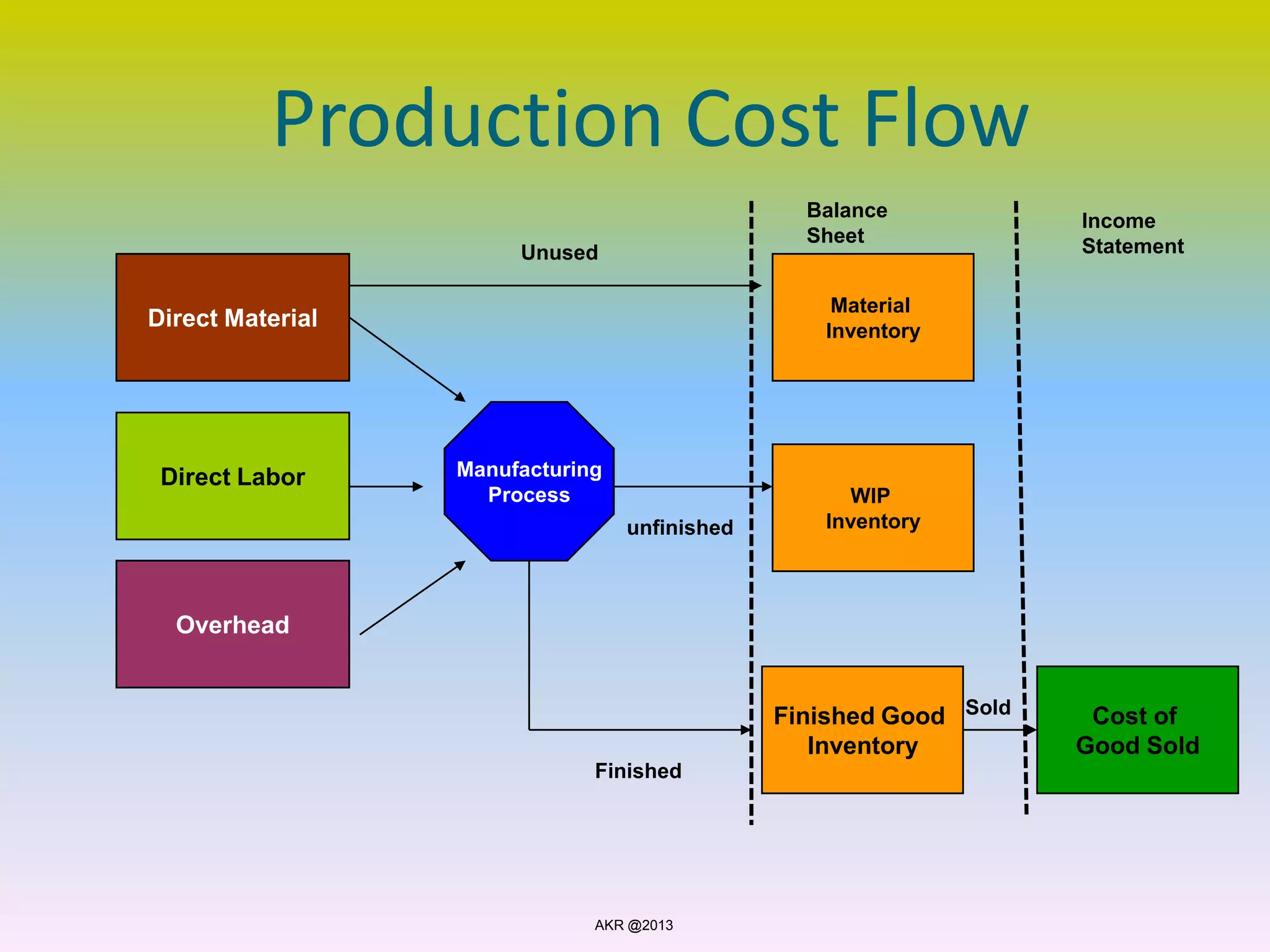

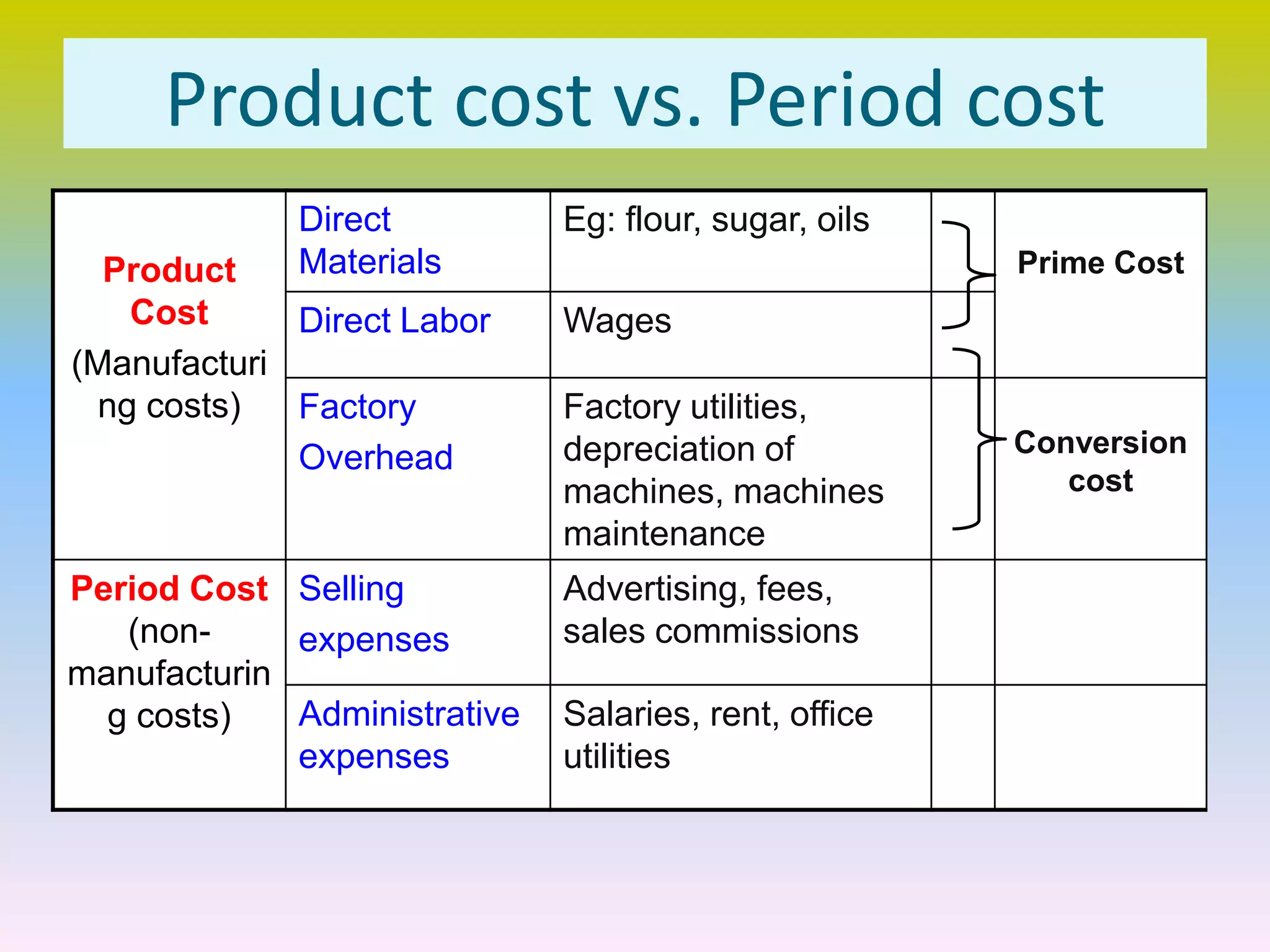

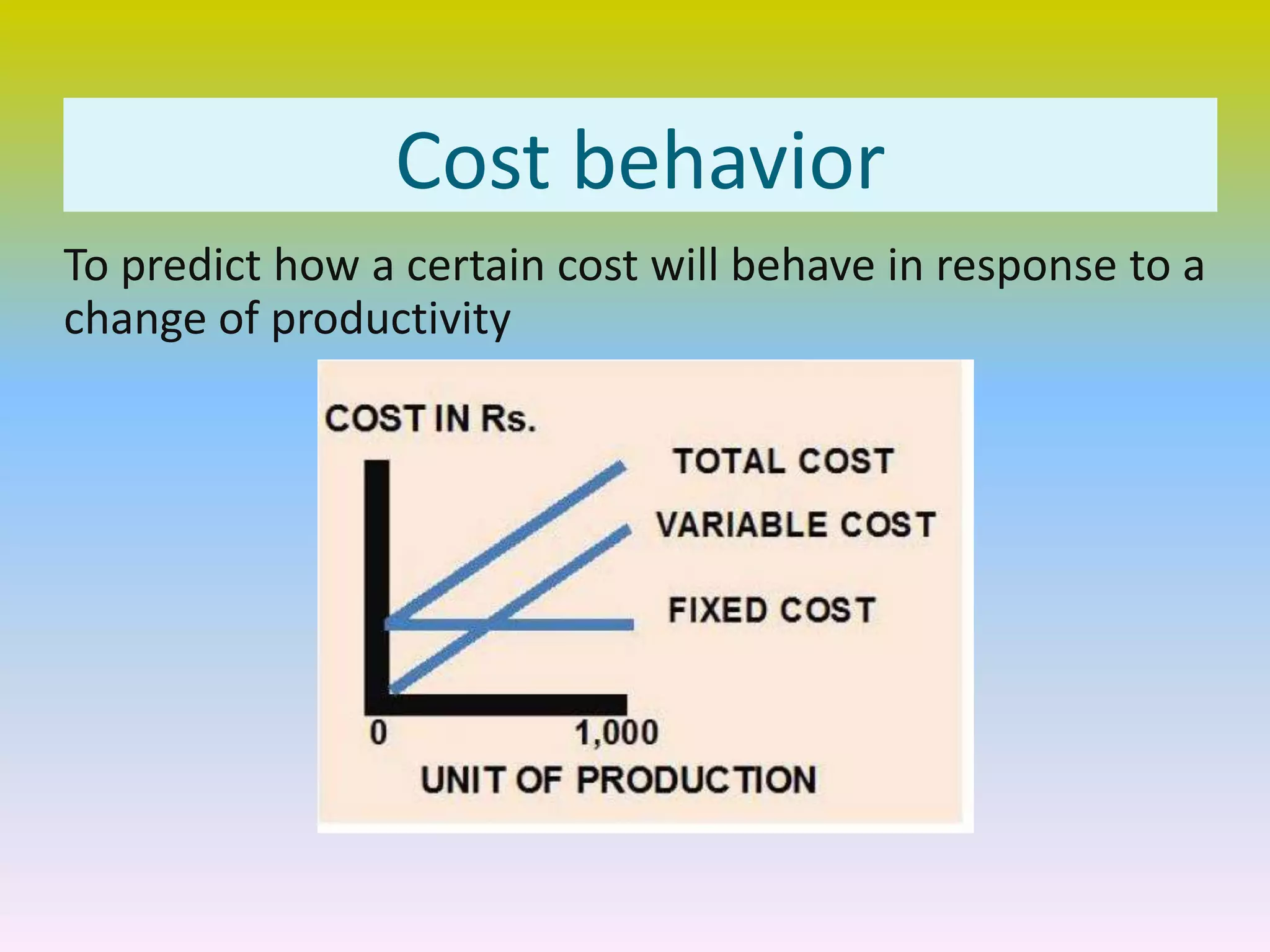

