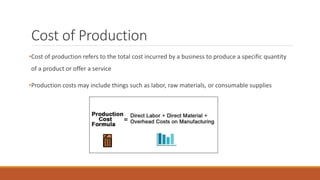

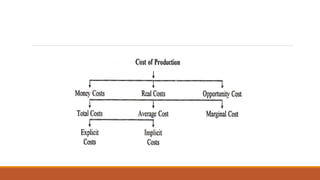

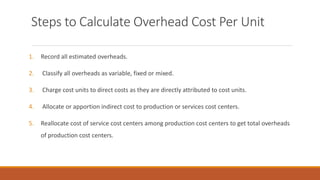

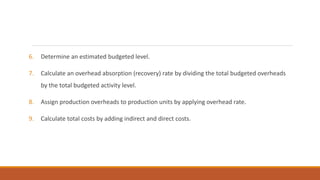

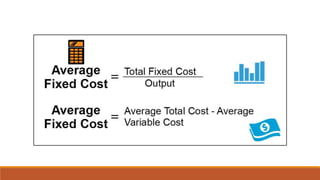

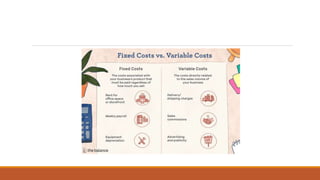

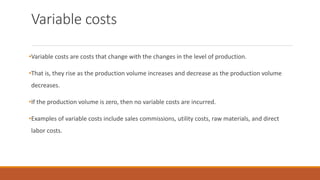

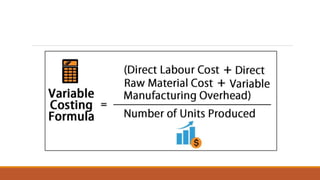

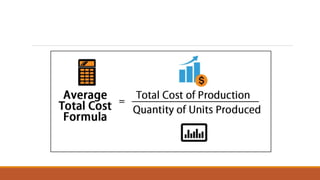

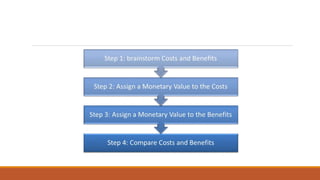

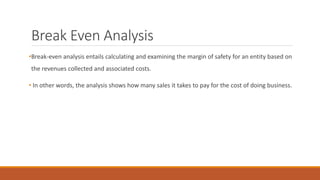

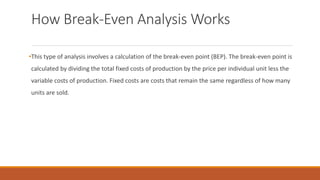

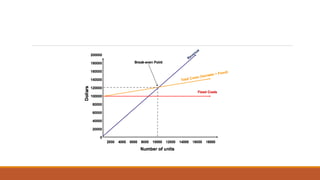

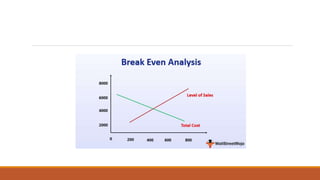

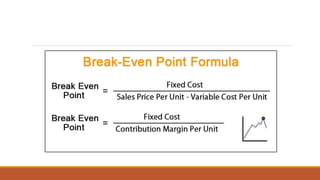

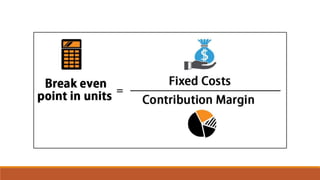

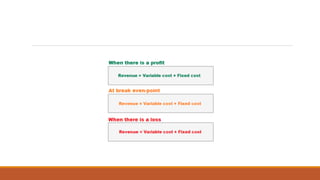

The document outlines production cost concepts, including definitions of production costs, cost centers, and types of costs such as fixed, variable, total, average, and marginal costs. It details the steps for calculating overhead costs per unit and includes an explanation of cost analysis and break-even analysis, emphasizing their importance for businesses in managing production and pricing strategies. References are provided for further reading.