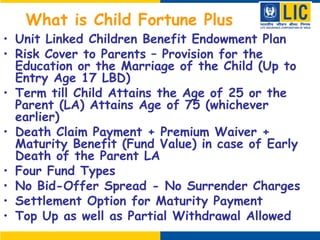

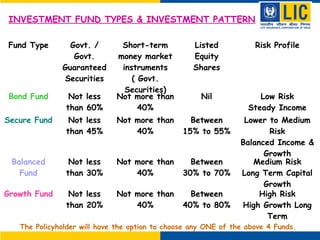

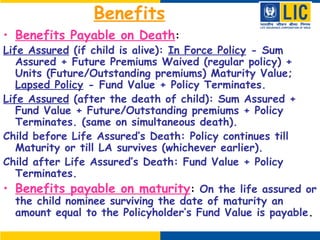

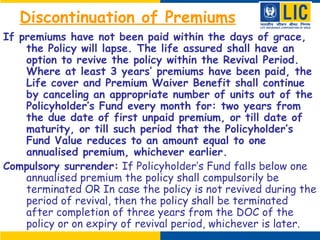

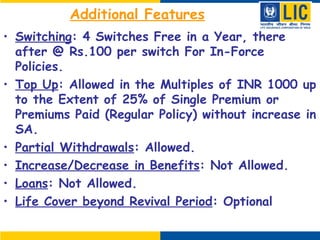

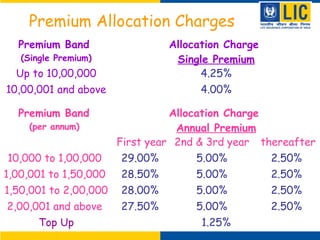

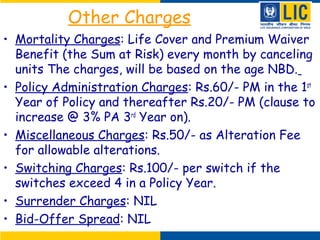

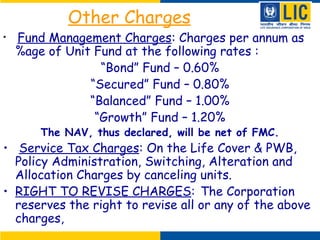

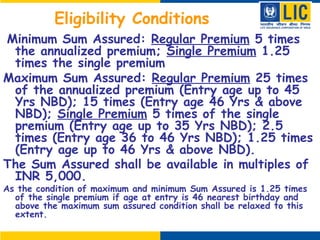

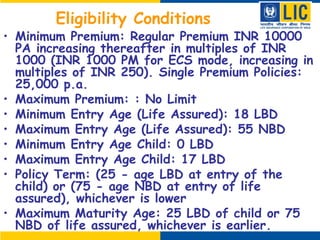

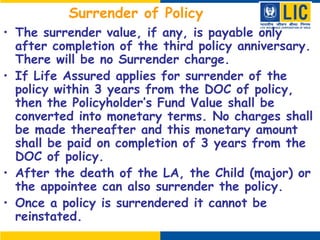

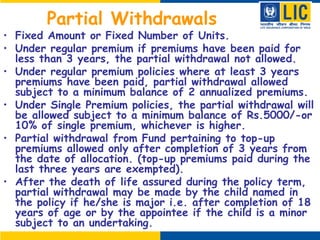

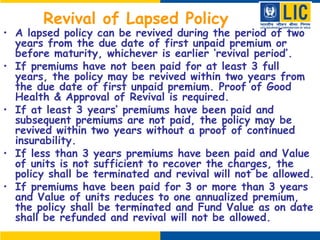

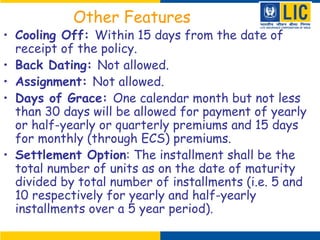

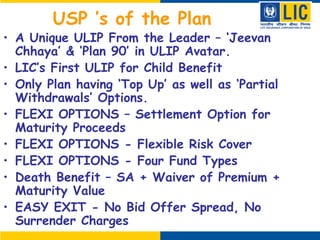

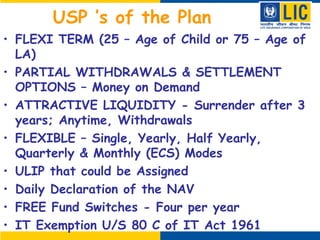

The document outlines a unit-linked children's benefit endowment plan, which provides risk cover to parents for their child's education or marriage, with options for fund selection, premium waivers, and various withdrawals. Key features include multiple fund types based on risk profiles, benefits payable on death or maturity, and specific provisions for policy surrender and revival. Additional elements include charge structures, eligibility conditions, and a focus on flexible terms to enhance policyholder satisfaction.