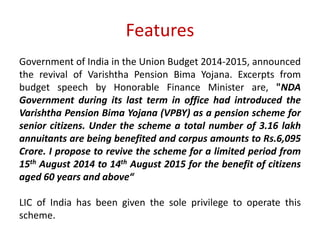

The document summarizes the Varishtha Pension Bima Yojana (VPBY), a pension scheme for senior citizens in India. Key details include:

- It provides lifetime monthly pension payments and refund of purchase price upon death.

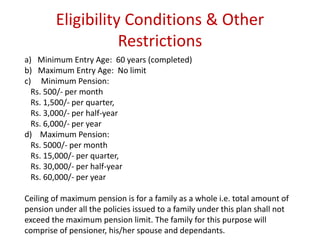

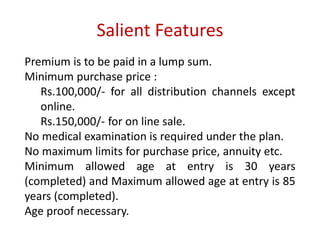

- Eligibility is age 60+ with no upper age limit. Minimum monthly pension is Rs. 500 and maximum is Rs. 5000.

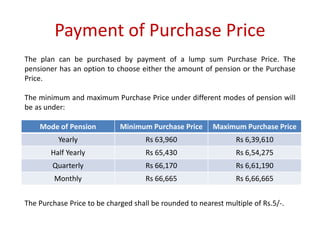

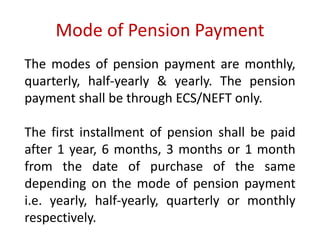

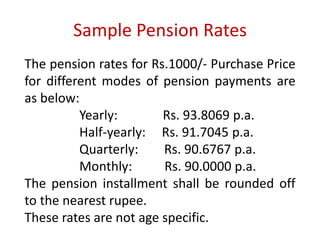

- Pension is purchased by lump sum payment of a purchase price ranging from Rs. 63,960 to Rs. 6,39,610 depending on payment mode (yearly to monthly).

- First pension installment is paid 1 month to 1 year after purchase depending on payment mode (monthly to yearly).