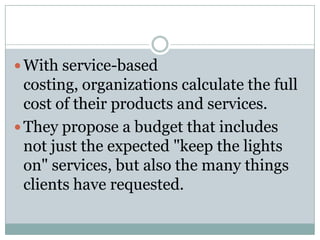

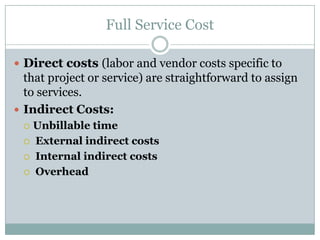

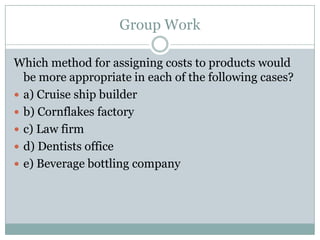

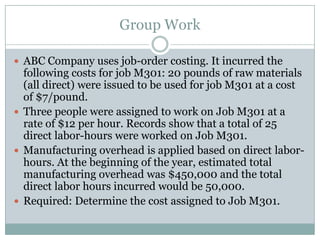

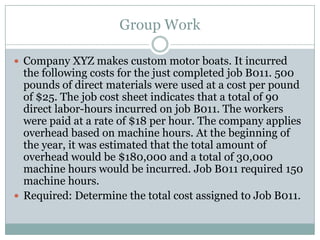

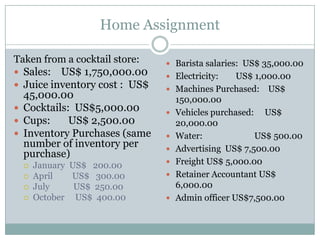

This document discusses different costing methods used in management accounting including job costing, process costing, batch costing, contract costing, and service costing. It provides examples and explanations of key concepts in job costing like job cost sheets, predetermined overhead rates, and manufacturing overhead. Process costing is explained as a method used for mass production of nearly identical units where costs are accumulated and assigned to units produced. Batch costing is defined as identifying and assigning costs to a set amount of similar goods produced in a batch. Contract costing applies especially to long-term construction projects performed over multiple periods. Finally, service costing calculates the full costs of services an entity provides using direct and indirect costs.