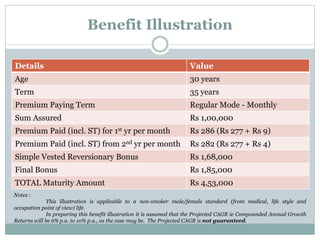

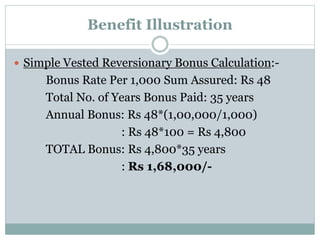

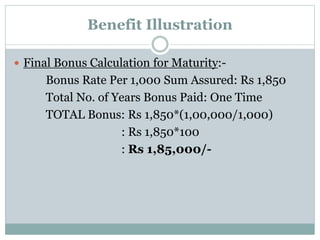

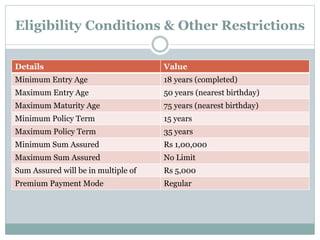

The New Jeevan Anand Plan No. 815 is a participating non-linked insurance scheme that combines lifelong death protection with maturity benefits. It offers death benefits defined as the higher of 125% of the basic sum assured or 10 times the annual premium, along with the ability to take loans against the policy. Additional features include an accidental death and disability rider, profit participation through bonuses, and flexibility in premium payment modes.