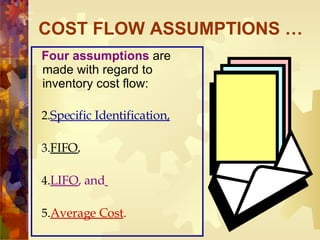

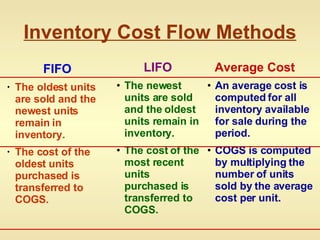

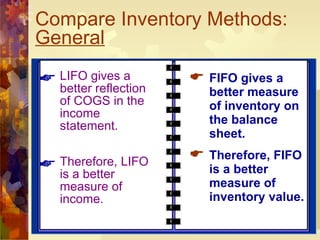

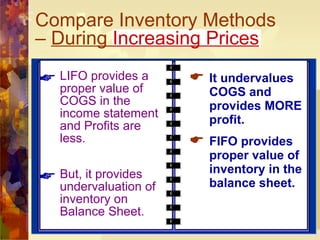

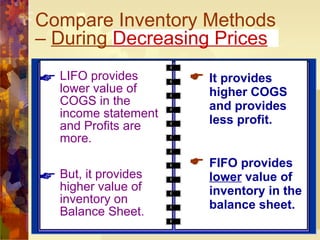

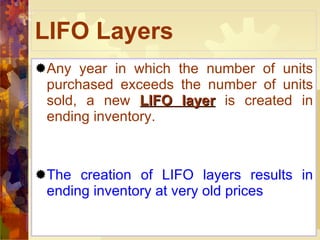

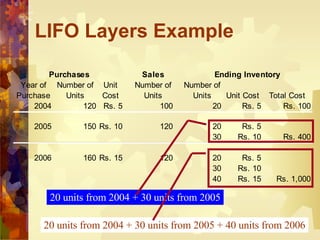

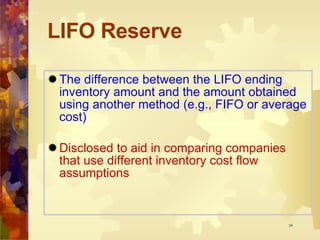

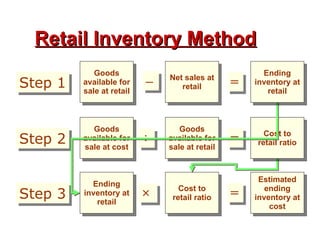

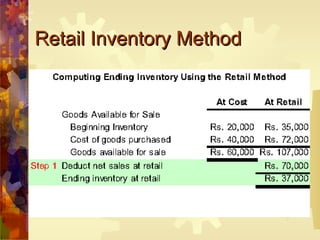

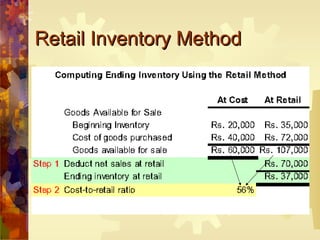

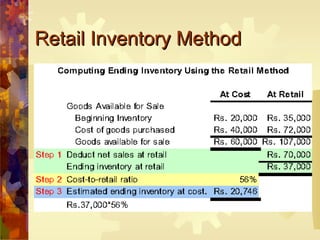

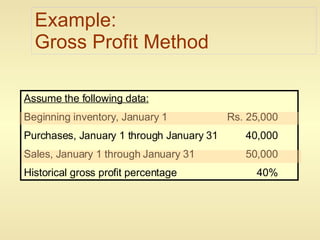

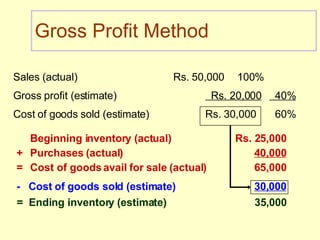

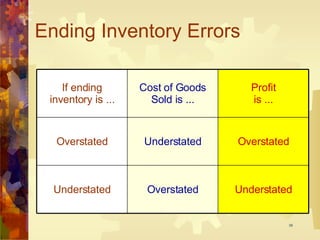

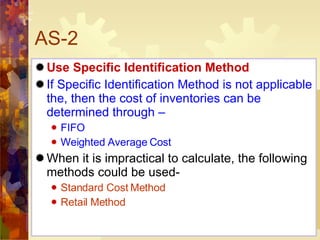

The document discusses different methods for valuing inventory, including specific identification, FIFO, LIFO, average cost, retail, and gross profit methods. It compares the LIFO and FIFO methods, explaining that LIFO matches current costs to current revenues while FIFO provides a better measure of inventory value. The document also discusses the impact of errors in inventory valuation and how inventory value should be reported and disclosed in financial statements.