Niit ru4 qfy2010-130510

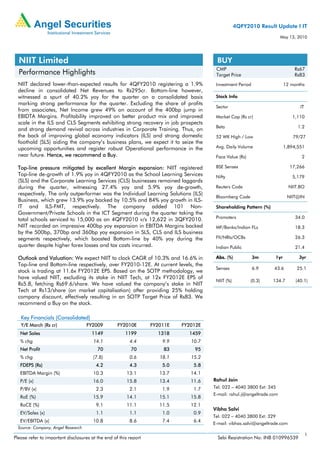

- 1. 4QFY2010 Result Update I IT May 13, 2010 NIIT Limited BUY CMP Rs67 Performance Highlights Target Price Rs83 NIIT declared lower-than-expected results for 4QFY2010 registering a 1.9% Investment Period 12 months decline in consolidated Net Revenues to Rs295cr. Bottom-line however, witnessed a spurt of 40.2% yoy for the quarter on a consolidated basis Stock Info marking strong performance for the quarter. Excluding the share of profits Sector IT from associates, Net Income grew 49% on account of the 400bp jump in EBIDTA Margins. Profitability improved on better product mix and improved Market Cap (Rs cr) 1,110 scale in the ILS and CLS Segments exhibiting strong recovery in job prospects Beta 1.2 and strong demand revival across industries in Corporate Training. Thus, on the back of improving global economy indicators (ILS) and strong domestic 52 WK High / Low 79/27 foothold (SLS) aiding the company’s business plans, we expect it to seize the upcoming opportunities and register robust Operational performance in the Avg. Daily Volume 1,894,551 near future. Hence, we recommend a Buy. Face Value (Rs) 2 Top-line pressure mitigated by excellent Margin expansion: NIIT registered BSE Sensex 17,266 Top-line de-growth of 1.9% yoy in 4QFY2010 as the School Learning Services Nifty 5,179 (SLS) and the Corporate Learning Services (CLS) businesses remained laggards during the quarter, witnessing 27.4% yoy and 5.9% yoy de-growth, Reuters Code NIIT.BO respectively. The only outperformer was the Individual Learning Solutions (ILS) Bloomberg Code NIIT@IN Business, which grew 13.9% yoy backed by 10.5% and 84% yoy growth in ILS- IT and ILS-FMT, respectively. The company added 101 Non- Shareholding Pattern (%) Government/Private Schools in the ICT Segment during the quarter taking the total schools serviced to 15,000 as on 4QFY2010 v/s 12,622 in 3QFY2010. Promoters 34.0 NIIT recorded an impressive 400bp yoy expansion in EBITDA Margins backed MF/Banks/Indian FLs 18.3 by the 500bp, 370bp and 360bp yoy expansion in SLS, CLS and ILS business segments respectively, which boosted Bottom-line by 40% yoy during the FII/NRIs/OCBs 26.3 quarter despite higher forex losses and tax costs incurred. Indian Public 21.4 Outlook and Valuation: We expect NIIT to clock CAGR of 10.3% and 16.6% in Abs. (%) 3m 1yr 3yr Top-line and Bottom-line respectively, over FY2010-12E. At current levels, the Sensex 6.9 43.6 25.1 stock is trading at 11.6x FY2012E EPS. Based on the SOTP methodology, we have valued NIIT, excluding its stake in NIIT Tech, at 12x FY2012E EPS of NIIT (%) (0.3) 134.7 (40.1) Rs5.8, fetching Rs69.6/share. We have valued the company’s stake in NIIT Tech at Rs13/share (on market capitalisation) after providing 25% holding company discount, effectively resulting in an SOTP Target Price of Rs83. We recommend a Buy on the stock. Key Financials (Consolidated) Y/E March (Rs cr) FY2009 FY2010E FY2011E FY2012E Net Sales 1149 1199 1318 1459 % chg 14.1 4.4 9.9 10.7 Net Profit 70 70 83 95 % chg (7.8) 0.6 18.1 15.2 FDEPS (Rs) 4.2 4.3 5.0 5.8 EBITDA Margin (%) 10.3 13.1 13.7 14.1 P/E (x) 16.0 15.8 13.4 11.6 Rahul Jain P/BV (x) 2.3 2.1 1.9 1.7 Tel: 022 – 4040 3800 Ext: 345 E-mail: rahul.j@angeltrade.com RoE (%) 15.9 14.1 15.1 15.8 RoCE (%) 9.1 11.1 11.5 12.1 Vibha Salvi EV/Sales (x) 1.1 1.1 1.0 0.9 Tel: 022 – 4040 3800 Ext: 329 EV/EBITDA (x) 10.8 8.6 7.4 6.4 E-mail: vibhas.salvi@angeltrade.com Source: Company, Angel Research 1 Please refer to important disclosures at the end of this report Sebi Registration No: INB 010996539

