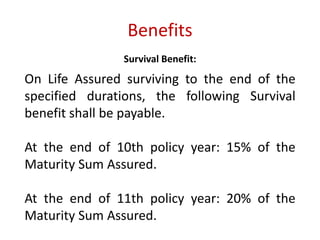

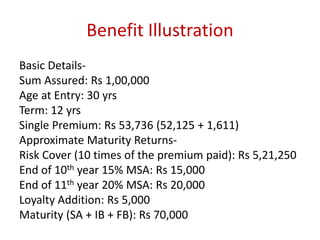

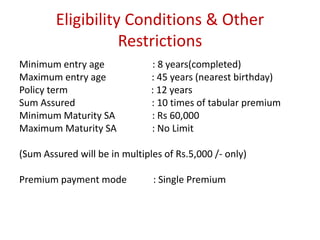

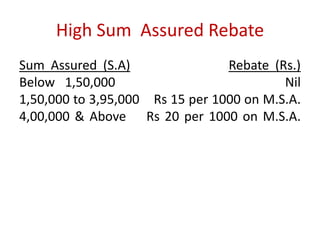

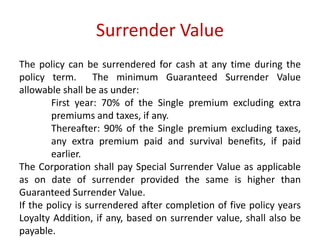

This document describes the features and benefits of LIC's Jeevan Shagun savings plan. The plan allows the policyholder to choose a maturity sum assured and pay a single premium. It provides death benefits of 10 times the premium as well as survival benefits paid out at years 10, 11, and maturity. At maturity, the policyholder receives 65% of the maturity sum assured plus any loyalty additions. The document provides details on eligibility, sums assured, premiums, loan and surrender benefits.