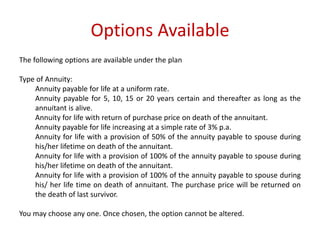

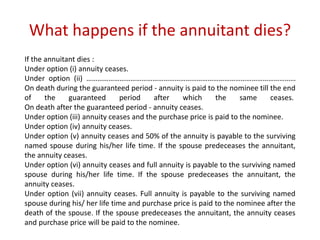

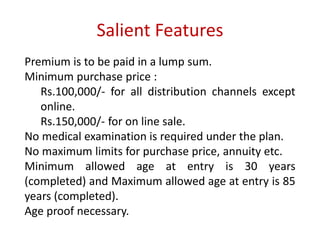

The Jeevan Akshay Vi Plan No. 189 is an immediate annuity plan that offers various annuity payment options for the lifetime of the annuitant after a lump sum payment. Multiple payment modes are available, and options differ based on conditions like death, ensuring certain payments to spouses. Key features include no medical examination, a minimum purchase price, and incentives for higher purchase amounts, along with a 15-day cooling-off period for policy cancellation.