- 2. NIIT Ltd. I 4QFY2010 Result Update Exhibit 1: 4QFY2010 Performance (Consolidated) Y/E March (Rs cr) 4QFY10 4QFY09 % chg FY2010 FY2009 % chg Net Revenues 295 301 (1.9) 1,199 1,149 4.4 Operating Costs 247 264 (6.4) 1,043 1,030 1.2 EBITDA 48 36 30.6 157 119 32.2 Depreciation 20 19 1.6 75 65 16.1 Other Income / (Expense) (6) (4) (33) (5) Income before Income Taxes 22 14 64.0 49 49 (1.2) Income Taxes 8 4 100.0 11 10 3.8 Net Income 14 10 49.1 38 39 (2.6) Share of Profit in Associates 10 8 29.4 32 31 4.4 Net Income after Associate Profits 25 18 40.2 70 70 0.5 Diluted EPS (Rs) 1.5 1.1 41.7 4.3 4.2 2.2 EBITDA Margin (%) 16.1 12.1 13.1 10.3 Net Profit Margin (%) 8.4 5.9 5.9 6.1 Effective Tax Rate (%) 35.7 29.3 22.1 21.1 Source: Company, Angel Research Unfavourable currency movement restricted Top-line growth NIIT witnessed Top-line de-growth of 1.9% yoy in 4QFY2010 mainly on account of the negative exchange movement, with the Rupee appreciating against most currencies during the quarter. The adverse exchange impact was seen in NIIT’s US Dollar denominated Revenues, which stood at Rs10.6cr during the quarter. Geographically, India, RoW and China witnessed growth with public private partnership model being successfully implemented in China during the quarter, as it inaugurated its largest facility with a seating capacity of about 10,000 students. Segment-wise, the SLS and CLS businesses remained laggards during the quarter. The SLS de-grew by 27.4% yoy mainly on account of de-growth in Revenues from 662 government schools earlier implemented in Andhra Pradesh, which were taken back during 4QFY2010. However, the Non-Government/Private Schools clocked16% yoy growth on the back of encouraging acceptance of the e-Guru product and arrested further decline in SLS Revenues. The company added 101 Non-Government/Private Schools during the quarter taking the total number of schools serviced to 15,000 as on 4QFY2010 v/s 12,622 in 3QFY2010. The CLS Business continued to languish for the third consequent quarter and registered de-growth of 5.9% yoy despite registering volume growth of 15% in e-Learning Products mainly on account of the forex impact and introduction of low-priced short duration courses. The only outperformer during the quarter, the ILS Business, registered 13.9% yoy growth backed by the 10.5% and 84% yoy growth in ILS-IT and ILS-FMT (includes new businesses, viz. the Banking-IFBI, Management-Imperia and BPO-based NIIT Uniqua and other new initiatives. Growth in the former was driven by India enrolments that grew 21% yoy with 35% yoy growth in Edgeineers range of programs and 88% yoy in Infrastructure Management Services courses. Placements continued to be strong, crossing the 8,000 mark, up by 13% yoy. In the new businesses, fresh order intake stood at Rs9.3cr (Rs3.6cr) in 4QFY2010 v/s Rs9.4cr in 3QFY2010. ILS-FMT enrolments grew 58% for the quarter, signaling an improving trend with 14 more placement partners added by IFBI (totally 24 as on date), whereas three large BPOs were added for the New Hire Training business. The company’s total headcount stood at 3,485, down from 3,540 in 3QFY10. May 13, 2010 2

