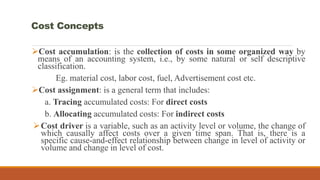

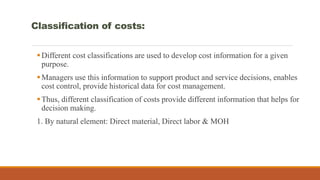

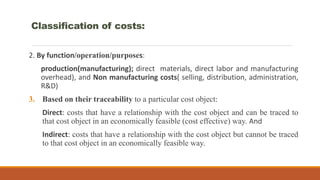

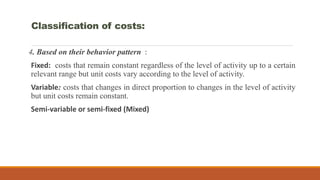

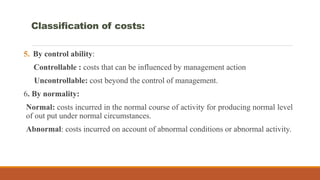

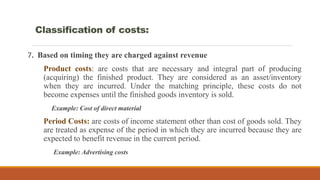

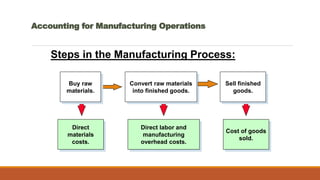

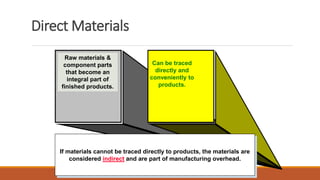

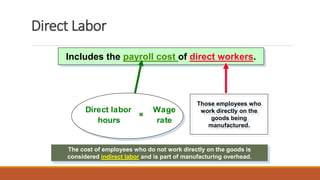

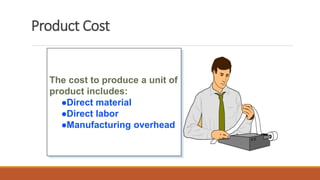

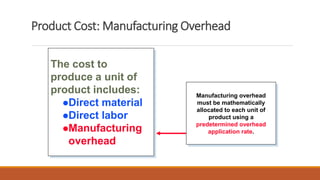

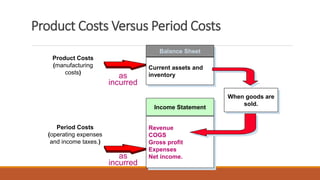

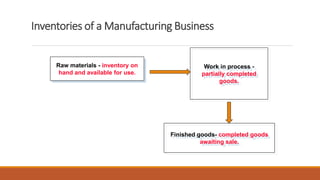

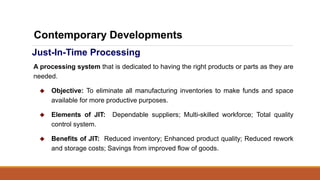

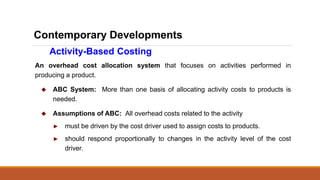

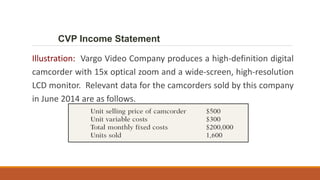

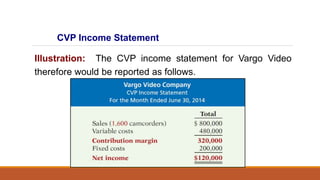

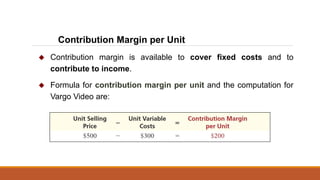

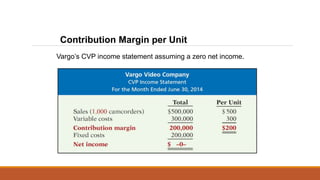

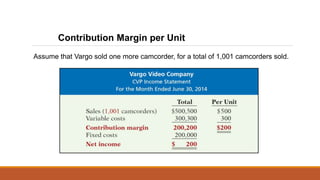

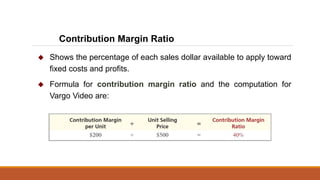

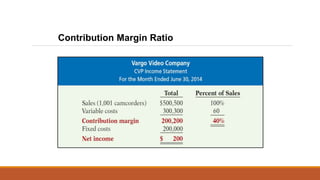

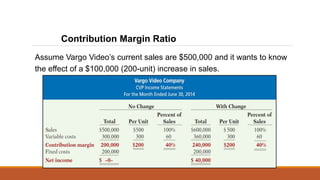

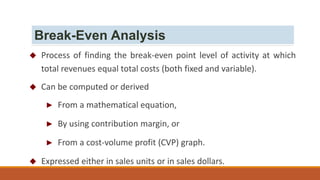

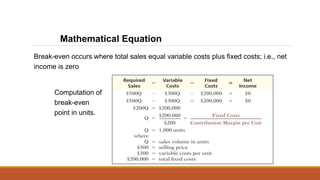

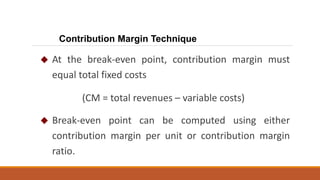

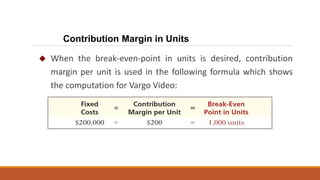

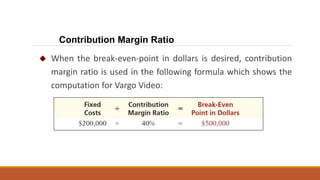

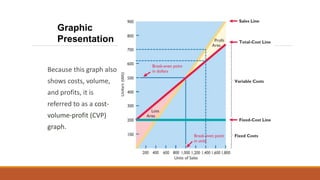

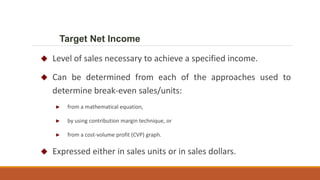

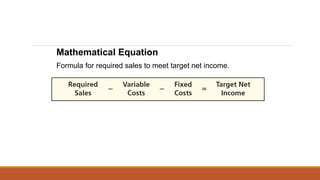