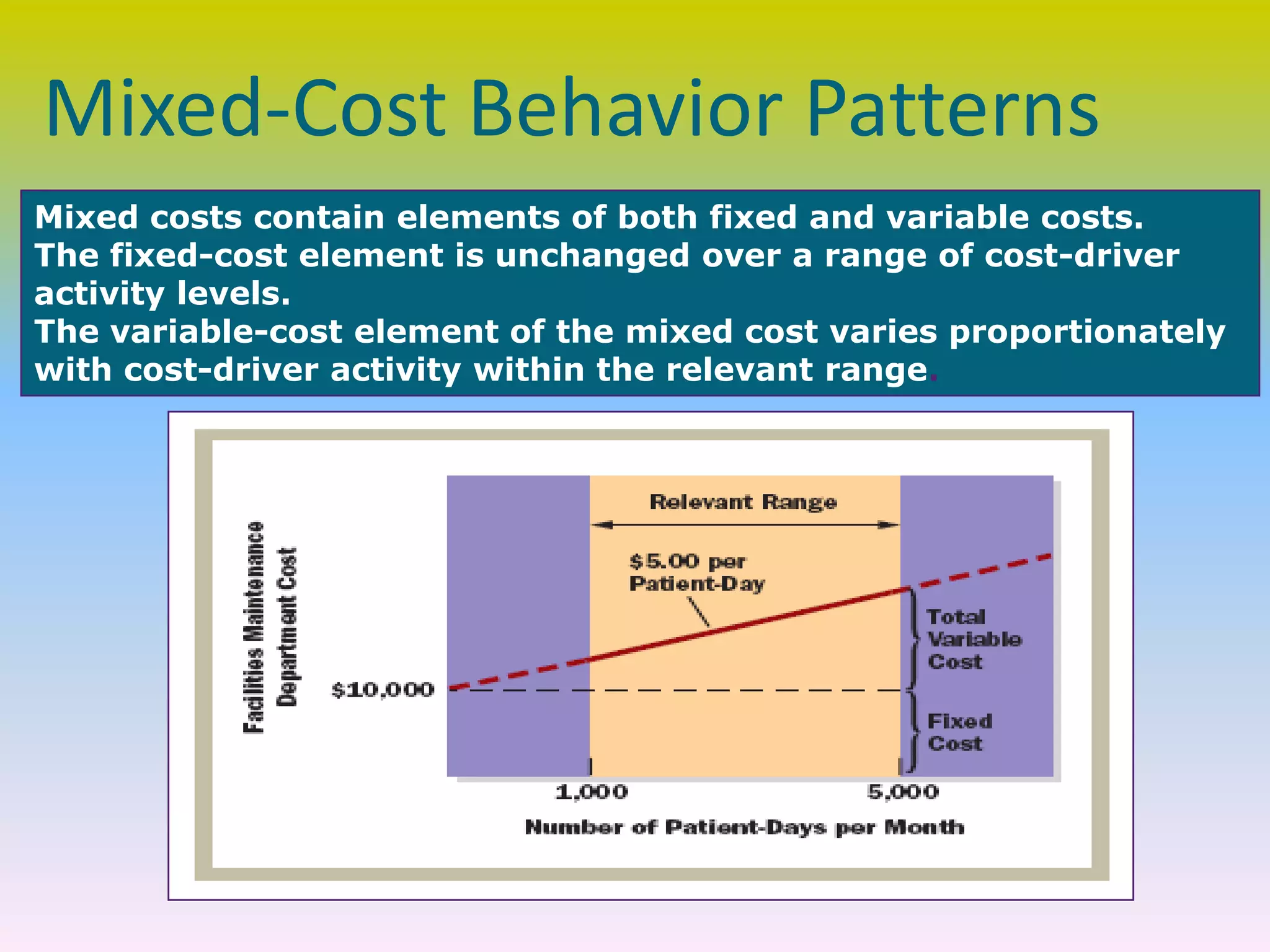

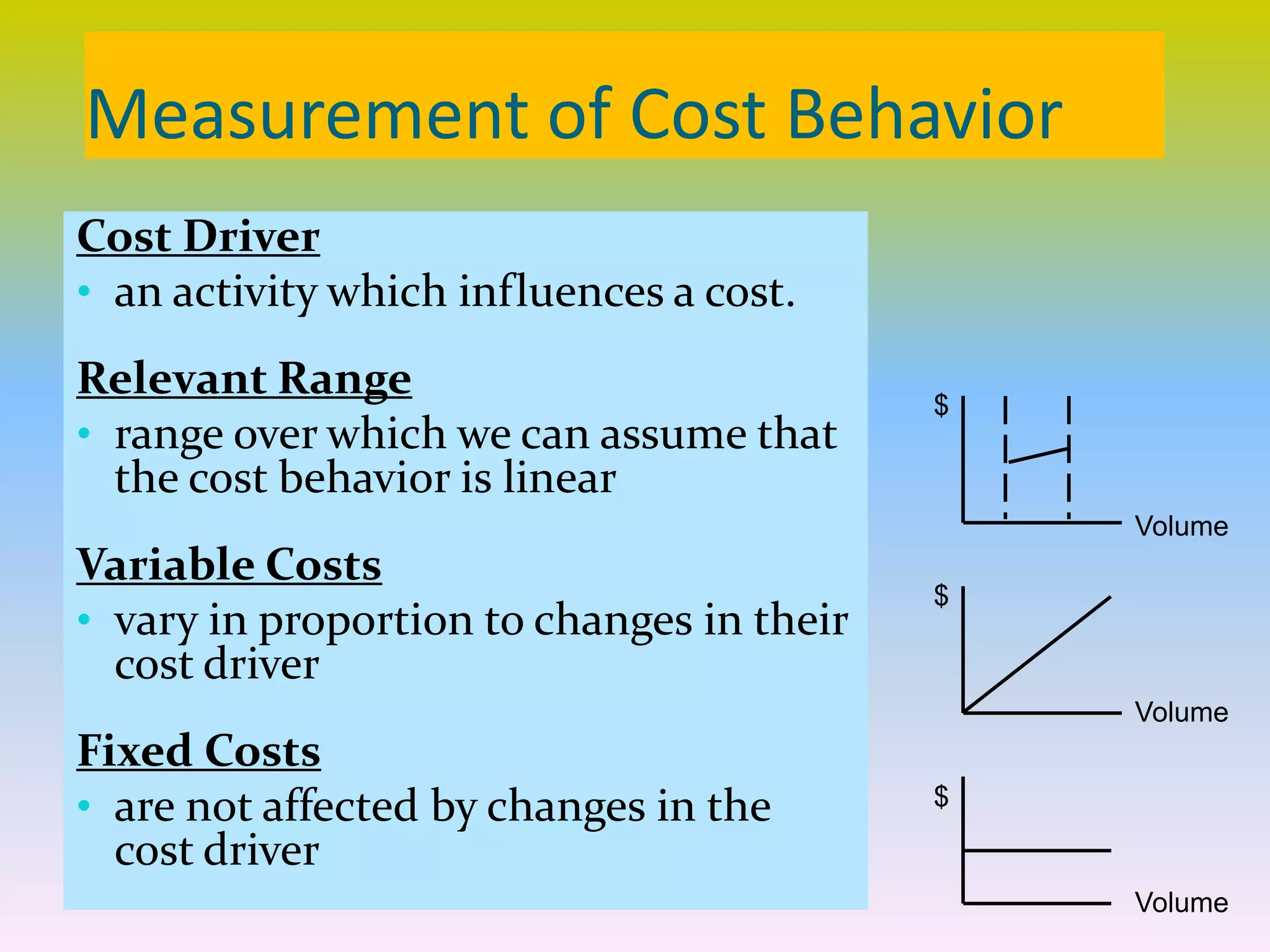

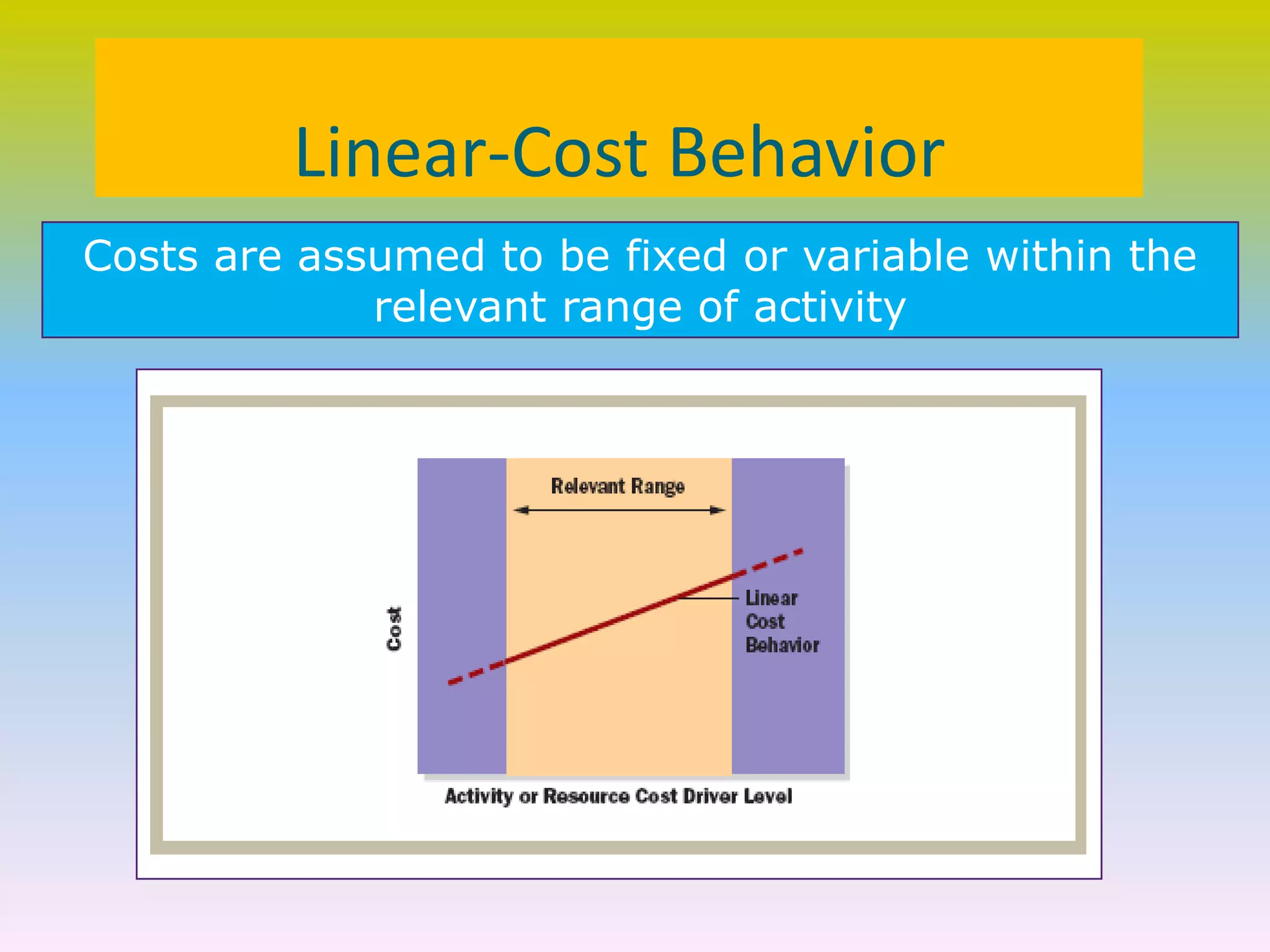