- 3. NIIT Ltd. I 4QFY2010 Result Update Exhibit 2: Segment-wise Revenue Break-up Segment Revenues (Rs cr) chg Contribution (%) 4QFY10 4QFY09 (%) 4QFY10 4QFY09 ILS Business 123.6 108.5 13.9 41.9 36.1 ILS-IT 114.4 103.5 10.5 38.8 34.4 ILS-FMT 9.2 5.0 84.0 3.1 1.7 SLS Business 32.1 44.2 (27.4) 10.9 14.7 Government Schools 19 32.7 (42.6) 6.4 10.9 Private Schools 13 11.5 16.0 4.5 3.8 CLS Business 139.3 148.1 (5.9) 47.2 49.2 Total 295.0 300.8 (1.9) 100.0 100.0 Source: Company, Angel Research Strong Profitability across businesses expand Margins NIIT recorded an impressive 400bp yoy expansion in EBITDA Margins in 4QFY2010 backed by expansion in EBITDA Margins by 500bp, 370bp and 360bp yoy in the SLS, CLS (with better product mix, cost management and consistent higher profitability in e-Learning Product business, viz. Element-K) and ILS business segments respectively. Though the company continued to report losses at the EBIDTA level in the new businesses, viz. ILS-FMT, it fell from Rs 4.8cr in 4QFY2009 to Rs2.2cr in 4QFY2010, as some of the new businesses have broken even, while for some the investment phase is almost complete thereby reducing losses. Exhibit 3: Segment-wise EBIDTA Margins Segment EBIDTA (Rs cr) chg EBIDTA Margin (%) chg 4QFY10 4QFY09 (%) 4QFY10 4QFY09 bp ILS Business 26.0 18.9 37.6 21.0 17.4 3.6 ILS-IT 28.2 23.7 19.0 24.7 22.9 1.8 ILS-FMT (2.2) (4.8) (54.2) (23.9) (96.0) SLS Business 7.4 8.0 (7.5) 23.1 18.1 5.0 CLS Business 14.1 9.5 48.4 10.1 6.4 3.7 Total 47.5 36.4 30.5 16.1 12.1 4.0 Source: Company, Angel Research Other Income stood at a negative Rs5.7cr v/s negative Rs3.6cr in 4QFY2009 largely due to the forex loss, which was to the tune of Rs1cr in 4QFY2010 v/s forex gains of Rs3.8cr in 4QFY2009. Depreciation was up 1.6% yoy, while the tax rate shot up by 643bp yoy at 35.7%. Thus, the excellent expansion in Gross Margins lifted overall Profitability performance and resulted in the 40.2% yoy spurt in Bottom-line during the quarter. May 13, 2010 3

- 4. NIIT Ltd. I 4QFY2010 Result Update Outlook and Valuation NIIT aims to drive growth in the SLS Segment through its content-led strong initiatives in Private schools related offerings, viz. E-Guru portfolio and Math Labs solutions. In this Segment, the company is currently increasing spend on the marketing and sales fronts to tap future opportunities in Tier II and III cities. The company incurred capex of around Rs95cr in FY2010 and plans to incur around Rs 90cr for FY2011E mainly on school projects. The company also sees strong assured annuity revenues from product roll outs for private schools. The IP-led revenues for FY2010 witnessed 12.3% yoy growth. Thus, non-linear revenues, viz. the strong annuity and IP-led revenues are expected to contribute to the company’s operational performance going ahead. In CLS the company aims to deliver strong volume backed growth in FY2011 through improved products mix and focusing on high margin Learning Products businesses, which has subscription based modules New Businesses are expected to recover going ahead on the back of strong hiring plans by Banks and Insurance companies and executive management education, which is expected to gain momentum would drive Imperia business. Apart from new businesses the growth in ILS is expected to be driven by strong IMS enrollments, better product mix and leverage on the recent tie-up with SAP and IBM. The company is targeting strong volume backed growth both in Revenues and Profits for FY2011E. We expect Margins to improve going ahead, as losses at the EBIDTA level in the new businesses would reduce with the new initiatives achieving break-even, while Margins in all other businesses are expected to be maintained. Going ahead, we expect NIIT to clock CAGR of 10.3% and 16.6% in Top-line and Bottom-line respectively, over FY2010-12E. At current levels, the stock is trading at 11.6x FY2012E EPS. Based on the SOTP methodology, we have valued NIIT excluding its stake in NIIT Tech at 12x FY2012E EPS of Rs5.8 fetching Rs69.6/share. We have valued the company’s stake in NIIT Tech at Rs13/share (on market capitalisation) after providing 25% holding company discount, effectively resulting in an SOTP Target Price of Rs83. Hence, we recommend a Buy on the stock. Exhibit 4: One year forward P/E Band 200 180 35x 160 140 Share Price (Rs) 120 25x 100 80 15x 60 40 5x 20 0 Jul-04 Jul-05 Jul-06 Jul-07 Jul-08 Jul-09 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Oct-04 Oct-05 Oct-06 Oct-07 Oct-08 Oct-09 Source: Company, Angel Research May 13, 2010 4