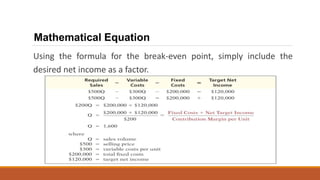

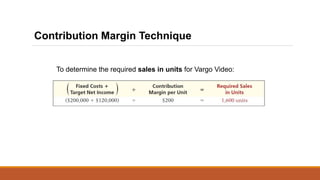

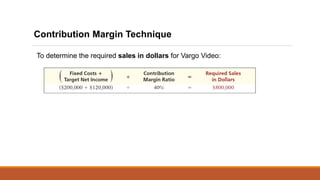

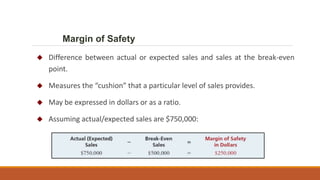

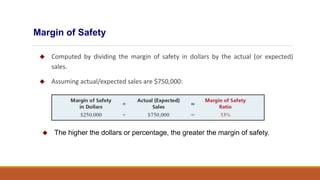

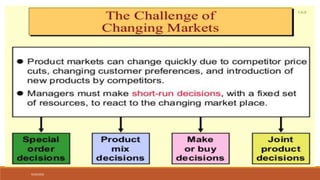

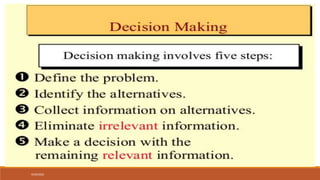

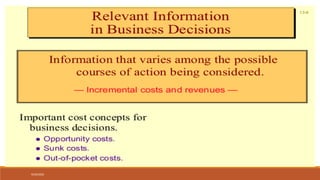

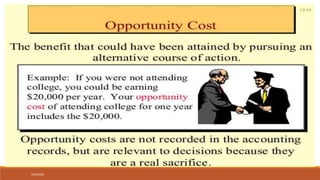

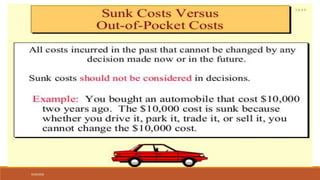

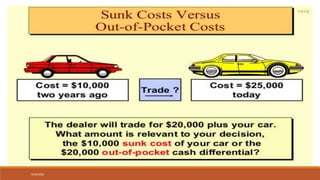

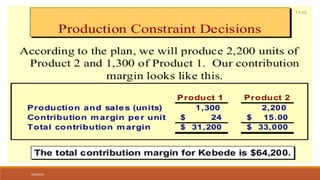

Cost and management accounting provides managers with detailed cost information to control operations and plan for the future. Cost accounting information is used for financial accounting and by managers for decision making. Management accounting provides economic and financial information for internal users. Cost concepts like cost objects, cost pools, and cost drivers are introduced. Costs are classified by elements, functions, traceability, behavior, and controllability. Product costs include direct materials, direct labor, and manufacturing overhead and become inventory until goods are sold. Period costs are expenses of the current period. Job order costing and process costing are introduced as costing systems. Just-in-time processing, activity-based costing, cost-volume-profit analysis, contribution margin,