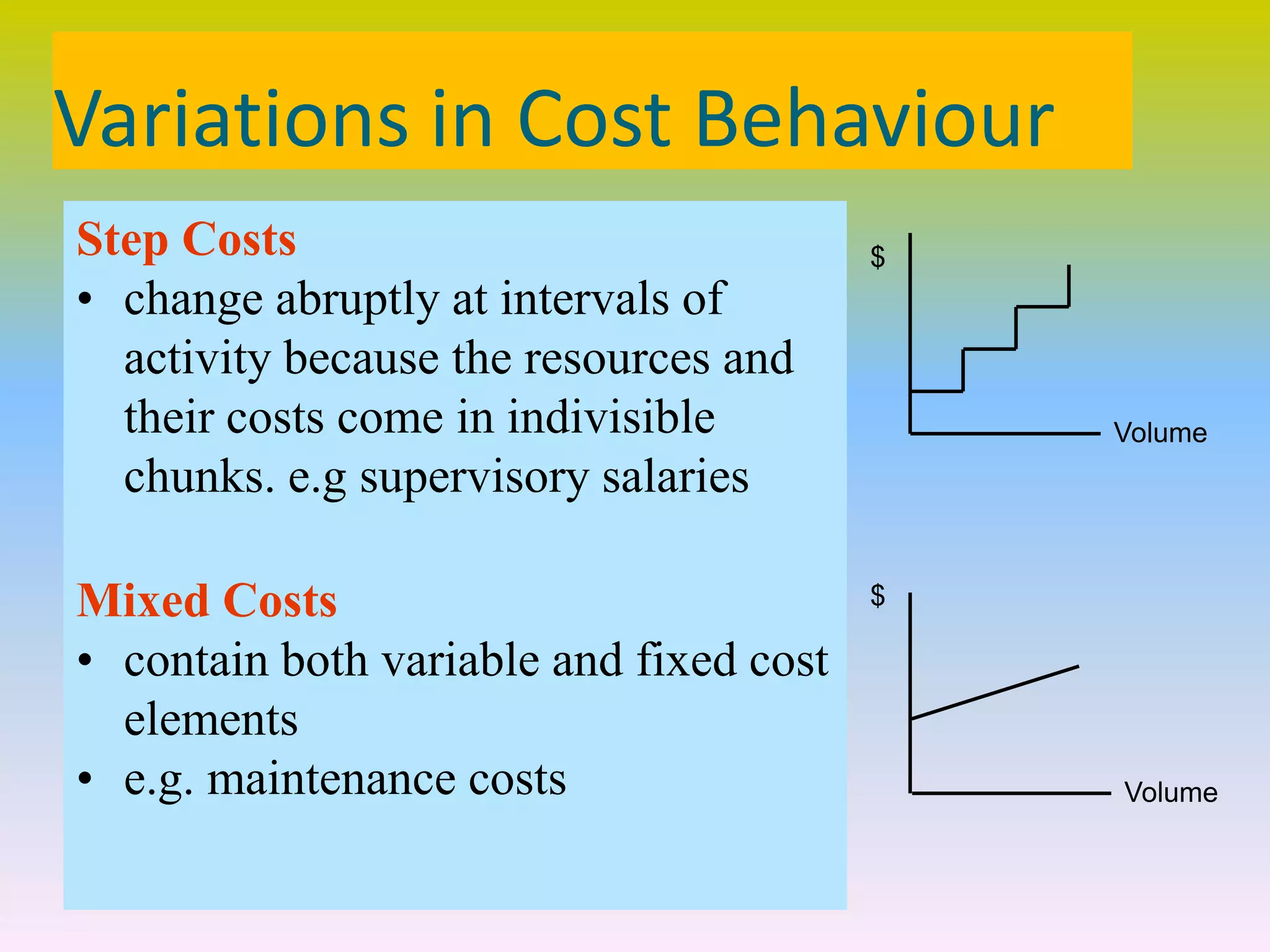

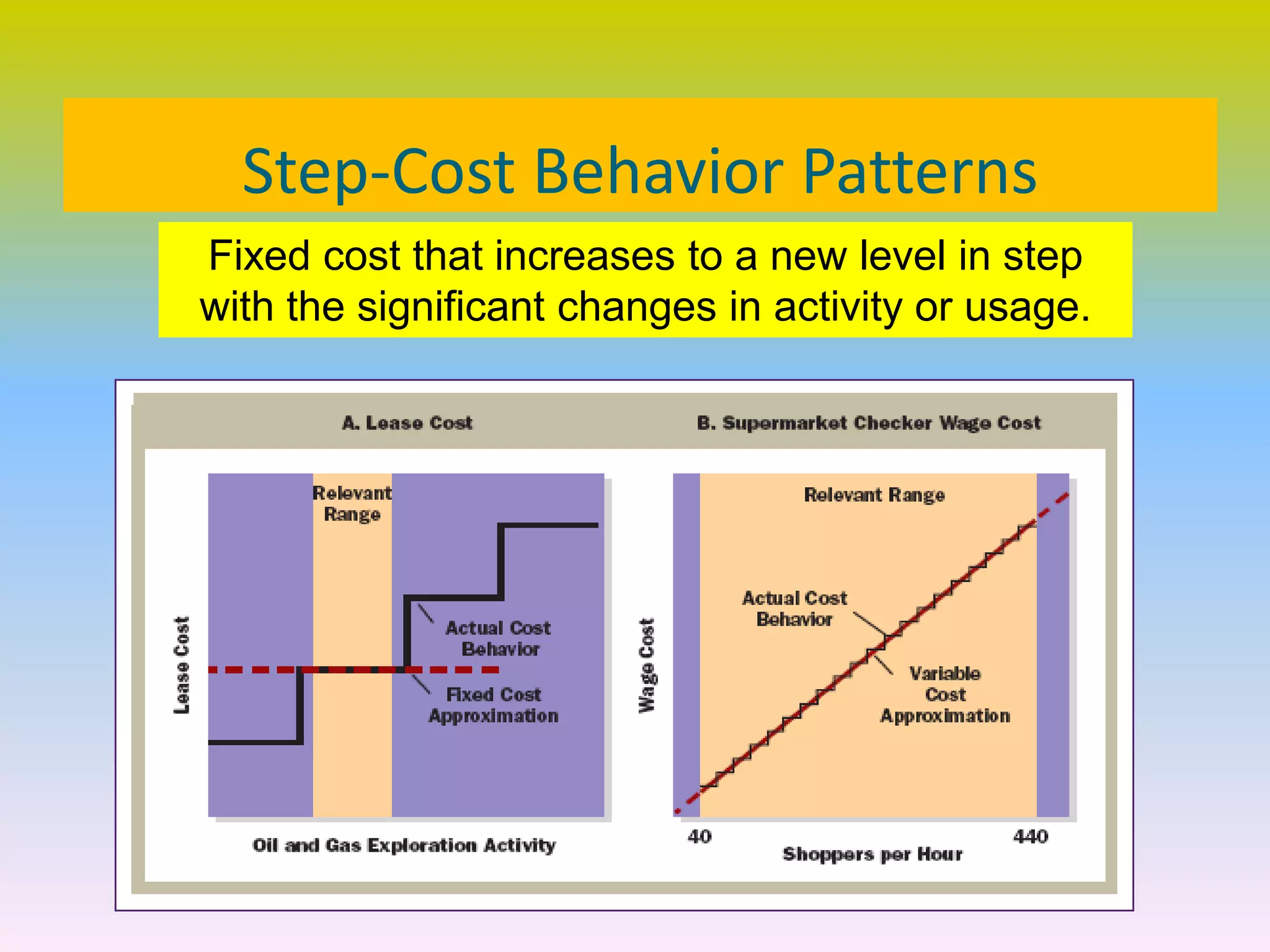

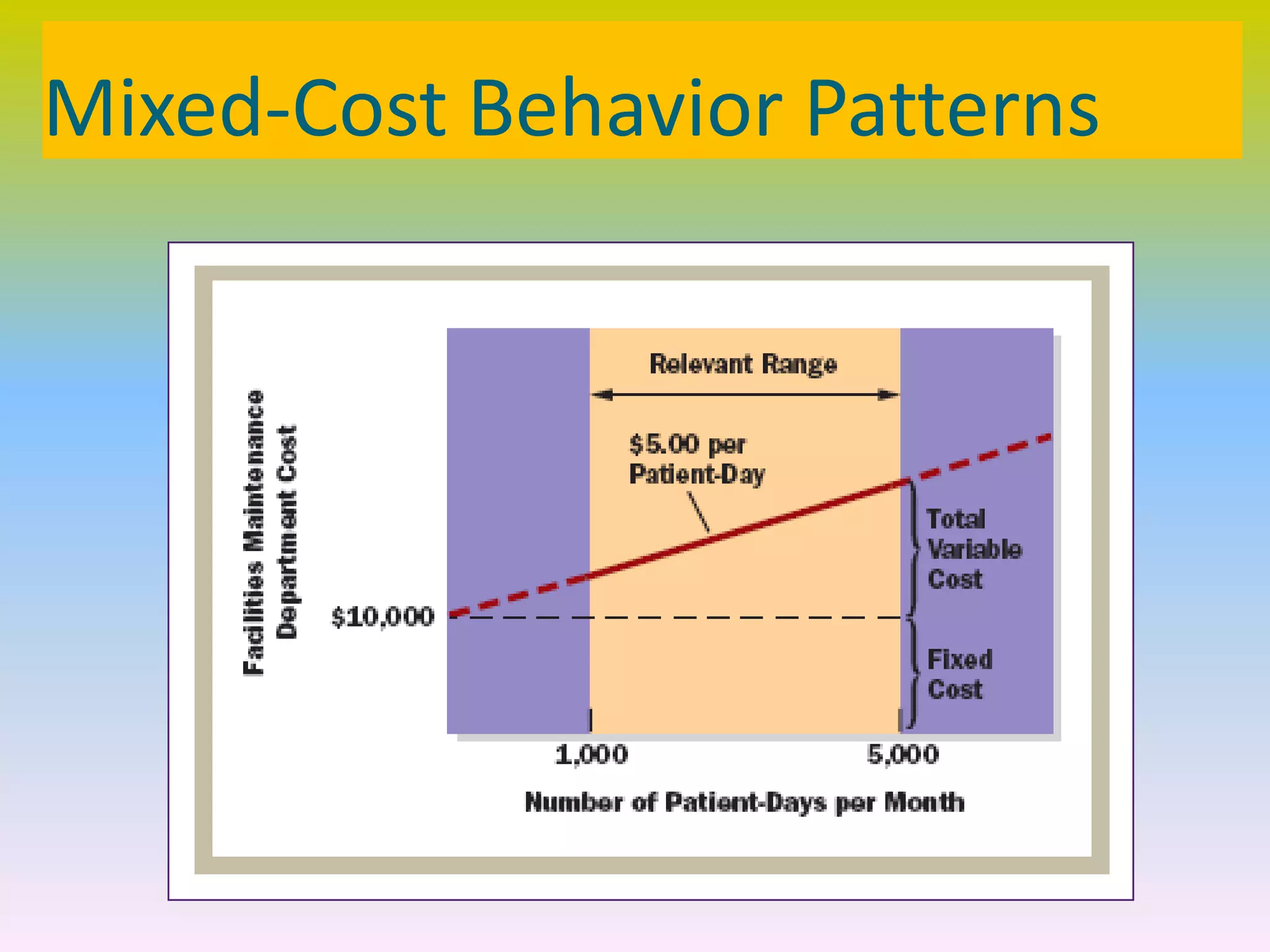

This document discusses types of production costs and cost behavior. It begins by introducing direct materials, direct labor, and manufacturing overhead as the three main types of manufacturing costs. It then differentiates between product costs, which include these manufacturing costs, and period costs like selling and administrative expenses. The document goes on to explain different patterns of cost behavior like variable, fixed, step, and mixed costs. It also discusses how management decisions around capacity, commitments, and discretion can influence cost behavior.