- 5. NIIT Ltd. I 4QFY2010 Result Update Profit & Loss Statement (Consolidated) (Rs cr) Y/E March FY2008 FY2009 FY2010E FY2011E FY2012E Gross sales 1,007 1,149 1,199 1,318 1,459 Less: Excise duty - - - - - Net Sales 1,007 1,149 1,199 1,318 1,459 Other operating income - - - - - Total operating income 1,007 1,149 1,199 1,318 1,459 % chg 26.6 14.1 4.4 9.9 10.7 Total Expenditure 904 1,030 1,043 1,137 1,253 Cost of Services 362 428 444 487 540 SGA 237 268 251 268 290 Personnel 305 334 348 382 423 Other - - - - - EBITDA 103 119 157 180 206 % chg 31.3 14.9 32.3 14.9 14.2 (% of Net Sales) 10.2 10.3 13.1 13.7 14.1 Depreciation& Amortisation 53 65 75 87 101 EBIT 50 54 82 93 105 % chg 60.3 7.2 51.7 14.0 12.7 (% of Net Sales) 5.0 4.7 6.8 7.1 7.2 Interest & other Charges 18 25 45 45 45 Other Income 8 20 12 13 15 (% of PBT) 19.1 41.2 24.6 21.4 19.6 Share in profit of Associates - - - - - Recurring PBT 40 49 49 62 74 % chg 63.2 22.9 (1.1) 26.3 20.6 Extraordinary Expense/(Inc.) - - - - - PBT (reported) 40 49 49 62 74 Tax (2) 10 11 14 18 (% of PBT) (5.1) 21.0 22.1 23.0 24.0 PAT (reported) 42 39 38 47 57 Add: Share of earnings of associate 33.4 28.3 32.2 35.4 39.0 Less: Minority interest (MI) (0.1) (2.5) - - - Prior period items - - - - - PAT after MI (reported) 76 70 70 83 95 ADJ. PAT 76 70 70 83 95 % chg 32.0 (7.8) 0.6 18.1 15.2 (% of Net Sales) 7.5 6.1 5.9 6.3 6.5 Basic EPS (Rs) 4.6 4.2 4.3 5.0 5.8 Fully Diluted EPS (Rs) 4.5 4.2 4.3 5.0 5.8 % chg 32.0 (7.8) 1.4 18.1 15.2 May 13, 2010 5

- 6. NIIT Ltd. I 4QFY2010 Result Update Balance Sheet (Consolidated) (Rs cr) Y/E March FY2008 FY2009 FY2010E FY2011E FY2012E SOURCES OF FUNDS Equity Share Capital 33 33 33 33 33 Preference Capital - - - - - Reserves& Surplus 369 445 488 541 603 Shareholders Funds 402 478 521 574 636 Minority Interest 1 1 1 1 1 Total Loans 205 348 405 406 411 Deferred Tax Liability (25) (34) (34) (34) (34) Total Liabilities 584 792 892 947 1,014 APPLICATION OF FUNDS Gross Block 362 507 601 741 901 Less: Acc. Depreciation 231 273 348 435 536 Net Block 131 234 253 306 366 Capital Work-in-Progress 48 62 62 62 62 Goodwill 219 278 278 278 278 Investments 89 107 109 109 109 Current Assets 457 569 606 646 700 Cash 80 75 62 79 93 Loans & Advances 130 150 150 150 150 Other 247 344 394 418 458 Current liabilities 361 457 417 455 501 Net Current Assets 96 112 189 192 199 Mis. Exp. not written off 0 0 0 0 0 Total Assets 584 792 892 947 1,014 Cash Flow Statement (Consolidated) (Rs cr) Y/E March FY2008 FY2009 FY2010E FY2011E FY2012E Profit before tax 40.1 49.3 48.8 61.7 74.4 Depreciation 52.9 64.7 75.1 87.1 100.7 Change in Working Capital 36.6 (23.8) (10.3) 14.2 6.2 Less: Other income 15.8 20.3 12.0 13.2 14.6 Direct taxes paid (19.9) (22.5) (10.8) (14.2) (17.8) Cash Flow from Operations 125.5 88.0 90.8 135.6 148.9 (Inc)./ Dec in Fixed Assets (84.8) (186.2) (94.9) (140.0) (160.0) (Inc)./ Dec. in Investments (2.8) (17.4) (2.7) - - (Inc)./ Dec. in loans and advances - - - - - Other income 7.1 43.0 32.2 - - Cash Flow from Investing (80.4) (160.7) (129.8) (140.0) (160.0) Issue of Equity 0.5 2.3 (43.1) - - Inc./(Dec.) in loans (22.0) 141.8 56.5 1.4 5.0 Dividend Paid (Incl. Tax) (16.8) (25.1) 27.0 29.1 33.5 Others (0.4) (51.3) (14.1) (9.6) (13.5) Cash Flow from Financing (38.8) 67.8 26.4 20.9 25.0 Inc./(Dec.) in Cash 6.3 (4.9) (12.6) 16.5 13.9 Opening Cash balances 73.6 79.6 74.7 62.2 78.7 Closing Cash balances 79.6 74.7 62.2 78.7 92.6 May 13, 2010 6

- 7. NIIT Ltd. I 4QFY2010 Result Update Key Ratios Y/E March FY2008 FY2009 FY2010E FY2011E FY2012E Valuation Ratio (x) P/E (on FDEPS) 14.8 16.0 15.8 13.4 11.6 P/CEPS 8.6 8.3 7.6 6.5 5.7 P/BV 2.8 2.3 2.1 1.9 1.7 Dividend yield (%) 0.0 0.0 0.0 0.0 0.0 EV/Sales 1.1 1.1 1.1 1.0 0.9 EV/EBITDA 11.1 10.8 8.6 7.4 6.4 EV / Total Assets 1.2 1.0 1.0 0.9 0.9 Per Share Data (Rs) EPS (Basic) 4.6 4.2 4.3 5.0 5.8 EPS (fully diluted) 4.5 4.2 4.3 5.0 5.8 Cash EPS 7.8 8.1 8.8 10.3 11.9 DPS 1.3 1.3 1.4 1.5 1.7 Book Value 24.4 28.9 31.5 34.8 38.5 Dupont Analysis EBIT margin 5.8 6.5 7.8 8.1 8.2 Tax retention ratio 105.1 79.0 77.9 77.0 76.0 Asset turnover (x) 1.3 1.1 1.1 1.1 1.1 ROIC (Post-tax) 7.9 5.6 6.5 6.8 7.0 Cost of Debt (Post Tax) 7.9 7.1 9.3 8.5 8.4 Leverage (x) 0.9 0.9 1.2 1.2 1.1 Operating ROE 7.9 4.2 3.0 4.8 5.5 Returns (%) ROCE (Pre-tax) 10.0 9.1 11.1 11.5 12.1 Angel ROIC (Pre-tax) 47.9 39.9 33.9 27.0 22.0 ROE 21.1 15.9 14.1 15.1 15.8 Turnover ratios (x) Asset Turnover (Gross Block) 2.8 2.3 2.0 1.8 1.6 Inventory / Sales (days) 4.7 3.5 3.5 3.5 3.5 Receivables (days) 77.1 78.7 103.0 100.0 100.0 Payables (days) 40.8 41.5 43.0 41.4 39.5 Working capital cycle (ex-cash) (days) 13.3 8.5 24.8 32.9 27.2 Solvency ratios (x) Net debt to equity 0.1 0.3 0.4 0.4 0.3 Net debt to EBITDA 0.4 1.4 1.5 1.2 1.0 Interest Coverage (EBIT / Interest) 2.8 2.2 1.8 2.1 2.3 May 13, 2010 7

- 8. NIIT Ltd. I 4QFY2010 Result Update Research Team Tel: 022-4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Securities Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, and are for general guidance only. Angel Securities Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Securities Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Securities Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Securities Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Disclosure of Interest Statement NIIT Ltd 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies’ Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below Rs 1 lakh for Angel and its Group companies. Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059. Tel : (022) 3952 4568 / 4040 3800 Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 May 13, 2010 8